In this episode we talk quickly about how travel insurance covers cancellations due to Coronavirus, and tips on how to get coverage as we go forward.

8 Steps to Verify You Have the Right Travel Insurance

One of the biggest complaints travelers have about travel insurance is that it doesn’t pay out when they expect it to. In nearly all of the cases we’ve seen over the years it comes down to the traveler not understanding what their plan covers and, more importantly, what it doesn’t.

One of the biggest complaints travelers have about travel insurance is that it doesn’t pay out when they expect it to. In nearly all of the cases we’ve seen over the years it comes down to the traveler not understanding what their plan covers and, more importantly, what it doesn’t.

Travelers buy travel insurance for all kinds of reasons:

-

‘I’m worried about terrorist attacks and want to be protected.’

-

‘My parents are elderly and I want to be able to get home if they need my help.’

-

‘If I get hurt or sick, I don’t want to worry about paying a huge medical bill.’

-

‘My job has been a little ‘weird’ lately and I’m worried about layoffs.’

To be sure you actually have the right travel insurance for your trip, follow these steps with the plan you already purchased or want to purchase. Check your plan within the review period so you still have time to cancel your policy (for a refund) or make changes to get the coverage you need.

1. Do a quick health review

If you’ve been to the doctor recently – is that condition likely to recur? If you visited the doctor for migraine headaches in the past few months, for example, and that condition reoccurs on your trip, your medical care while traveling might not be covered.

Why?

Because the condition is considered pre-existing and most travel insurance plans exclude medical care for pre-existing conditions. A traveler who has a pre-existing condition can purchase a plan with coverage if they purchase it soon after their first trip payment or buy the optional upgrade. Some travel insurance plans cover pre-existing conditions automatically if the plan is purchased early. No travel insurance plans cover losses due to mental health issues or suicide.

Very Important: be warned that the exclusions for pre-existing medical conditions apply not only to the traveler but also to family members and travel companions. Most people don’t have the full details of another’s health history, but if a close relative or business associate’s state of health leads to a decision to cancel your travel plans, that cancellation may not be covered if the cancellation was due to a pre-existing medical condition.

2. Check your destination

To get the latest health and security information about where you’re going, you have a number of sources outside of the standard media coverage.

-

To find out the latest travel safety information – including warnings about the potential for terrorist actions, see the State Department Website.

-

To find the latest health information – including information about recommended vaccines the latest outbreaks, see the Traveler’s Health section of the CDC Website.

Check out our topic on the Best Places for Travel Health and Safety Info for more details.

3. Check your travel mileage

How far you travel factors into a number of travel insurance benefits. Most travel insurance policies limit the coverage unless a traveler is going a certain distance from home. For example:

-

If you’re traveling abroad, you are likely to be outside your health insurance network on your trip. That means you won’t have benefits for emergency medical treatment without travel medical coverage.

-

If you’re traveling within your home country, the benefits for medical evacuations and repatriation may not be in effect.

The key is to be sure your destination is far enough to warrant the coverage you’re paying for.

4. Know your trip activities

The activities you do on your trip could render your coverage invalid. Travel insurance plans typically exclude a number of activities that are considered more hazardous than say running along the beach in the dark. Specifically activities like parasailing, hang-gliding, mountain sports, diving and more are excluded from the typical plan unless you purchase an upgrade.

Some travel insurance plans are designed specifically for adventure travelers, but even if you’re a typical traveler and don’t plan on doing anything potentially dangerous, you could run into a unique opportunity to do something adventurous on your trip.

Take out your travel insurance policy documentation and read the section labeled ‘Exclusions’ to know which activities could cause your policy to be useless. You don’t want to find out that rock climbing is a non-covered activity after you fall and get hurt. Know ahead of time.

5. Double check the dates

In the chaos of planning a trip, the dates may get shuffled around a little so you can get the best airfare or meet a friend while waiting for a connecting flight. The key is to double check that the dates you are traveling are the dates you’re covered for with your travel insurance plan. Everything has to match up correctly if you later have to make a travel insurance claim.

The same is true for the traveler’s ages, names, etc. Scrutinize the details and call your travel insurance provider as soon as you identify a discrepancy so the change can be made ahead of time. Once you depart, these changes can’t be made.

6. Verify your layovers

Travel insurance coverage for trip delays and missed connections comes with the standard caveat that you gave yourself enough time from the start. If you schedule a multi-stop flight with tight connections and the first flight is delayed for an hour due to mechanical repairs, you could throw off your entire trip.

Even worse, if the delay means you incur a loss and want to make a claim on your travel insurance plan they will verify that you had enough time to make your connection.

7. Check the policy limits

Every insurance plan has limits applied to the coverage. The baggage limits, for example, may not be enough to fully reimburse you for a lost bag and it’s contents (depending on what you’re taking with you). Where the limits really get sticky are when it comes to medical and evacuation coverage. Specifically, you want to have enough coverage to pay for these events should they occur, but you don’t want to pay too much for coverage you may never use.

