So, what do you do if you’ve purchased your travel insurance policy and something about your trip changes?

So, what do you do if you’ve purchased your travel insurance policy and something about your trip changes?

It happens to lots of travelers, but it’s important to remember that you can make changes to your policy as long as they are made before you start the trip.

The most common changes made to travel insurance plans are:

- Changing the departure and return dates

- Increasing or decreasing the trip costs

- Adding additional members to the policy

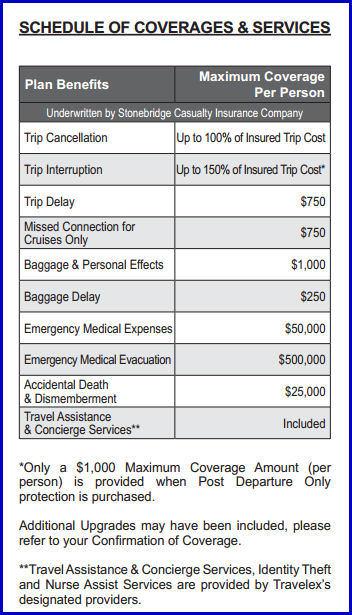

- Adding additional coverages to the policy

In all cases, a call to the travel insurance provider is all that’s required to make such changes – be sure to have your policy number and the necessary changes on hand to make that process easier.

1. Some trip changes require a policy update

Why would you need to change to make changes to your travel insurance policy? Well, we’ll offer a few common examples:

- You get a call from the cruise company offering you a great incentive to pay a little more and get an upgrade on your cabin. You decide to surprise your wife and buy the upgrade. Three months later, however, you have to cancel your trip because of a family illness, and you make a claim on your travel insurance policy. Without changing your travel insurance plan, you would only have access to the original amount you insured.

- You and your wife are taking the kids to Cozumel and shortly before leaving, you find a super-saver fare and ask your parents to come along too. When you arrive, however, your father is very ill and rushed to a local hospital. If you didn’t update your travel insurance plan to include your parents – or have them purchase a separate plan – you won’t have coverage for his international travel medical bills or an emergency evacuation to receive medical treatment back in the States.

- You’re doing further research on your all-inclusive resort trip and realize that it’s been a long time since you’ve been SCUBA diving. You decide to add a few afternoon SCUBA dives to your list of activities. If you don’t remember to check the policy and be sure adventure activities like SCUBA diving are covered, you will have no travel medical coverage for accidents that occur on your trip.

Travel insurance companies know that your trip will often evolve up until the time you leave. It’s important to keep them informed of the changes that affect the coverage in your policy to ensure that you avoid the common ‘loopholes’ that catch some travelers off guard.

2. Your premium may change a little – up or down

It might, depending on the changes you’re making. If you are increasing the trip costs or lengthening the trip dates, you may have to pay a slightly increase in the premium, but as we noted above – that small extra amount could save you a lot more should you have to cancel.

If the changes result in a lower premium, a refund will be issued.

Additional travelers can be added to some policies, but travel insurance providers typically require that travelers covered by the same travel insurance policy be related or reside at the same address.

3. The rules are slightly different with group plans

If the travel insurance policy is a group plan, most travel insurance providers require that all members of the group be covered for the plan to be in effect. That means each person in the group taking the same trip has to be listed and covered by the plan. If someone is left off the plan, the entire group’s coverage could be invalidated.

If, before departure, one or more people in the group can’t make it, call the travel insurance provider and make the necessary changes to the group travel insurance policy to make sure that the coverage you have on everyone else is valid and in effect when you need it.

4. Make your travel insurance plan changes early

In all cases you should make your travel insurance plan changes as soon as humanly possible. Every travel insurance policy comes with a free review period in which the insured traveler can read the policy, understand the exclusions, and make changes to the policy or cancel the plan for a refund (minus a small fee).

Of course, it’s best to get the trip details right when you’re first generating a quote and making your purchase, but we’re all human and mistakes and misunderstandings happen. But, you can’t make changes after you depart for your trip.

The key thing to remember is that a travel insurance policy is a legal agreement between you and the insurance provider. You agree to pay a premium and give them accurate trip details and they agree to the terms of their coverage. If you provide them with inaccurate trip information, they have every right to deny your claim.