The total trip cost includes any non-refundable, pre-paid trip arrangements. This represents the actual lost money if you need to cancel the trip.

Non-refundable, pre-paid costs might include airfare, hotel reservations, pre-arranged transportation, or any other arrangements that would represent a financial loss. The cost of these items should be added together to determine the total trip cost.

Some costs that would not qualify as non-refundable, prepaid costs are:

• Lodging costs not subject to cancellation penalties

• The cost of meals during the trip

• Visa, passports

• The cost of souvenirs or gifts

• Side trips you arrange while traveling

The cost of these items should not be added to the total trip cost. If you have any questions, contact the insurance company and they will answer any questions.

What if I change my mind after I purchase a travel insurance policy?

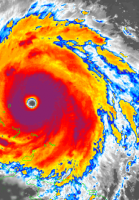

What if I change my mind after I purchase a travel insurance policy? As hurricane season starts sending big storm up the coast, many people consider purchasing travel insurance.

As hurricane season starts sending big storm up the coast, many people consider purchasing travel insurance.

Many people wonder if there are deductibles with travel insurance policies, similar to auto or home insurance.

Many people wonder if there are deductibles with travel insurance policies, similar to auto or home insurance.  Bizpack is a policy add-on that provides cancellation benefits specific to work related situations. It is offered with

Bizpack is a policy add-on that provides cancellation benefits specific to work related situations. It is offered with  From the Dallas Morning News, a good article about traveling with your children and travel insurance plans that will cover them.

From the Dallas Morning News, a good article about traveling with your children and travel insurance plans that will cover them.