It’s a tricky balance, but luckily our travel insurance comparison tool offers some suggestions based on your age, your destination, etc. to help you determine how much travel medical and evacuation is enough.

8. Don’t make assumptions

Don’t make assumptions about your travel insurance coverage. Many travelers read that their policy covers trip cancellation, for example, and assume it means the plan will cover no matter what causes the cancellation. Or, they read that their plan covers travel delays but they don’t understand that the delay must meet a minimum number of hours.

If you have a specific concern, read your travel insurance policy (or the description of coverage) before you buy or or soon after so you understand your concerns are covered.

If you’re worried about the possibility of losing your job, for example, and you want to be sure you can cancel your trip and be reimbursed your non-refundable trip costs, make sure that job loss is listed as a covered reason and that your length of employment meets the requirements (usually at least a year is required).

Getting the right travel insurance takes a little bit of thinking, some research, and a careful review of the policy you choose. It’s not hard, but it does take a little effort on your part. See the 9 Most Expensive Travel Mistakes You’re Likely to Make for more details on what to watch out for.

9 Expensive Travel Mistakes You’re Likely to Make

We all make mistakes, but we’ve also learned that some mistakes cost more than others do. This is especially true when you’re traveling. While no traveler can predict unexpected events like volcanic eruptions or earthquakes, there are a number of expensive mistakes travelers make often enough to warrant this post.

We all make mistakes, but we’ve also learned that some mistakes cost more than others do. This is especially true when you’re traveling. While no traveler can predict unexpected events like volcanic eruptions or earthquakes, there are a number of expensive mistakes travelers make often enough to warrant this post.

The following are some of the most expensive mistakes travelers common make – and how to avoid them.

1. Not checking your passport early

This mistake can happen to the best of us – after all, ten years is a long time and if you use your passport infrequently it’s easy to forget when it is due to expire.

Trip cancellation coverage with your travel insurance plan may cover your lost trip expenses if your passport is lost or stolen, but it won’t cover them if your passport has expired because that’s part of your good faith responsibility to verify.

In addition, entry into some countries like Costa Rica requires that your passport be valid for six months AFTER you arrive in the country. If you get turned away at the border for having an invalid passport, your travel insurance plan won’t reimburse you for your costs.

If you’re planning a trip where you’ll need your passport, check the expiration date early and for everyone who’s going on the trip. See the State Department’s information on how to get your passport in a hurry if you need to expedite your passport renewal..

2. Using your phone overseas

These days, our phones do far more than ever before – and many of us are ridiculously dependent on those services to find our way around, find a restaurant, keep everyone updated on our day, etc. But using your phone in a foreign country without an international plan can be shockingly expensive.

Of course, you could leave your phone behind and see what travel was like in the ‘old days’. If that’s too scary, you have lots of options to choose from to stay in touch without losing your shirt, including:

-

Get a temporary overseas plan with your provider for the duration of your trip.

-

Switch to a Voice over IP app like Skype to make calls when you find a Wi-Fi hotspot or use your 3G network.

-

Switch your phone’s SIM card, which you can buy locally and pay local rates.

-

Buy or rent a temporary pre-paid phone that works where you’re traveling.

-

Use a free hotspot and spend your time on social media (just remember to disable any automatic downloads).

See Does travel insurance cover phones to understand how to protect your phone.

3. Packing too much stuff

Nearly all of us struggle with this one and more than half of us return home with an outfit that was never worn on the trip. With baggage fees climbing steadily, it’s wise to rethink how much stuff you’re bringing with you and remember that you can buy something you’re missing on your trip.

Regularly check the weather reports for your destination – both current and historical data – to be sure the items you have are really what you need.

See these tips to lighten your load:

Avoid an expensive situation at check-in by reviewing your airlines’ baggage rules and weighing your bag ahead of time. An overweight bag can really bite into your available travel money.

4. Traveling without medical insurance

Not one of us likes to spend money where it’s not necessary, but having travel medical insurance is not one of those scenarios. Sure, you might get through your entire trip without breaking your ankle on a cobblestone street, or contracting a severe case of norovirus, or slipping on the wet tiles at a spa, but if you do wind up in a hospital that’s outside your health insurance network, it can be an expensive financial blow.

Many countries require up-front payment for medical care even with travel insurance, and some travel insurance providers will pay the medical facility directly. If your travel insurance company reimburses you instead, you may need plenty of credit on your credit card.

Before you leave, contact your health insurance provider and find out what coverage you will have where you’re traveling. If there’s little or none, a travel medical plan is a cheap way to protect yourself.

