In most cases, civil riots such as those currently occurring in London are specifically excluded from travel insurance plan coverage. See our What Travel Insurance Does Not Coverpage for details.In some plans, travel delay coverage will kick in if you are delayed while en route or on your way home due to civil riots. As an example, the Complete plan by M.H. Ross includes this language under covered reasons for travel delay benefits:

In most cases, civil riots such as those currently occurring in London are specifically excluded from travel insurance plan coverage. See our What Travel Insurance Does Not Coverpage for details.In some plans, travel delay coverage will kick in if you are delayed while en route or on your way home due to civil riots. As an example, the Complete plan by M.H. Ross includes this language under covered reasons for travel delay benefits:

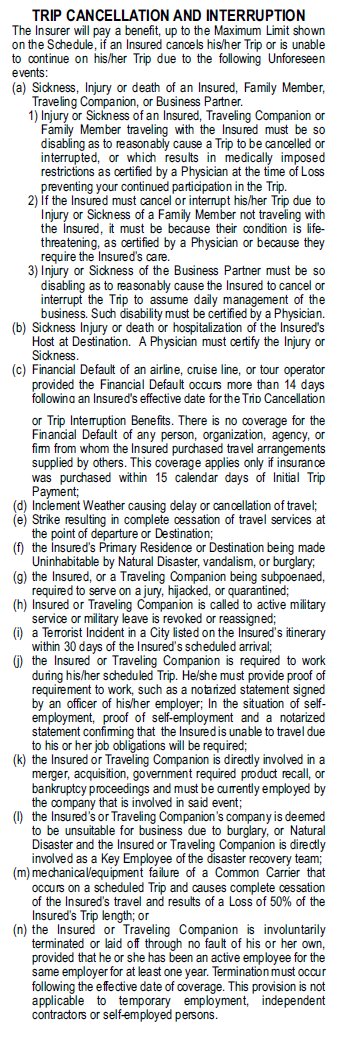

“quarantine, hijacking, Strike, natural disaster, terrorism or riot;â€

That means this plan would provide travel delay benefits if your travel was delayed the minimum number of hours due to the London riots.

If you are injured during your trip, your medical expense coverage will, in most cases, provide coverage for your medical care up to the plan limits and after any applicable deductibles. Of course, deliberately putting yourself in harm’s way means your travel insurance protection will not be in effect. You must take all reasonable and necessary steps to keep yourself out of danger.

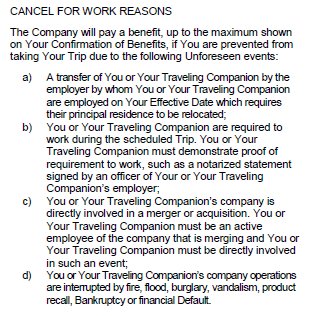

If you decide to cancel your trip due to concerns about the riots, it’s important – as always – to review your travel insurance plan’s description of coverage to see if you have coverage to cancel for that reason. In most plans, you must have purchased ‘cancel for any reason’ coverage in order to cancel for these reasons. Contact the travel assistance services number listed on your travel insurance plan if you are unsure.