What happens if I miss my connecting flight? Will I be covered?

What happens if I miss my connecting flight? Will I be covered?

We’ve all been there. Sitting on the plane listening to the announcements about being behind schedule, landing 20 minutes late. Next your connecting gate is listed as Z-99, at least a 20 minute mad dash through the airport. Nothing like getting your relaxing vacation off to a good start.

Package plans include trip delay coverage

Travel insurance plans are available to cover travel delay. Most package plans that cover trip cancellation also cover travel delay. Basically, travel delay coverage will pay for expenses incurred because of a delayed trip.

Every policy is different, but in general covered travel delay reasons include:

- common carrier delay (including weather related)

- lost or stolen passport, travel documents, or money

- natural disaster

- injury or sickness of insured or travel companion

There are different delay times and coverage amounts

The different insurance companies have different rules regarding delay length and coverage amounts. In general, most companies cover for delays of 3-6 hours, but many have higher delay limits of 12-24 hours. This is the amount of time before the travel delay benefits kick in.

Travel insurance companies will also have different coverage amounts, both on a daily coverage basis and total amount covered. For example: $100 per day with a $1000 dollar maximum.

Stay in contact with your insurance company

It is also good to stay in contact with your insurance company. If you are experiencing a delay, call the company and let them know of the situation. They can advise you about your benefits and help you through the process.

Additional Resources

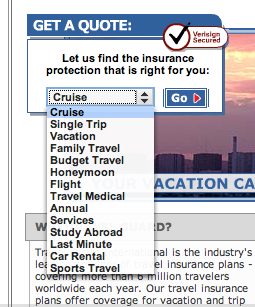

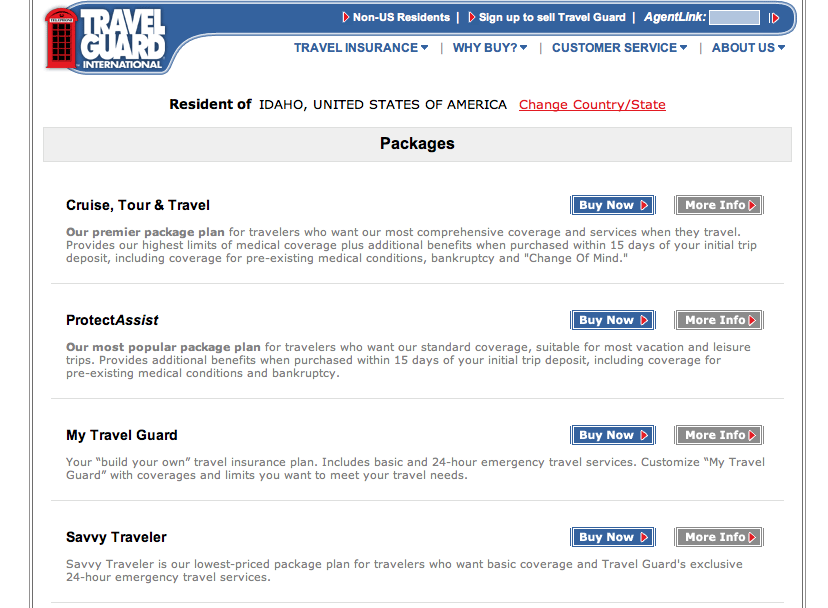

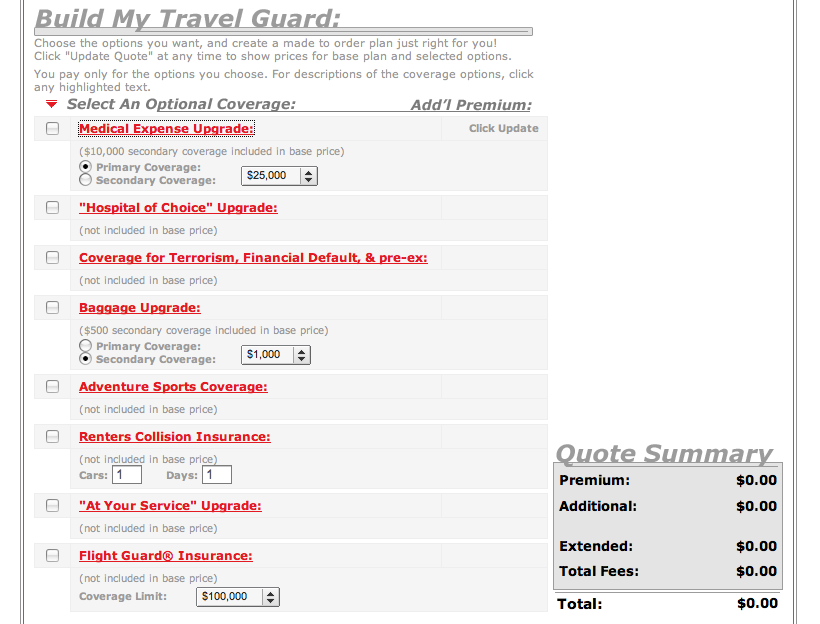

Arriving at the travelguard.com homepage, you see a basic welcome page and some content describing travel insurance in general. There is a quote form in the upper-left area (webpage sweet spot), but it is a little confusing.

Arriving at the travelguard.com homepage, you see a basic welcome page and some content describing travel insurance in general. There is a quote form in the upper-left area (webpage sweet spot), but it is a little confusing.

As winter approaches, many of you will head to the slopes to do some skiing, snowboarding, or cross-country. Here in New England, Vermonters are getting ready for a great season and everyone is hoping for some early snow.

As winter approaches, many of you will head to the slopes to do some skiing, snowboarding, or cross-country. Here in New England, Vermonters are getting ready for a great season and everyone is hoping for some early snow.

So you have decided to live and work abroad as an expatriot. The lure of life in a new and exciting country has finally pushed you into it.

So you have decided to live and work abroad as an expatriot. The lure of life in a new and exciting country has finally pushed you into it.