5. Forgetting to tell your bank

If it’s unusual for your credit or debit card to have a charge for restaurant meal in Paris, then your bank may suspend your card for potential fraud. This is an excellent service when the charge isn’t your own and your card has been stolen, but it can be a real problem when you need to pay for your next purchase and the card has been cancelled.

Avoid this situation altogether by contacting your bank and let them know the dates and where you’ll be traveling. Be sure to give them both pieces of information and tell them how to get a hold of you on your trip – if you’re in Paris and a charge shows up on your account from Singapore, the bank will do what it’s trained to do and close your account anyway.

6. Making booking mistakes

Many of us are guilty of this one and it includes a wide range of mistakes:

-

Not leaving enough time between connecting flights

-

Not verifying our calendars and taking into account the time differences

-

Booking the wrong outbound or return flight

-

Booking a flight out of the wrong airport

Rebooking departure dates is one of the most common traveler mistakes and it happens all the time. You can make a lot of changes to airline tickets, but these days those changes can lead to a hefty fee. Double and triple check your calendar before making reservations.

7. Not reserving a place to stay – at least for the first night

Even the most spontaneous travelers need somewhere to put their suitcase – and perhaps their bum – down for the first night. Traveling can be hard on the human body and landing in an unfamiliar city without a reservation could prove more expensive than you think. Wandering around with heavy bags looking for a place to rest isn’t ideal either.

No matter how flexible you want your trip to be – have a place to stay the first night. Keep that reservation and hotel information handy so you can get directions from a local or give it to a cab driver.

8. Failing to research local transportation

What do you know about the transportation at your destination? If you’re staying in a friendly seaside village, do you know how you will get from the airport to that final destination? You can’t assume that the transportation system where you are traveling is similar to the one you have back home. You might be used to lots of cabs and buses being available at all times of the day and night, but try that in some regions of the world – especially if your plane was significantly delayed and you’re arriving late in the night – and you could end up sleeping in a park until morning.

Do a little research on the transportation so you know how far you’ll be going and how you’ll get there. If you’re planning to take public transportation, be sure you know what options you’ll have when you arrive. Also, it may be more cost-effective to buy your rail passes before you leave.

9. Taking the ‘typical tourist’ route

Staying on the standard tourist route is often the most expensive way to travel. While there are certainly some sites that are not to be missed on certain trips – the Eiffel Tower in Paris, for example – the simple demand for those views means they cost more. Visiting the less known destinations can significantly reduce the cost of your trip and often those are some of the most interesting places to visit.

The same is true for traveling during the high season. A destination’s peak travel period results in the highest demand and thus the highest prices. If you’re planning to travel during a busy time, book well in advance for the best prices. If you can travel during the off-season, however, you’ll save a lot of money but you may not have ideal weather conditions. The shoulder seasons are often ideal to get the best of both worlds.

How the Latest Global Travel Alert Affects your Travel Insurance

Earlier this week, the U.S. State Department issued a global travel alert announcing the threat for terrorist attacks on Westerners and warning U.S. citizens to take precautions while traveling.

Earlier this week, the U.S. State Department issued a global travel alert announcing the threat for terrorist attacks on Westerners and warning U.S. citizens to take precautions while traveling.

The travel alert expires on August 31, 2013, and nearly the moment it was issued, many U.S. travelers were scrambling to check their travel insurance policies and understand the terms under which they might be able to cancel their travel plans – and get a refund – or travel anyway and be sure their emergency medical care will be covered.

Let’s review how this latest global travel alert affects your travel insurance coverage.

A Terrorist Act (by definition) May Not Be What You Think

Travel insurance doesn’t always apply to emergency situations the way many travelers expect it to – especially in cases of terrorism, or political and civil unrest that causes instability in certain regions of the world. Specifically, a terrorist incident is not the same as political or civil disorder or riots.

Understanding how your travel insurance plan defines a terrorist act is critical to understanding your coverage.

See your travel insurance plan’s definition of terrorist act – here is an example copied from the plan description document for TravelEx’s Select plan:

Some travel insurance plans – like Seven Corner’s Round Trip Choice plan – define a terrorist incident like this:

Terrorist Incident: means an incident deemed a terrorist act by the United States Government that causes property damage or Loss of life.

Essentially, the coverage in the plan isn’t in effect unless the U.S. government deems it a terrorist act. So, just because you’d define it as an act of terrorism doesn’t mean your travel insurance provider does.

Changing Your Mind is Not a Covered Reason to Cancel

Most travel insurance policies do not cover trip cancellations in response to a travel alert or travel warning – the terrorist action actually has to occur for the coverage to kick in. For those plans that do include cancellation coverage for terrorist actions, the following rules generally apply:

-

The travel alert must be issued after your plan’s effective date (meaning you can’t buy travel insurance now because the threat is already a known event).

-

The terrorist incident must occur after your plan’s effective date and within a certain number of miles of your travel destination.

