Using Wufoo.com, I have added a new feedback feature to the blog. Please feel free to add you opinion.

You can use the form below, or access it anytime with the link to the right, Feedback Forum under Pages.

Using Wufoo.com, I have added a new feedback feature to the blog. Please feel free to add you opinion.

You can use the form below, or access it anytime with the link to the right, Feedback Forum under Pages.

Some people ask if there is any advantage to purchasing a travel insurance policy sooner rather than later. Meaning, should I book my trip and buy travel insurance at the same time, or wait until the day before I leave to get coverage.

There are 2 advantages to purchasing trip insurance as soon as possible

1. You get protection against the financial default of a tour operator, airline or cruise line

This depends on exactly which company you buy from, but in general you will have coverage for financial default. If you purchase a trip from Luigi’s Italian Adventures, and two months later Luigi goes out of business, you would have coverage.

2. The pre-existing medical condition exclusion is usually waived

Again, this depends on the company and plan, but in general the pre-ex exclusion is waived. Read more about Pre-existing conditions here.

As the travel insurance niche grows, more and more business is being processed online. Some companies report as much as 70% of all sales being transacted online. Here are 3 reasons the web is perfect for purchasing travel insurance:

As the travel insurance niche grows, more and more business is being processed online. Some companies report as much as 70% of all sales being transacted online. Here are 3 reasons the web is perfect for purchasing travel insurance:

1. Instant coverage

Most companies selling their travel insurance policies online offer instant coverage, meaning once the application and payment is recieved and approved, you can enjoy instant coverage. Policies are emailed to customers, they can print it out, and get on the plane.

2. Easy policy comparison

Customers begin most buying processes online, even for offline purchases like cars, boats, and houses. When they start investigating, customers want to search around, read reviews, and compare a wide variety of products. Comparison sites and individual company sites allow customers to see all their options, quickly and easily.

3. Less overhead means lower premiums

When you buy insurance from a travel agency or insurance agency, you either pay more or get less. There are higher costs associated with brick & mortar businesses, and those costs are passed along to the customer in highr premiums. With online forms, email, and streamlined admin, web companies can offer the best products at the most competative prices.

An amazing story from the Kansas City Star about a student doing doctoral degree work in New Guinea. While living in the wild and videotaping birds, he suffered a burst appendix. He was able to treat himself with antibiotics, and make an absurd 5-day trek to an Australian hospital. (Read Full Story)

An amazing story from the Kansas City Star about a student doing doctoral degree work in New Guinea. While living in the wild and videotaping birds, he suffered a burst appendix. He was able to treat himself with antibiotics, and make an absurd 5-day trek to an Australian hospital. (Read Full Story)

Also, from the Telegraph, a story about a UK citizen traveling in France. While on holiday, a 32-week pregnant woman gave birth to a baby boy. She is covered by the EHIC (European Health Insurance Card), which provides health coverage for Europeans traveling to member European countries. She also took out travel insurance for the trip. The only problem is in her getting home, because both coverages do not cover repatriating them. (Read Full Story)

Credit card companies offer many benefits to cardholders in an effort to aquire and retain customers. Some even offer “Travel Insurance”, but cardholders should do some research before relying on it for their next trip.

Credit card companies offer many benefits to cardholders in an effort to aquire and retain customers. Some even offer “Travel Insurance”, but cardholders should do some research before relying on it for their next trip.

Travel insurance included with a credit card is very limited

Usually travel insurance from credit cards is limited to coverage for flight accidents, car rental damage or for accidental death while you are traveling, but often this protection is in effect only when you pay for travel with that particular credit card.

Most credit cards do not offer any coverage for travel medical expenses, evacuation costs, or trip cancellation expenses.

These are the most common reasons people purchase trip insurance. They want to be sure their trip investment if protected against cancellation. Travelers also want to know if they get sick or injured while on vacation, they can get the help they need and any necessary evacuation.

You can argue that the coverage provided with your credit card is better than nothing, which is true. If, however, you are looking for actual trip insurance with the best coverage, check with some reputable travel insurance companies.

