In the comments of this website, we often get complaints from travelers who believed they were covered for an event but found out later they weren’t.

In the comments of this website, we often get complaints from travelers who believed they were covered for an event but found out later they weren’t.

- They denied our claim because the departure date changed! I had no idea that was important.

- I thought our cancellation would be covered for any reason, but I didn’t read the exclusions.

- When he needed medical treatment, we thought it would be covered, but our claim was denied due to a pre-existing condition.

No more than you can assume your car insurance coverage will reimburse you for a particular event, you can’t assume that travel insurance will either. While car insurance is somewhat more standardized (at least in the States), travel insurance is a relatively new product in the insurance market. Plus, the risks of travel – the September 11 terrorist attacks in the U.S. for example – are continually causing changes to travel insurance plans.

The situation is further complicated by a number of related products like cruise waiver plans, one-size-fits-all insurance you can buy when booking your flight, and credit card travel protection plans.

With all of these options, you have to read the fine print to know what you’re covered for because every plan is a little different. This is true no matter what type of travel protection you choose. In fact, you may be surprised to find:

- Cruise line waivers won’t reimburse your non-cruise costs (like airfare) and they only issue a voucher for future travel instead of giving your money back.

- Credit card travel protection has very few covered reasons for trip cancellation and severe limits on the maximum trip costs.

- Travel protection purchased on booking sites doesn’t give you the time to review the plan before you buy it – after all, you’re trying to score a ticket price!

Instead of making assumptions and sticking our heads in the sand, let’s sit down and review the steps to understanding your travel insurance plan. These steps will apply no matter what travel protection you choose although we should warn you that most waiver plans and trip benefits won’t stand up to all the steps. Only a good travel insurance plan will.

6 Steps to Understanding your Travel Insurance Plan

Before we start, if you already purchased your travel insurance plan begin by checking the dates of your review period. All travel insurance plans come with a unique benefit – the free look period which starts when the plan is purchased and lasts between 10 and 15 days. During this period, you can review your plan, make changes, and even cancel it if it won’t work for you.

Now, assuming you haven’t bought your travel insurance or you are within the review period, let’s figure out how to tackle this plan document.

1. Check that you have the right document

The marketing brochure is nice, it may have been what prompted you to buy the travel insurance, but it’s not the actual plan document. You can read the plan’s description of coverage before you buy it (even on booking sites), so take a little time and find the right document.

If you already purchased your travel insurance online, the document will have been sent to you by email. If you purchased your plan with a travel agent or cruise line, they should have sent you the document to read.

2. Start with the high-level details

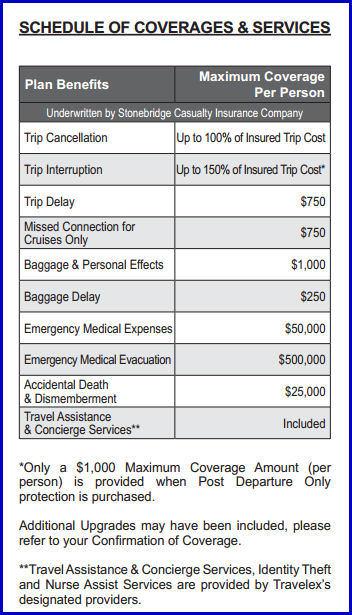

While all travel insurance plans are different, their documents follow a basic pattern that begins with stating the high-level details first. Often, this is displayed in a table like the following:

This is the high-level overview of your coverage and the limits. Once you identify the most important coverage for your needs, you’ll want to review this list to be sure that it meets your minimum expectations. Notice that the coverage is per person.

3. Think about your risks

What are the risks on this particular trip at this particular time of your life?

- Is someone dear to you fighting a chronic disease? If they’re hospitalized while you’re traveling and you want to return to be with them you’ll need to have a pre-existing condition waiver with your plan.

- Are you traveling during hurricane season? Even if your travel destination isn’t directly affected, a hurricane can ground flights across many states and tie up travel traffic for days.

- Do your travel plans include connecting flights? Many travelers book nonrefundable tickets to save money, but can be left in a bind if their first flight doesn’t arrive on time.

- Will you participate in any high-risk activities? You may be surprised to find out that many travel insurance plans exclude activities travelers often participate in like skiing, diving, and whitewater rafting.

- Determine how far you will be from adequate medical care. If you’ll be traveling far from good medical care or in a region where medical care is inadequate, you’ll want a good limit for evacuations.

- Are you traveling to a region that’s considered high risk for political demonstrations, or earthquakes, or other risks? You’re going to want to verify your coverage will be viable in those instances.

4. Match your needs to the coverage and the limits

Given your identified risks, read the sections of the document that cover those risks and understand how the coverage will protect you in the event that risk presents itself.

- If you have to cancel your trip to return to a loved one’s side, will you be able to recover all your pre-paid trip costs? If your trip is expensive, is the plan limit high enough?

- If your vacation rental is destroyed by a hurricane the week before your trip, will you be able to recover those trip expenses? Is the plan limit high enough and are hurricanes specifically covered?

- If you miss your connecting flight, what will the insurance plan provide in the way of alternative flights, meals, lodging, etc.?

- If you go cut your foot while diving, will your travel medical coverage help you find and then pay for your emergency medical treatment? Is the medical coverage limit adequate for a real emergency?

- If the streets are suddenly engulfed in a civil riot and tear gas is being fired, will your travel plan arrange for your safe passage out of danger? Is the evacuation limit high enough and are non-medical evacuations even covered at all?

5. Don’t panic if it’s not initially covered

Don’t initially panic if you read that something isn’t covered because while a travel insurance plan will have exclusions that are typical for all travel protection plans:

Many travel insurance plans also give a traveler options as optional riders that overcome the exclusions that most credit card plans and cruise waiver plans do not. This is one of the most important differences between those protection plans and a travel insurance plan.

You may have to read another section to find the optional coverage, and if it’s not there, remember that you can choose another plan or cancel the plan you’ve purchased and pick the right plan for your trip.

6. Do read the exclusions

Every travel insurance policy comes with a list of situations in which coverage is not valid – these are called the exclusions and it’s no different from your homeowner’s plan or your automobile plan (they have exclusions too).

See What Travel Insurance Does Not Cover for a detailed explanation.

Study the exclusions and you’ll have a much better understanding of what events are not covered ahead of time – fewer surprises later. Still got questions? Call the travel assistance services line and ask very specific questions about the coverage.

See? Now that wasn’t so hard, was it?