-

The terrorist incident must occur within a certain number of days (usually 15-30) of your scheduled departure date.

-

The same city must not have already experienced a terrorist incident within ninety days prior to the incident that is causing you to cancel your trip.

Those travelers with trips scheduled after the August 31, 2013 expiration of the global travel alert can get coverage for their trip, but remember that buying your plan soon after your first trip deposit is always recommended.

Travelers who purchased a travel plan with ‘cancel for any reason’ coverage can cancel their travel plans no later than 48 hours prior to their departure. ‘Cancel for any reason’ coverage is the only coverage that allows a traveler to cancel for any reason at all and get 50-100% of their money back.

See more about terrorism as a covered reason to cancel your trip and a list of policies with that type of coverage.

Benefits May Not Be Payable for Certain Types of Terrorist Incidents

Travel insurance providers limit their losses for some events using exclusions, which are clearly defined in your travel insurance plan. For example, most travel insurance plans specifically exclude any coverage for sickness, injuries, or other losses due to war, attacks using weapons of mass destruction, nuclear, chemical, biological or other warfare – regardless of who commits the act or whether war has been declared or not.

This means that if a terrorist decides to unleash a nuclear attack where you are intending to travel or are already traveling, your cancellation, your emergency medical treatment, your evacuations, etc. will not be covered by your travel insurance plan – even if it’s defined as a terrorist action simply because of the type of incident.

If You’re Traveling Soon and Have Travel Insurance

This particular global alert was issued on August 2, 2013 and expires on August 31, 2013. If you are traveling within this travel alert’s time frame, especially if you are traveling to one of the areas listed in the global travel alert, which are: North Africa, the Middle East, and the Arabian Peninsula, you’ll want to do the following:

-

See if you purchased ‘cancel for any reason’. If you decide not to go, you’ll need to cancel your trip no later than 48 hours prior to departure.

-

Check your plan’s exclusions section to see how your cancellation, trip interruption, emergency medical, and evacuation will be covered in the event of a terrorist attack.

-

Check your plan’s coverage for political evacuation. In some cases this coverage will provide for your evacuation in the event of government or social upheaval in a foreign country. Remember that the event must occur for the coverage to be available.

If an event does occur within the travel alert’s time frame and you’re traveling, know that extra costs due to travel delays may be covered if the carriers stop all travel for a certain number of hours.

Summing It Up

The issuance of a travel alert or travel warning associated with an increased threat of terrorist attacks does not automatically trigger benefits under your travel insurance policies. Travelers who are concerned about taking their trips in light of the increased threat must have purchased their insurance prior to the alert being issued.

Travelers with plans to travel after the expiration of this latest alert should purchase their travel insurance early – soon after their initial trip deposit date – and consider getting ‘cancel for any reason’ protection in case other alerts are issued and they decide to cancel.

Rules of the Road for Overseas Driving

The hazards of being on the road are reinforced by some truly awful statistics. Over one million people are killed in road accidents globally every year and hundreds of U.S. citizens are among those killed or badly injured in road accidents overseas. About 70% of those deaths occur in developing countries and involve pedestrians or cyclists. Further, over 10 million people are crippled or injured in road accidents every year.

The hazards of being on the road are reinforced by some truly awful statistics. Over one million people are killed in road accidents globally every year and hundreds of U.S. citizens are among those killed or badly injured in road accidents overseas. About 70% of those deaths occur in developing countries and involve pedestrians or cyclists. Further, over 10 million people are crippled or injured in road accidents every year.

Note: No matter where you are in the world, the first rule of road safety is to wear a seatbelt at all times.

When you are traveling overseas, it’s important to remember that are many road safety rules other than which side of the road you’re supposed to drive on.

Every country has their own road safety laws, driving customs, and road security factors. The potential hazards of any given region of any given country are unique to that area and if you’re unfamiliar with the region in which you are traveling, you are more at risk of making a mistake, misjudging a turn, or failing to properly understand the signs.

The potential hazards of road conditions are another factor. Your driving skills may be further tested if you encounter:

-

Seasonal driving hazards like flooding or rock slides

-

Livestock or other obstacles on the road

-

School bus stops or school crossings

-

Narrow roads, narrow bridges, or poorly maintained roads

-

Roadblocks, border crossings, and crash barriers

The local rules of the road and driving culture should also be taken into account, including:

-

Speed limits and traffic signals

-

When and when not to honk

-

When and when not to flash your lights

-

Yielding to pedestrians or cyclists

-

Driving age

-

Driving while using mobile devices

-

Drinking and driving

-

Emergency response procedures

-

Local emergency service numbers

-

Potentially corrupt law enforcement

In addition, there are vehicle safety issues to consider. Not every country has the same standards for vehicle safety or required safety inspections. In some cases, you won’t find seat belts for every passenger and severely overloaded vehicles are a possibility in some regions of the world.

