Travelers who get in a bad spot on a trip, and then make a claim with their travel insurance company, often feel like they’ve been cheated when their claim is denied.

Travelers who get in a bad spot on a trip, and then make a claim with their travel insurance company, often feel like they’ve been cheated when their claim is denied.

More often than not, however, they’ve made a mistake when purchasing their travel insurance.

These are the most common mistakes made by travelers when buying their travel insurance.

1. Buying ‘travel insurance’ with your ticket

Lately it seems that everyone is getting in on the trip protection game, and for a traveler, it seems like the easy choice: buy your airline ticket and for just a few dollars more, you’ve got trip cancellation insurance.

Our comment board is full of complaints about these types of plans. The problem is that the coverage is very narrowly defined and almost never delivers the protection a traveler wants and needs.

See that link to buy Travel Insurance now? Don’t click it!

2. Assuming your Credit Card has the Coverage you need

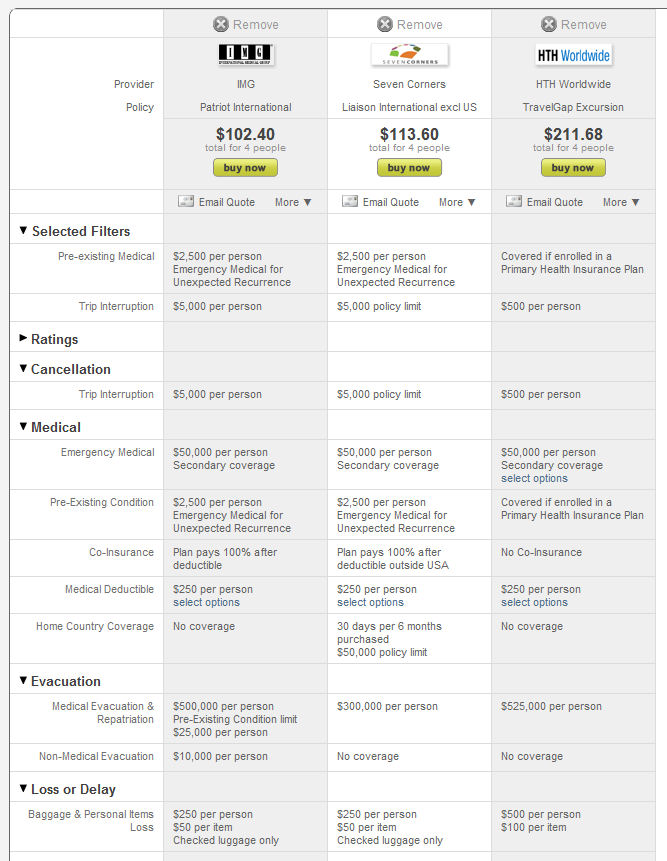

This is a common mistake, travelers avoid purchasing travel insurance because they believe they already have it with their credit card. While the advertising may look similar, the travel protections offered with your credit card agreement simply don’t measure up to the level of protection offered by a true travel insurance plan from a reputable travel insurance company.

See Credit Card travel protection vs. Travel Insurance for more information.

3. Forgetting about recent illnesses

If you have seen a doctor for an illness or injury within the look-back period, that’s going to be considered a pre-existing medical condition. If you encounter a problem related to that condition and you don’t have the pre-existing medical condition waiver, your trip insurance could be invalid.

See our review of Pre-existing medical condition coverage to determine whether you need this waiver.

4. Ignoring the Exclusions

Every insurance plan has exclusions, but the exclusions in your travel insurance plan can leave you in a bad spot. Travel insurance companies have to limit the coverage to limit their liability.

We recently encountered a father who was angry because his daughter’s trip interruption wasn’t covered. His daughter had abandoned her trip because her best friend committed suicide. Neither suicide nor best friends are included in the covered reasons for trip interruption, and reading the policy description is essential if you are to understand the plan.

See What Travel Insurance Does Not Cover for more details.

5. Neglecting the covered reasons for trip cancellation

Many people assume ‘trip cancellation’ means for any reason at all, and that’s just not true. For example, you can’t cancel your trip because you just lost your job if that’s not a covered reason listed in your policy (many policies do cover this).

All travel insurance plans provide a clear list of covered reasons for trip cancellation. If your reason isn’t on the list, your cancellation won’t be covered.

6. Failing to purchase the plan in time

While you can buy travel insurance right up until the day before you leave, nearly all plans require that you purchase your plan with a certain number of days from making your initial trip payment to have coverage for a number of travel risks, like pre-existing medical conditions and hurricanes, for example.

Buying your travel insurance as soon as possible is the best way to avoid common problems travelers encounter. See When should I buy my travel insurance? for additional information.

7. Providing incorrect trip details

When you receive your trip insurance documents in e-mail, stop and verify you’ve provided the correct information, such as your travel start and return dates, the traveler’s ages, your target destination, your total trip cost, etc. If anything is wrong here, it can invalidate your travel insurance plan.

The solution?

Every travel insurance plan comes with a free review period and in that timeframe, you can change or cancel your policy (for a minimal fee). Luckily all travel insurance policies – even those you purchase from the airline – have a free review period in which you can make changes and even cancel your policy.