When deciding how much insurance to purchase, should I include the equivalent “cost” of the airline ticket that I purchased with my frequent flyer miles?

When deciding how much insurance to purchase, should I include the equivalent “cost” of the airline ticket that I purchased with my frequent flyer miles?

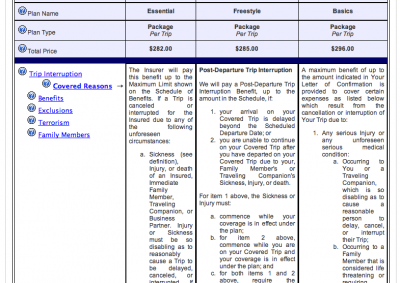

Generally the insurance companies will not insure tickets purchased with reward points or miles, simply because no money has been paid.

You should, however, insure yourself for adequate trip interruption coverage. Make sure that you have purchased enough trip interruption coverage to cover the cost of an economy ticket home plus the cost of any unused, non-refundable land arrangements that you might lose if you have to interrupt your trip.

As the travel insurance niche grows, more and more business is being processed online. Some companies report as much as 70% of all sales being transacted online. Here are 3 reasons the web is perfect for purchasing travel insurance:

As the travel insurance niche grows, more and more business is being processed online. Some companies report as much as 70% of all sales being transacted online. Here are 3 reasons the web is perfect for purchasing travel insurance:

Credit card companies offer many benefits to cardholders in an effort to aquire and retain customers. Some even offer “Travel Insurance”, but cardholders should do some research before relying on it for their next trip.

Credit card companies offer many benefits to cardholders in an effort to aquire and retain customers. Some even offer “Travel Insurance”, but cardholders should do some research before relying on it for their next trip. For Travel Medical, Multi-Trip Medical and Medical Evacuation Policies, coverage begins at 12:01AM the day of your departure. If purchased on, or after your departure date, coverage begins at 12:01AM the next day. For Flight Accident Policies, coverage becomes effective the day of your departure upon boarding your flight.

For Travel Medical, Multi-Trip Medical and Medical Evacuation Policies, coverage begins at 12:01AM the day of your departure. If purchased on, or after your departure date, coverage begins at 12:01AM the next day. For Flight Accident Policies, coverage becomes effective the day of your departure upon boarding your flight. This is the number of days that the insurance company will “look back” from the day the insurance was purchased, to see if your claim is related to a pre-existing medical condition.

This is the number of days that the insurance company will “look back” from the day the insurance was purchased, to see if your claim is related to a pre-existing medical condition.

What is the definition of a Pre-Existing Medical Condition?

What is the definition of a Pre-Existing Medical Condition?