In some regions of the world, you may have difficulty summoning roadside assistance (although your travel insurance provider can provide some help here). If cell phone service is less than reliable, you may have difficulty calling for help.

Here’s what you need to think about before hitting the road and driving overseas.

Verify whether you have auto insurance overseas

In general, the auto insurance you have back home will not cover you abroad – except in some circumstances when your policy may provide coverage in neighboring countries (Canada and Mexico). Check with your insurer, but know that even if your policy is valid, it may not meet your host country’s minimum requirements.

While most auto rental companies can provide auto insurance, your best bet is to have independent travel insurance with coverage for car rental collision. You’ll save a lot of money by not buying at the rental counter. You may have the same level of coverage with your credit card as well, so you can check with your credit card travel protection plan.

Either way, it’s important to note that these plans do not provide coverage for damage to other vehicles, structures, or persons – it’s not like your auto insurance back home. See what’s not covered with car rental collision coverage (including the coverage with your credit card) for more details.

Note: some countries require drivers of rental cars to buy coverage inside the country. See our review of car rental collision coverage for more details.

See this post for details on coping with a car crash abroad.

Is an International Driving Permit Required?

The documentation requirements of every country are different and it’s your responsibility to ensure you have what you need to comply. International driving permits are officially sanctioned by the United Nations and accepted worldwide in over 150 countries as a recognized form of identification. In some countries, an international driving permit is required to rent a motor vehicle, and for many tourists it’s simply a handy form of identification or assistance while traveling.

Essentially, many tourists rely on international driving permits as inexpensive identification security that allows them to keep their more private identification safely hidden in their money belts!

So, how do you know if an international driving permit is required or just nice to have? Essentially, because most countries do not recognize a U.S. driver’s license as valid identification and most will accept a valid international driving permit you’re best off getting one if you’ll be traveling and/or driving in any overseas country.

International driving permits cannot be issued more than six months in advance of your desired travel dates, and you can obtain an international driving permit even if you’re already overseas (with 4-6 weeks of time or pay extra for express mail processing).

See Should You Get an International Driving Permit for more details

Read the guidelines for an international driving permit.

Learn about local driving laws before you leave

Try to obtain information about local driving laws before you leave from the country’s embassy website (look up the embassy), foreign tourism offices, or from a car rental company in the foreign country.

The U.S. State Department’s country-specific pages for information. In looking up Traffic Safety for Belize for example, we found these useful details:

-

Valid U.S. driver permits are accepted

-

Poor road maintenance is common

-

Pedestrian crossings are not always well marked

-

Unusual traffic customs include pulling to the right before making a left turn, stopping in the middle of the road to talk, tailgating at high speeds, and more

-

Bicycle traffic is a constant traffic hazard

-

Hitting a cyclist can mean significant financial penalties and jail time

-

and more

This information will give you a good start and the local driving laws should fill in any questions you have.

6 Tips to Prepare for and Survive Traveler’s Culture Shock

Living in a new country – even for a temporary visit – can be quite a challenge. The temperatures may be unbearable, the streets too noisy or too quiet, the people too rude or overly friendly, the food mildly or wildly strange and you’re feeling like you fell into a different planet – welcome to culture shock.

Living in a new country – even for a temporary visit – can be quite a challenge. The temperatures may be unbearable, the streets too noisy or too quiet, the people too rude or overly friendly, the food mildly or wildly strange and you’re feeling like you fell into a different planet – welcome to culture shock.

Similar to learning a language, the rules and customs that define a particular culture are learned early and reinforced steadily throughout our life. A person’s culture shapes their identity and provides an understandable framework for social interactions.

When a person travels to another region of the world, even where the people speak their own language, they find there are many cultural differences. When those rules, behaviors, and social customs you always understood no longer serve you well, the traveler experiences culture shock.

All travelers experience some level of culture shock when arriving in a new place – in fact, many travelers will say it’s all part of the experience. How much it affects any particular traveler can range from mild confusion to sincere fear and anxiety.

1. Prepare for what’s coming by reading up on your destination

One of the worst mistakes travelers make is thinking that it won’t be that bad, that culture shock won’t affect them too much and they can just think their way through it. Unfortunately, these travelers sometimes have a terrible trip but preparing for the differences in culture can help.

Resources to study include updated travel guides and the Kwintessential website (which has a lot of information for business travelers, but leisure travelers can benefit as well).

What you’re looking for in those guides is the following:

-

How to order food

-

Tipping – frowned upon or necessary?

-

Use of the bathrooms

-

Basic dining etiquette

-

What to wear so as not to offend

-

Simple social rules

-

Some basic language: greetings, ‘please’ and ‘thank you’, etc.

Essentially, learn what’s different about doing all the basic things you do every day.