For Travel Medical, Multi-Trip Medical and Medical Evacuation Policies, coverage begins at 12:01AM the day of your departure. If purchased on, or after your departure date, coverage begins at 12:01AM the next day. For Flight Accident Policies, coverage becomes effective the day of your departure upon boarding your flight.

For Travel Medical, Multi-Trip Medical and Medical Evacuation Policies, coverage begins at 12:01AM the day of your departure. If purchased on, or after your departure date, coverage begins at 12:01AM the next day. For Flight Accident Policies, coverage becomes effective the day of your departure upon boarding your flight.

Related Links

More TraveInsuranceReview.net FAQ’s

This is the number of days that the insurance company will “look back” from the day the insurance was purchased, to see if your claim is related to a pre-existing medical condition.

This is the number of days that the insurance company will “look back” from the day the insurance was purchased, to see if your claim is related to a pre-existing medical condition.

For example: You go to the doctor on Jan. 1st with complaints of chest pains. 39 days later you are traveling and suffer an actual heart attack. If the insurance has a 90 day pre-existing condition period, your doctor visit would fall within it and they would consider the heart attack a pre-existing condition.

Related Topics

What is a pre-existing medical condition?

More TravelInsuranceReview.net FAQ’s

QuoteWright.com is a travel insurance company based in Connecticut. They offer plans from all of the leading online travel insurance companies, and allow you to compare different policies side-by-side to find the right one for your trip.

QuoteWright.com is a travel insurance company based in Connecticut. They offer plans from all of the leading online travel insurance companies, and allow you to compare different policies side-by-side to find the right one for your trip.

Easy quote from homepage

QuoteWright.com has set up their site very simply. The homepage features a quote engine in the top left, the most prominent spot on most web pages. The quote engine also asks for minimal information, which leads the customer down an easy path to an insurance quote.

The field for travel dates does feature a calendar function, which is much better than using pick lists for dates. However, when used in Firefox or Safari, the pop-up calendar has contrast issues and you cannot read some buttons.

They also ask for the type of travel insurance you are interested in, which can be a little confusing for first time buyers. They’re not sure what type of insurance they need.

Screenshot of QuoteWright.com homepage

Quote engine remembers previously entered information

In the next step, you are asked for some more information, such as State of residence, ages of travelers, your destination, and date of first trip payment. The other fields, such as travel dates and Country of Residence, are auto-filled for you.

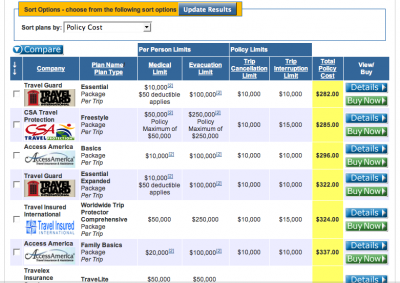

Compare policy screen features a “Sort By� function

The next step shows all the different policies offered by the different travel insurance companies. You can select some by checking the boxes on the left, and proceed to a side-by-side comparison. You can also sort these results using different criteria, such as policy cost, plan type, and different coverage limits. This is helpful in finding the right policy for your trip, without sorting through inappropriate policies.

Screenshot of compare policy page

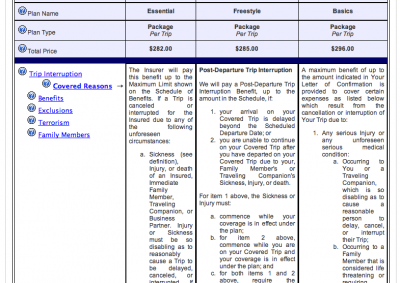

Side-by-side lets you compare policies quickly

If you proceed to the side-by-side comparison, you will see the policy names listed across the top, and the policy benefits listed down the left column. The benefits on the left are clickable terms, so you can fully understand the different policies. When they are clicked, however, the page is refreshed and the definition of the clicked term is written in a vertical column. This is difficult to read and time consuming to click back and forth. Opening a new, smaller window might be easier.

Screenshot of vertical columns full of text

Payment screen is secure, and remembers previously entered information

After finding the right policy for your needs, you can click Buy Now and be taken to the purchase screen. Any information previously entered is auto-entered here, saving time and frustration. QuoteWright.com accepts major credit cards, and you will receive an email confirmation shortly.