Celebrating a birthday and their wedding anniversary, Ron and Elissa Merritt flew from Minneapolis last week to Costa Rica for a winter getaway. The couple took an ATV trip into the scenic mountains when Elissa lost control of her vehicle and plunged down a steep cliff burying her in an avalanche of dirt and rocks.

Celebrating a birthday and their wedding anniversary, Ron and Elissa Merritt flew from Minneapolis last week to Costa Rica for a winter getaway. The couple took an ATV trip into the scenic mountains when Elissa lost control of her vehicle and plunged down a steep cliff burying her in an avalanche of dirt and rocks.

At a San Jose hospital, administrators told Ron he would have to pay cash for her care, so he handed over his credit card for the first $5,000. The following morning, his card was charged more and the bill is rising each day.

Family back home have started a benefit to raise funds to get Elissa back to America, where the couple’s health insurance can defray the costs, but a medical evacuation is predicted to take up to $30,000 and Elissa cannot travel by commercial airlines as it would be medically unsafe.

It is crucial for travelers leaving their home country to understand that your health insurance does not extend beyond the borders – this includes Medicare and Medicaid as well. In some cases, U.S. health insurance companies will reimburse travelers for out-of-network costs out of country, but it depends entirely on the insurance company policy rules.

Our hearts go out to Ron and Melissa and their worried families and we wish the best for Melissa’s condition and recovery.

Why Travel Insurance Really is Cheap

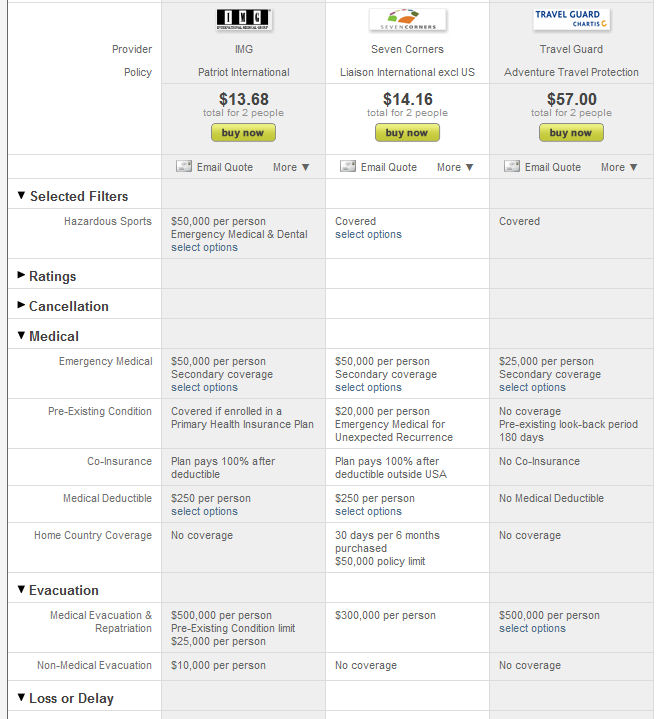

We don’t know Ron or Elissa’s ages, or whether they have pre-existing medical conditions, but as an example, we ran some basic trip details through our travel insurance comparison tool to get an idea what travel insurance would have cost a similar couple.

Using these trip details:

- 2 travelers ages 32 and 37

- going from Minnesota to Costa Rica

- 5 days

- NO cancellation coverage

- hazardous sports coverage

We got a number of policies from a several companies. We’re showing you just a few below:

Note that two of these plans have as much as $50,000 in emergency medical (which is sounds like Elissa may need), and all have medical evacuation coverage from $300,000-$500,000. When you consider the bills, fear, and uncertainty Ron and Elissa are facing right now, the cost of even the highest of these three plans is very, very cheap indeed. Plus, travel insurance plans come with 24/7 emergency travel assistance representatives, many of whom will arrange for payments to be made directly to the hospital, and all will coordinate and pay for a medical evacuation back home.

Again, we sincerely hope that this couple is able to get safely home soon.