Sure home exchangers are saving loads of money on their travel costs by swapping homes instead of paying for lodging, but one item you may want to spend a little extra on is travel insurance with ‘cancel for any reason’ coverage.

Here’s why: ‘cancel for any reason’ coverage lets you cancel your trip for any reason not listed in the standard plan coverage and get up to 100% of your total trip costs back.

This means that even though you don’t have pre-paid lodging expenses to worry about, you can still be reimbursed for your lost airfare and other pre-paid expenses.

Why not rely on standard trip cancellation benefits?

Standard trip cancellation benefits reimburse travelers for their pre-paid non-refundable trip costs if the trip is cancelled for a covered reason. This means that the reason must be listed in the travel insurance plan document to get reimbursed for your expenses.

This is an important distinction that catches many insured travelers off guard.

‘Cancel for any reason’ coverage is a catch-all benefit that lets you cancel your trip and receive between 50 and 100% of your trip costs back. No questions asked. After all, no travel insurance plan lists ‘our hosts changed their mind about exchanging homes’ as a covered reason to cancel your trip.

15 Trip cancellation reasons covered by ‘cancel for any reason’

‘Cancel for any reason’ coverage will protect you if:

- A terrorist attack occurs, and you’re uncomfortable about flying right now.

- The transportation workers strike and you can’t reach your destination.

- Your sister-in-law is very ill and you have to help care for her children.

- Your boss demands that you stay and finish the project before your trip – or else.

- The U.S. State Department issues a travel warning and you decide not to go.

- Your best friend is in a terrible car accident and you want to be at her side.

- A natural disaster occurs – either at your destination or at home – and you decide to stay home.

- Your son’s best friend commits suicide and you want to help him through his grief.

- You’ve been invited to interview for the job of a lifetime – during your vacation week.

- A flu epidemic breaks out and your babysitter cancels because she started running a fever.

- Your beloved pet is ill or dying.

- Your nanny is deported.

- You decide you can’t afford the trip after all.

- You change your mind.

- Your home exchange partners changes their mind.

These are all very real reasons that very real travelers have been forced to cancel their trips – and many of these reasons (depending on the travel insurance plan) are not covered by the standard trip cancellation benefit.

Important facts about ‘cancel for any reason’

It’s important to understand that ‘cancel for any reason’ (just like many insurance benefits) has a number of rules that apply and make the coverage valid.

Those rules include the following:

- You have to purchase your insurance within a certain number of days after making the initial trip payment. In the case of home exchangers, the first payment is often the purchase of their airlines tickets.

- You have to insure 100% of your pre-paid travel arrangements. For home exchangers, this is usually pretty easy and consists of your transportation costs and any pre-paid non-refundable tours, etc.

- You should check the travel insurance plan’s per-person maximum limit to be sure it’s enough to recover your pre-paid and non-refundable costs.

- If you have to cancel, it must be within the plan’s designated number of days prior to departure. For some plans, you can cancel at the last minute – others require 2 days’ notice.

- Your reimbursement may be subject to cancellation penalties and depending upon the plan, you may not receive 100% of your expenses back (although you can get coverage for 100%, you have to choose the right plan).

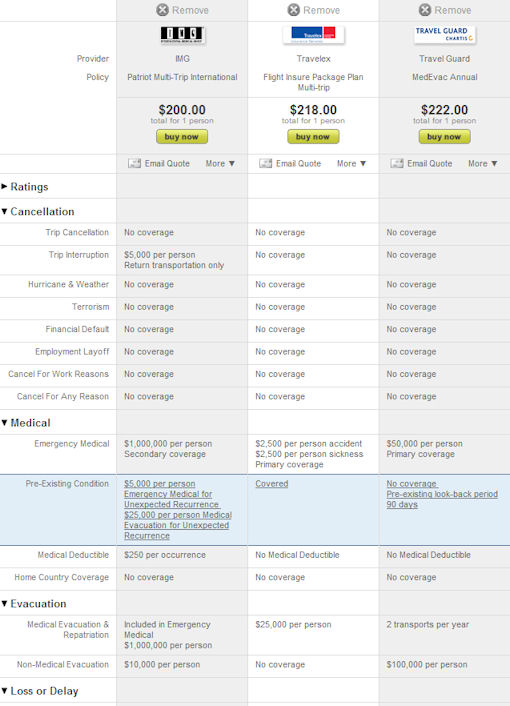

See a full review of ‘cancel for any reason’ coverage and get a list of companies and plans that include this coverage.

Many of us are looking at our list of resolutions for the new year, and if travel is on your to-do list for the coming year, it just might be time to look into your travel insurance coverage ahead of time.

Many of us are looking at our list of resolutions for the new year, and if travel is on your to-do list for the coming year, it just might be time to look into your travel insurance coverage ahead of time.