Recently, we were asked a question by a senior traveler: “I’m 68 years old and want to make sure I have enough coverage for any possible situation I might encounter. I don’t think that Carnival’s basic coverage would do that. I would like to purchase something to supplement the Carnival policy.â€

Recently, we were asked a question by a senior traveler: “I’m 68 years old and want to make sure I have enough coverage for any possible situation I might encounter. I don’t think that Carnival’s basic coverage would do that. I would like to purchase something to supplement the Carnival policy.â€

In order to present a complete and fair analysis, we began locating and reading the policies available online for several cruise lines. Right away, we noticed that the terminology is different – they use the term ‘vacation protection plan’ rather than ‘travel insurance’ – but once you work out the switches in terms, they’re pretty easy to read.

Here’s what we discovered in a side-by-side comparison of cruise line trip protection plans and travel insurance plans.

Cruise plan details are vague – you can only read them after purchase

All of the plans we found referred to a separate document called a Schedule, which apparently defines the specific information about the plan the traveler is purchasing based on their purchase amount. So, right away we realized we weren’t going to be able to get a complete picture of the coverage without first buying a ticket and purchasing the coverage.

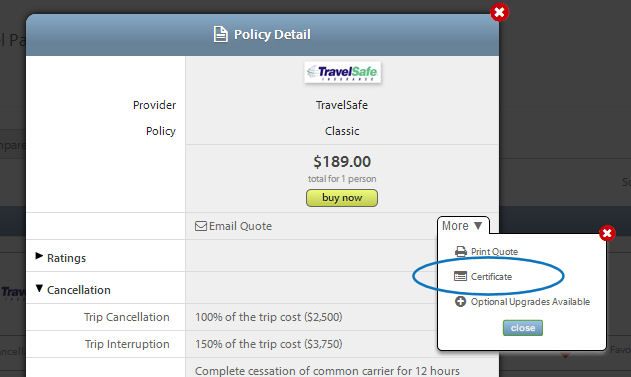

This is different – and far less transparent – than how it works when you buy travel insurance from a comparison site like ours. When you buy travel insurance with our quote tool, you can read the policy detail before you buy it. That is, the complete description of coverage where the only reference to a ‘Schedule’ is referring to your real departure date.

No details are hidden or hard to find.

Plus, with travel insurance, you get a free review period in which you can ask questions, make changes, and even cancel your plan for a refund (minus a small fee).

Emergency evacuation coverage is limited with cruise line plans

In reading the descriptions of cruise line plans, we found all of them limited the emergency evacuation to around $30,000 (some plans didn’t list the actual limit – you had to refer to the Schedule you get after your purchase).

While you might have enough coverage, it’s unclear. Rarely does an evacuation cost more than $100,000, but the cruise line plan limit is less than what you’d get with most basic travel insurance plans.

Evacuation coverage with a travel insurance plan, on the other hand, means a fully coordinated evacuation that’s arranged and paid for by the travel insurance provider. After receiving medical care, the coverage also provides assistance and payment to get you transported by commercial transportation to either:

-

your primary residence

-

a location of your choice in your home country

-

a medical facility near your primary residence or location of choice in your home country

In addition, a travel insurance plan usually allows additional benefits with the emergency evacuation coverage including:

-

Bringing a friend or family member to be with you where you are hospitalized

-

Returning your dependent children home or to a location of your choice

Cancellation policies are very strict with the cruise line

The covered reasons you can cancel your trip and be reimbursed for your trip investment are much stricter with your cruise line plan than with a travel insurance plan.

The Summary of Coverage for Norwegian Cruise Line indicates that cancellation is allowed up to the ‘total vacation cost’ if you have to cancel for sickness, injury, or death of you, and immediate family member, your traveling partner or a business partner. You can also cancel for Other Covered Events, which include

-

traffic accident

-

hijacking, quarantine, jury duty

-

your home is uninhabitable due to natural disaster

-

job loss

Here’s the catch, however: the total vacation cost refers only to those expenses you incurred through the cruise line. If you purchased your flights, transportation, or pre-departure hotel rooms separately, those won’t be covered by your cruise line package.

Plus, cruise lines require you to cancel your trip within a defined timeframe – that’s listed in the ‘Schedule’ apparently too. According to an article by Peter Greenberg, the closer you get to the departure date, the more you’ll be forfeiting to the cruise line if you have to cancel. Carnival Cruise Lines will keep 50% of your money if you cancel less than 56 days prior to your departure and cruises during holiday seasons require more notice. Other cruise lines require more notice.

A travel insurance plan not only covers your entire trip costs, the covered reasons for cancelling are broader and include reasons like:

-

theft of passport

-

travel supplier financial default or bankruptcy

-

assault

-

school year extension

-

terrorist attacks

-

mandatory evacuations

-

required to work

-

transfer of employment

Plus, the cruise line plans automatically exclude all coverage from pre-existing medical conditions – even evacuation. Travel insurance plans do not exclude pre-existing conditions from evacuation or repatriation benefits and with a travel insurance plan, you can get coverage for pre-existing conditions for things like travel medical, cancellation, and trip interruption.

Enhanced cancellation still means cruise credit – not cash

Even if you buy the ‘enhanced trip cancellation protection’ which looks and sounds a lot like the ‘cancel for any reason’ with a travel insurance plan, you will receive 75-90% of your cruise investment toward a future cruise. Certain restrictions apply to the use of those cruise credits, but we couldn’t find the restrictions (they might be in the ‘Schedule’).

The ‘cancel for any reason’ coverage with a travel insurance plan also comes with cancellation penalties, but at least it’s cash – not a future credit that may be restricted by a time limit. If you can’t reschedule your cruise within their timeframe, you effectively gave the cruise line a really big tip.

See our full explanation of why buying travel insurance from a 3rd party company is better than buying from a cruise line for more details – including 5 Reasons You Should Not Buy Protection Plans from the Cruise Line.