These days, most people agree that the ‘staycation’ lasts only a year at most and then couples and families typically get back to real vacations pretty quickly.

These days, most people agree that the ‘staycation’ lasts only a year at most and then couples and families typically get back to real vacations pretty quickly.

The old days of being limited to staying in a hotel, however, are long over and many travelers – even solo travelers – have turned to vacation rental properties as a good alternative to hotels.

Vacation rental properties come in the form of single rooms, condominiums, apartments, even entire houses, yachts, tree houses, airstreams, and castles and they come in all sizes and are available nearly everywhere.

Some great sites for finding vacation properties include: Vacation Rentals by Owner, HomeAway, Airbnb, and more.

In addition to the ability to live like a local, some of the most important reasons travelers like vacation rentals instead of the hotel are:

- More room and more privacy – travelers can come and go or stay as they please without disturbing room service and without having to check in and out like with a bed and breakfast

- Stay comfortably together as a group – an excellent option for extended family or large groups of friends

- Cost savings – paying for several rooms to house a family with children can be cost-prohibitive whereas a rental condo, apartment, or house allows everyone more room, access to a kitchen to save money on meals, and the ability for families and groups to stay together

If you’re looking at booking a vacation rental for a Spring Break getaway or thinking ahead to your summer vacation, it’s a good idea to consider your travel insurance options at the same time.

What are the concerns/risks with a vacation rental?

As with any insurance plan, you purchase it to protect yourself from the unknown – those things that can happen, but hopefully don’t happen. This is why we buy car insurance, to protect ourselves in the event of an accident, even one with another motorist who doesn’t have insurance.

It’s also why we buy travel insurance, to protect us from losses that we cannot predict:

- A hurricane is pending and you’d like not to be there when it happens.

- Your kid becomes very ill and you have to head to the mainland hospital and abandon your vacation.

- Some projects at work are not gelling and you have to cancel your trip to handle them – and keep your job.

- Your own home is vandalized and you have to cancel your trip to handle the problem, file insurance papers, assess the damage, etc.

- A family member dies.

- You’re the victim of an assault and you need to stay home and recover.

- The airline suddenly filed for bankruptcy and cancelled all flights.

Life is unpredictable, and life while traveling is just unpredictable in another location, so it stands to reason that smart travelers protect themselves from expensive losses when they spend a lot of money on a vacation rental.

Avoid the Travel Insurance Offered with your Rental

Many experienced vacation rental property managers offer their guests standard travel insurance with their rental agreement and they’ll include language like this in the contract agreement:

Cancellations that are received in writing between 30 and 60 days prior to arrival date qualify for a 50% refund. There are no refunds for reservations cancelled within 30 days of your arrival date. Travel insurance for unexpected cancellations is recommended to all our guests.

This is a great way to protect themselves, but their travel insurance plan may not protect you as well as it protects them.

Let’s look at some examples – what if:

- Someone gets very sick before the trip and you have to cancel? With the right travel insurance plan, you’ll have coverage for up to 100% of your trip investment if you have to cancel for an illness or injury.

- You’re in a traffic accident on the way to your vacation? Sounds awful, but it could happen and if you cancel your trip by default (you’re in the hospital), you can bet that standard travel insurance plan isn’t likely to send you a check for your loss.

- Someone on your trip or back home has a pre-existing medical condition? If you have to abandon your trip to be at your father’s side in the hospital and he’s in there because of a pre-existing medical condition, is that standard travel insurance policy going to refund the remainder of your trip investment? Likely not.

Even more concerning – does their standard travel insurance plan cover:

- emergency medical care?

- trip interruptions?

- medical evacuations?

If your vacation rental requires a ferry ride to get to the front door, you’re going to want to be sure you can reach medical care if you need it. Sometimes an evacuation is the only way to go about that.

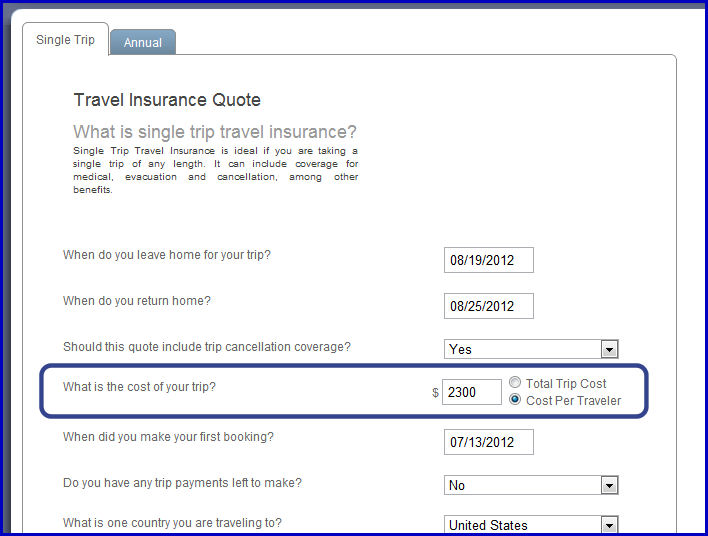

You can spend the time studying their policy and comparing it with other travel insurance plans, or you can plug your trip details into our travel insurance comparison tool and select the options you need while price-shopping among many plans from many companies.

3 Steps to Insuring Your Vacation Rental

Use the following steps to prepare to cover your vacation in a vacation rental property:

- Gather your planned trip details, including:

- The number of people and their ages

- Your vacation dates – starting the day you leave until the day you return

- The date you made the first trip payment (see why this is important)

- Total up your non-refundable trip costs, including:

- Pre-paid, non-refundable airfare

- You pre-paid, non-refundable lodging costs (remember, even many hotels now have refund restrictions for rooms booked online)

- Any pre-paid, non-refundable tours, boat reservations, ferry tickets, and more

- See What determines my total trip cost? for more details

- Think about where you may need special coverage, like for:

- Hazardous sports – for those in your group who may hang-glide, para-sail, rock-climb, etc.

- ‘Cancel for any reason’ – for situations where you want the ability to cancel for any reason. If you’re not sure see Is ‘Cancel for any reason’ worth it?

- Pre-existing medical – for those traveling with you and for those staying behind who may cause you to have to cancel or abandon your trip. See the explanation of pre-existing medical condition coverage for details.

After you’ve chosen your plan, you have a certain number of days (usually 10-15) to review the plan and make changes or cancel it. See Understanding your Free Look Period/Refund Policy for details.

Finally, to be 100% confident you have the right plan, see this topic.

Remember: Even Travel Insurance Doesn’t cover ‘Everything’

It’s important to note that travel insurance, just like every other type of insurance, doesn’t cover ‘everything’. The following are just a few things that will not be covered with your vacation travel insurance:

- Losses due to hurricanes and/or mandatory evacuations (unless your plan specifically covers these events).

- Loses due to changing your mind or deciding you can’t go (but ‘cancel for any reason’ coverage can help here).

- Losses due to lousy weather conditions (although you can purchase ‘cancel for any reason’ coverage and cancel before your trip starts if you decide you’d rather skip it because of the weather).

For more information about what travel insurance does not cover, see this topic too:

8 Things Travel Insurance Will Never Cover – Ever

In addition, and especially with a vacation rental, your travel insurance won’t cover damage to the rental property itself. Unfortunately, the vacation property owner’s insurance may or may not cover the damage either, and you can be sure that their rental agreement spells out the terms for things like carpet burns, broken furniture, etc. If something gets damaged, you’ll likely have to pay for that yourself.