In a medical emergency, time is a critical factor to successful treatment. A personal medical profile is a single place where the medical professionals who are treating a traveler can obtain access to a traveler’s medical history, pre-existing conditions, current medications and contact their current health care providers back home. Access to that information can make the difference between timely and effective emergency medical treatment and disaster.

In a medical emergency, time is a critical factor to successful treatment. A personal medical profile is a single place where the medical professionals who are treating a traveler can obtain access to a traveler’s medical history, pre-existing conditions, current medications and contact their current health care providers back home. Access to that information can make the difference between timely and effective emergency medical treatment and disaster.

A number of travel insurance plans include a feature that lets you put together a travel medical profile.

In addition to your travel itinerary, you’ll want to include the following in your profile:

- Personal contacts – relatives and friends who can be contacted in a medical emergency. Be sure to identify the order in which they should be contacted in case the first person on your list is traveling with you (your spouse perhaps?).

- Medical care provider contacts – the doctors who actively treat you and who will have your current medical records. If there are multiple doctors, list them by which condition they are treating.

- Insurance information – not just the travel insurance plan, but also current health care insurance information, including plan and member numbers.

- Full medical disclosure – list your pre-existing conditions, including speech, memory, hearing and other non visible conditions that someone treating you in an emergency situation will need to know, such as heart conditions or diabetes.

- Complete medical history – including allergies, blood type, current medications and immunizations.

For additional information see this Traveling Smart topic from UStiA.

Which plans have this option?

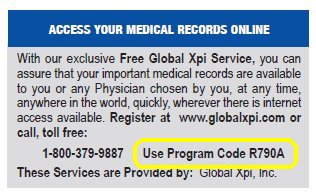

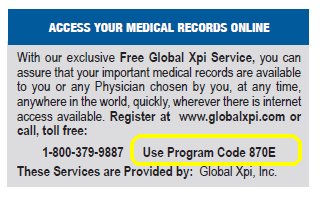

We found two companies offering plans with the exclusive Global Xpi Service.

- Global Alert’s plans: Essential, Preferred, and Preferred Plus.

- MH Ross’s plans: Asset, Bridge, and Complete.