2. Check the local calendar

Many regions of the world have local festivals, celebrations and national holidays that may be taking place when you are visiting. Knowing the local calendar can help you in two ways:

-

You can learn ahead of time about the origins of the holiday and be prepared to join in – even if on the fringe at the start – and share in the culture

-

You will be prepared if stores and restaurants are closed and you have to find alternatives to entertain and feed yourself for a bit of time

Every country’s rules are different and holidays can have a significant effect on whether a traveler can visit a museum or historical site, get a meal, shop for groceries, etc. on a holiday. Knowing ahead of time means you’re a far better traveler even if you don’t quite blend into the fabric of your host country yet.

3. Ask around for a local contact

If you have friends or family who have traveled where you are going, see if you can get a local contact – someone they met along their trip, for example. It’s especially helpful if you can be shown around in the new culture soon after you arrive. Someone to walk you through the basics, so to speak.

You can find websites that will help you get in touch with someone at your destination. Women travelers will find hermail.net useful and if you’re planning to go on the cheap for a few days or your entire trip, couchsurfing can be a great way to connect with others. If you’re home swapping, ask your host if they can introduce you to a neighbor or friend who would be willing (for the price of a free lunch perhaps?) show you around the area for a day and walk you through the do’s and don’ts.

If you can’t find a local contact, try a walking tour – a private one if you can arrange it. A walking tour will give you a close-up, ground level view of the culture that bus tours won’t and you’ll have time to chat with the tour guide and learn from them.

4. Befriend, be friendly, and observe

Befriend your hotel desk clerk, concierge, tour guide, host – even the local cafe owner – anyone whom you will see on a regular basis and can be your go-to person to answer questions and clear up confusions. These folks are often your best source of information for understanding the cultural differences so you can ease the shock you’re experiencing.

Be friendly (with reserve in many countries) to everyone you meet and smile. Try to greet locals in their language and make every effort to be polite. In many cases, people will help you along simply because you made an effort.

Observe how people interact with each other and in groups. Notice how they greet each other, where they stand with each other, how they sit, who speaks first, and where their eyes land when they’re talking together. What is normal for you – walking up to a fruit stand and selecting a piece of fruit to buy, for example, could be a significant affront to someone in another country. Hint, don’t select your own fruits and vegetables in France.

5. Be patient and gentle with yourself and others

As with many other types of stress, culture shock affects the traveler both physically and emotionally. It’s important to take a moment and be patient with yourself and with others (especially fellow travelers) if you are feeling the effects of culture shock, which may include:

-

Feeling lonely, lost or sad

-

Difficulty sleeping or severe sleepiness

-

Loss of appetite or overdrinking

-

Feeling isolated or overly critical of local customs

-

Lack of confidence, feeling insecure

Remember that all of these are most likely due to the physiological process of adjusting to culture shock. Some travelers adjust to it more quickly than others, so if you are not adjusting as quickly as your travel companion is, ask them to be patient with you as well.

6. Establish healthy eating, exercising, and sleeping routines quickly

Many travelers forego their healthy living standards when they travel: eating too much, drinking too much, and forget about exercise. Eating and drinking too much can affect your ability to get good quality sleep. If you’re used to exercising, the lack of exercise can leave you feeling restless and anxious.

All of those routines and habits that keep you sane and healthy and operating well at home are more critical when you are in a foreign culture, however, so it’s important to establish healthy eating, sleeping, and drinking habits quickly and get a little exercise every day.

Not only will your efforts quickly banish jet lag – which is often confused with culture shock – it will help you get in tune with the local environment and daily routines of local citizens. An early morning jog that ends at a local cafe can introduce you to some great folks who can help you figure out what to see that day, for example. Plus, they’re more likely to check on you the next day if you meet them at about the same time.

In the end …

Most travelers find they earn more respect, make more friends, and enjoy their trip far more when they focus on the people they meet and spend a little time learning their traditions and customs. Each positive move you make toward stepping into a foreign culture opens up more opportunities and diminishes the effects of culture shock. It can take a little time, but oh the experiences you’ll have and the stories you’ll be able to tell!

Why Cruise Line Trip Protection Really Is a Bad Choice

Recently, we were asked a question by a senior traveler: “I’m 68 years old and want to make sure I have enough coverage for any possible situation I might encounter. I don’t think that Carnival’s basic coverage would do that. I would like to purchase something to supplement the Carnival policy.â€

Recently, we were asked a question by a senior traveler: “I’m 68 years old and want to make sure I have enough coverage for any possible situation I might encounter. I don’t think that Carnival’s basic coverage would do that. I would like to purchase something to supplement the Carnival policy.â€

In order to present a complete and fair analysis, we began locating and reading the policies available online for several cruise lines. Right away, we noticed that the terminology is different – they use the term ‘vacation protection plan’ rather than ‘travel insurance’ – but once you work out the switches in terms, they’re pretty easy to read.

