Trip Interruption Coverage

All kinds of things can interrupt a trip and require you to get home fast. Here’s what you should know about trip interruption coverage.

10 March 2011

This coverage reimburses up to 150% of your unused trip costs if you have to end your trip and return home for a covered reason. The covered reasons for interrupting your trip are the same as the covered reasons for cancelling your trip when you have a package plan.

| Contents (click to jump down) What does Trip Interruption cover? Important notes about this coverage What type of policy covers this? How much coverage does each company provide? Summary |

Let us tell you a story

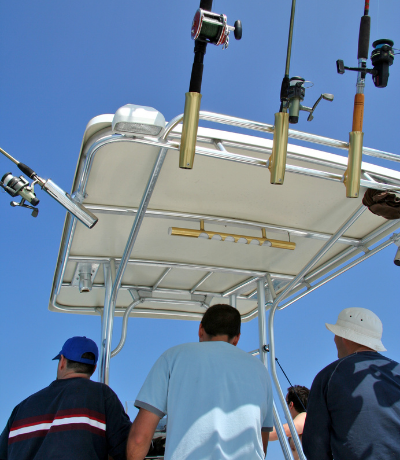

Jack, his father, and his three brothers were on a deep sea diving trip off the coast of Florida. They had purchased a great package and got a per-person discount. As they were coming into dock one evening, Jack caught up with his voice mail and was shocked to learn that his business back home had been burglarized. The police back home needed to speak with him as soon as possible, so did his insurance agent.

Jack decided to return home and take care of the problems that waited for him there. Of course, the rest of the family wanted to stay and finish their vacation. With travel insurance that includes trip interruption coverage, Jack’s family won’t have to pay a higher occupancy rate because he had to leave, and Jack will get reimbursed for the cost of scheduling an earlier flight home.

What does Trip Interruption cover?

Trip interruption is post-departure coverage that reimburses you up to the covered amount defined in the policy for unused travel expenses that you will forfeit if you have to end your trip and return home. In addition, trip interruption coverage provides additional reimbursement to cover the costs that result from the purchase of additional tickets to return home. If your trip is interrupted and you are able to rejoin the trip, some plans will also provide reimbursement for the additional transportation costs related to re-joining your trip.

Some travel insurance plans also reimburse travelers for the change in per-person occupancy rates if a traveling companion has to return home but the insured continues the trip.

Important notes about this coverage

- This coverage typically requires that you purchase your travel insurance plan within a certain number of days (usually 14-21) of making your initial trip deposit.

- This coverage requires that your return transportation be economy fare, or similar quality as the originally issued tickets, less any applied credit from an unused return travel ticket.

- Travelers usually have to insure the entire cost of their trip to be eligible for this coverage. This coverage is in effect at 12:01 a.m. on the scheduled departure date.

What type of policy covers this?

Many, but not all, package plans include trip interruption coverage. With a package plan, you’ll find the description of covered reasons for trip interruption is typically organized with the trip cancellation benefit description.

While trip interruption coverage is typically isolated to package plans, some travel medical policies include trip interruption benefits in their coverage.

Summary

- Recover up to 150% of unused trip costs if you have to return home

- This coverage often allows you to rejoin the trip when the emergency is handled

- Helps travelers who would pay a higher per-person rate if one traveler leaves (some plans)

- This coverage is offered in many package plans and a few travel medical plans

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.