Many travelers are away from home several times a year, and travel insurance companies have designed annual coverage plans for them.

Companies like HTH Worldwide, Travelex, International Medical Group, and Travelguard all offer a variety of annual coverage, multi-trip insurance plans. These plans offer many of the standard benefits such as medical/dental coverage, accidental death, and emergency medical evacuation.

These annual travel insurance plans usually limit the length of individual trips, from 30-70 days per trip. Longer trips allow for more risk to the insured, so they do need to add these individual trip limits.

What if I change my mind after I purchase a travel insurance policy?

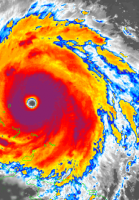

What if I change my mind after I purchase a travel insurance policy? As hurricane season starts sending big storm up the coast, many people consider purchasing travel insurance.

As hurricane season starts sending big storm up the coast, many people consider purchasing travel insurance.

Many people wonder if there are deductibles with travel insurance policies, similar to auto or home insurance.

Many people wonder if there are deductibles with travel insurance policies, similar to auto or home insurance.  Bizpack is a policy add-on that provides cancellation benefits specific to work related situations. It is offered with

Bizpack is a policy add-on that provides cancellation benefits specific to work related situations. It is offered with  From the Dallas Morning News, a good article about traveling with your children and travel insurance plans that will cover them.

From the Dallas Morning News, a good article about traveling with your children and travel insurance plans that will cover them.