Here’s what we discovered in a side-by-side comparison of cruise line trip protection plans and travel insurance plans.

Cruise plan details are vague – you can only read them after purchase

All of the plans we found referred to a separate document called a Schedule, which apparently defines the specific information about the plan the traveler is purchasing based on their purchase amount. So, right away we realized we weren’t going to be able to get a complete picture of the coverage without first buying a ticket and purchasing the coverage.

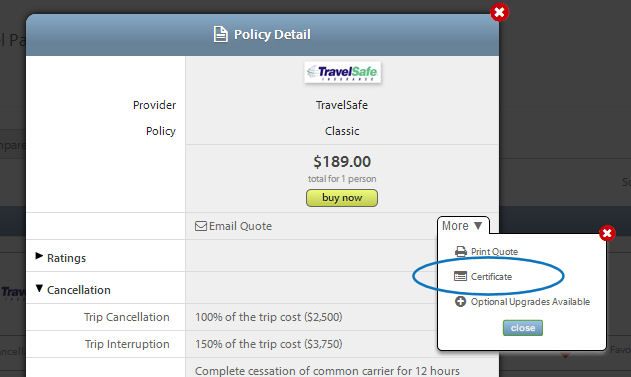

This is different – and far less transparent – than how it works when you buy travel insurance from a comparison site like ours. When you buy travel insurance with our quote tool, you can read the policy detail before you buy it. That is, the complete description of coverage where the only reference to a ‘Schedule’ is referring to your real departure date.

No details are hidden or hard to find.

Plus, with travel insurance, you get a free review period in which you can ask questions, make changes, and even cancel your plan for a refund (minus a small fee).

Emergency evacuation coverage is limited with cruise line plans

In reading the descriptions of cruise line plans, we found all of them limited the emergency evacuation to around $30,000 (some plans didn’t list the actual limit – you had to refer to the Schedule you get after your purchase).

While you might have enough coverage, it’s unclear. Rarely does an evacuation cost more than $100,000, but the cruise line plan limit is less than what you’d get with most basic travel insurance plans.

Evacuation coverage with a travel insurance plan, on the other hand, means a fully coordinated evacuation that’s arranged and paid for by the travel insurance provider. After receiving medical care, the coverage also provides assistance and payment to get you transported by commercial transportation to either:

-

your primary residence

-

a location of your choice in your home country

-

a medical facility near your primary residence or location of choice in your home country

In addition, a travel insurance plan usually allows additional benefits with the emergency evacuation coverage including:

-

Bringing a friend or family member to be with you where you are hospitalized

-

Returning your dependent children home or to a location of your choice

Cancellation policies are very strict with the cruise line

The covered reasons you can cancel your trip and be reimbursed for your trip investment are much stricter with your cruise line plan than with a travel insurance plan.

The Summary of Coverage for Norwegian Cruise Line indicates that cancellation is allowed up to the ‘total vacation cost’ if you have to cancel for sickness, injury, or death of you, and immediate family member, your traveling partner or a business partner. You can also cancel for Other Covered Events, which include

-

traffic accident

-

hijacking, quarantine, jury duty

-

your home is uninhabitable due to natural disaster

-

job loss

Here’s the catch, however: the total vacation cost refers only to those expenses you incurred through the cruise line. If you purchased your flights, transportation, or pre-departure hotel rooms separately, those won’t be covered by your cruise line package.

Plus, cruise lines require you to cancel your trip within a defined timeframe – that’s listed in the ‘Schedule’ apparently too. According to an article by Peter Greenberg, the closer you get to the departure date, the more you’ll be forfeiting to the cruise line if you have to cancel. Carnival Cruise Lines will keep 50% of your money if you cancel less than 56 days prior to your departure and cruises during holiday seasons require more notice. Other cruise lines require more notice.

A travel insurance plan not only covers your entire trip costs, the covered reasons for cancelling are broader and include reasons like:

-

theft of passport

-

travel supplier financial default or bankruptcy

-

assault

-

school year extension

-

terrorist attacks

-

mandatory evacuations

-

required to work

-

transfer of employment

Plus, the cruise line plans automatically exclude all coverage from pre-existing medical conditions – even evacuation. Travel insurance plans do not exclude pre-existing conditions from evacuation or repatriation benefits and with a travel insurance plan, you can get coverage for pre-existing conditions for things like travel medical, cancellation, and trip interruption.

Enhanced cancellation still means cruise credit – not cash

Even if you buy the ‘enhanced trip cancellation protection’ which looks and sounds a lot like the ‘cancel for any reason’ with a travel insurance plan, you will receive 75-90% of your cruise investment toward a future cruise. Certain restrictions apply to the use of those cruise credits, but we couldn’t find the restrictions (they might be in the ‘Schedule’).

