Airlines have initiated a new way to gouge gullible customers. What sounds like a good idea, charging you an extra fee to retain the value of your nonrefundable ticket should you have to cancel, has morphed into something less than desirable because the airlines will charge you a fee to change your ticket and you still don’t get your money back. You simply get to use whatever value is left, after their fees, toward another ticket you can use in the future.

Airlines have initiated a new way to gouge gullible customers. What sounds like a good idea, charging you an extra fee to retain the value of your nonrefundable ticket should you have to cancel, has morphed into something less than desirable because the airlines will charge you a fee to change your ticket and you still don’t get your money back. You simply get to use whatever value is left, after their fees, toward another ticket you can use in the future.

Rather than accept these airline ‘deals’ that really have little value, consider trip cancellation or ‘cancel for any reason’ coverage instead.

Let’s run some quick numbers through our travel insurance comparison tool, and see what this would cost.

We’ll imagine two travelers are taking a short anniversary trip, here are the pertinent trip details:

- Denver to San Francisco

- Three night stay

- Travelers are 32 and 37 years old

- Cost per traveler is $1,095

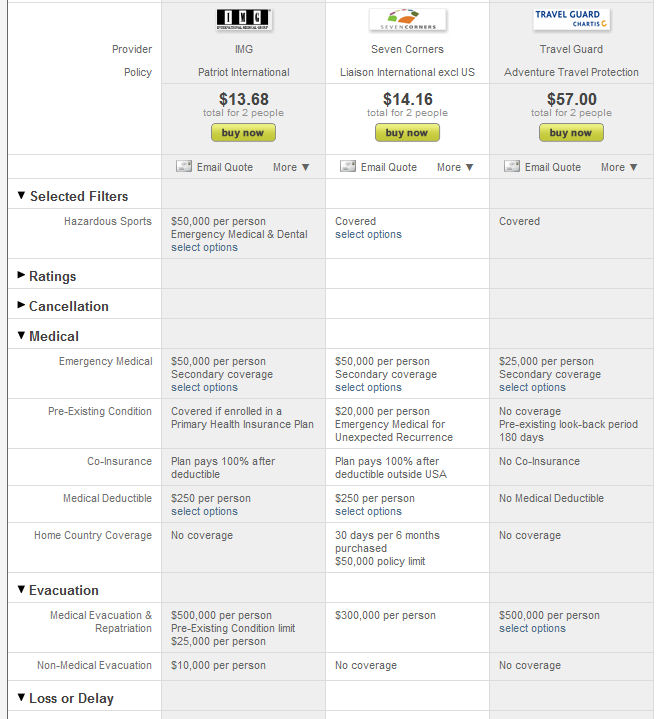

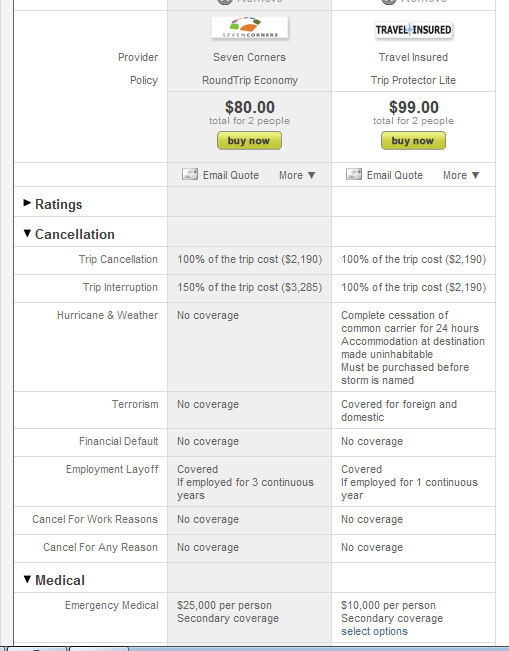

Using those trip details, we got about 40 potential policies. We’ll choose the two lowest-priced plans from the results and compare.

Notice that with travel insurance, these travelers can get 100% of their trip costs back if they have to cancel for a wide number of reasons (the reason for cancellation must be a covered reason), but they also get:

- Emergency medical if they get sick or injured or crack a tooth on their trip

- Trip interruption if they have to return home early for an emergency

- Medical evacuation if they have to be transported back home for medical reasons

- Travel delay if their flight is delayed for weather, mechanical failure, etc.

- Baggage protection if their luggage doesn’t arrive intact or is delayed

- Life insurance if they die on their trip

- 24/7 Travel assistance services if they need any kind of travel assistance

So, for a lot less than what the airline will give you, you really can have your entire pre-paid costs refunded to you. The key, of course, is to carefully read your trip insurance policy and cancel your trip for a covered reason.

Having travel insurance really is the only SURE way to get a refund on your nonrefundable airline tickets, but you’ll also get a refund for your pre-paid hotel costs and a number of other benefits in case something goes wrong on your trip too.