The ‘cancel for any reason’ coverage with a travel insurance plan also comes with cancellation penalties, but at least it’s cash – not a future credit that may be restricted by a time limit. If you can’t reschedule your cruise within their timeframe, you effectively gave the cruise line a really big tip.

See our full explanation of why buying travel insurance from a 3rd party company is better than buying from a cruise line for more details – including 5 Reasons You Should Not Buy Protection Plans from the Cruise Line.

Can You Afford to Buy Travel Insurance?

There’s a saying that goes something like this; “if you can’t afford travel insurance, you can’t afford to travel,†but we think that oversimplifies the issue. After all, not every trip needs coverage and not every traveler needs travel insurance.

There’s a saying that goes something like this; “if you can’t afford travel insurance, you can’t afford to travel,†but we think that oversimplifies the issue. After all, not every trip needs coverage and not every traveler needs travel insurance.

To know if you can afford to buy travel insurance, it’s important to think about the coverage you already have, how much you’re spending on your trip, your risk of and ability to pay for medical emergencies and evacuations – and then make the decision.

There are a number of reasons people think they don’t need to buy travel insurance, including:

My credit card annual fee includes travel protection

Many credit cards are now getting into the travel protection game. If you have a credit card with travel protection included with your annual fee you may have coverage for:

-

Rental cars

-

Baggage loss

-

24/7 Travel assistance

-

AD&D or flight accidents

-

Concierge services

-

Identity theft protections

That’s great, but it’s important to understand that there are limits to those travel protections just like there are with travel insurance. For example, your rental car coverage doesn’t include personal liability or extend to covering damage to another vehicle, structure, or person. Motorbikes, scooters, RVs, and trucks are probably not covered either, but they wouldn’t be covered by a travel insurance plan with rental car coverage either.

You’ll need to get a copy of your credit card travel protection plan and compare the benefits side-by-side with travel insurance to understand what coverage you have for travel disasters.

I have health insurance, so I’m not worried about medical care

Awesome, you’ve got medical care, but are you 100% certain your coverage extends to where you’re going? We hear about travel medical emergencies that happen overseas all the time – a woman falls off a boat and nearly drowns, a child breaks a leg jumping off the high dive, a man suffers a stroke. All of these medical emergencies cost money and if you’re outside your health insurance network, you could be paying 100 to 80% of these costs out of pocket.

Medical emergencies happen anytime and anywhere they like and most U.S. based health insurance plan coverage does not extend outside the borders of this country. Even Medicare for seniors doesn’t work outside the U.S. although some supplement plans do offer limited emergency medical care cover.

In addition, it’s unlikely that your health insurance plan likely includes evacuations or repatriation.

An emergency medical evacuation is enacted when a person is badly injured and there is no emergency transportation that can get them to a medical facility. The cost of emergency medical evacuations is based on two factors: your condition and your location and medical evacuations can cost upwards of a hundred thousand dollars or more. Got room for that on your credit card?

A repatriation is the return of your body to your home if you die while traveling. The legal transportation of human remains is not only a delicate subject – and a time sensitive one! – it’s also packed with legal regulations and requirements. Unless your family knows the language very well and has a friend in the foreign government, they’re likely to spend a lot of time and money getting your body home for burial. The cost of repatriation can be be as high as thousands, even ten thousand, dollars.

A travel medical plan often costs a traveler less than a dollar a day and it includes benefits like these: trip interruption, baggage protection, even trip delays.

I don’t need cancellation because I’m not going to cancel my trip

No one plans to cancel their trip and no one wants to cancel their trip, but whether you’re forced to cancel your trip is another story.

Every day we hear stories of people who were forced to cancel their trips for the craziest reasons and they lose all their pre-paid trip costs.

Why might you be forced to cancel your trip? Take a look at these real-life stories from our message board:

-

I’m about to lose my current job but I got an interview for the job of my dreams – they can’t move the date!

-

My daughter was moving and I planned to travel and help her pack until I broke my hand

-

My purse was stolen from my locker at work and it had my passport, visa, and travel documents inside!

-

That terrorist attack has made me too nervous to fly – I want to cancel my trip and wait until it’s safer.

-

My son was in a car accident and there’s no one to care for him while he recovers.

Trip cancellation coverage means you can cancel your trip for a covered reason and get up to 100% of your insured trip costs back. That’s peace of mind you can probably afford.

We could tell you that you can’t afford to travel without insurance, but we’re not going to say that because some trips simply don’t need coverage.

Get a travel insurance quote and compare plans

The best way to know if you can afford travel insurance is to get and compare a few quotes. Use our travel insurance comparison tool, type in your trip details, then filter the plans based on your needs. All you’re losing by looking is a few minutes of your time and you could be very surprised to find travel insurance is really affordable – especially when you consider the trouble that could happen and what that would cost.