Travel insurance is designed to reimburse travelers for unexpected losses, and travel insurance plans with trip cancellation or ‘cancel for any reason’ benefits ensure that a traveler who has to cancel their trip doesn’t also have to forfeit their trip investment (provided they cancel their trip for a covered reason).

Travel insurance is designed to reimburse travelers for unexpected losses, and travel insurance plans with trip cancellation or ‘cancel for any reason’ benefits ensure that a traveler who has to cancel their trip doesn’t also have to forfeit their trip investment (provided they cancel their trip for a covered reason).

Most travel insurance plans require that a traveler insure all their non-refundable travel arrangements that are subject to cancellation penalties in order to have certain benefits.

These include but are not limited to the following:

- Pre-existing condition coverage

- ‘Cancel for any reason’ coverage

- ‘Cancel for work reasons’ coverage

See 5 Reasons to Purchase Travel Insurance Early for more details.

This means that even if you purchase a travel insurance plan on time (within the required number of days after making your initial trip deposit), you might not be able to cancel your trip for a full refund if you haven’t covered all your pre-paid, non-refundable trip costs.

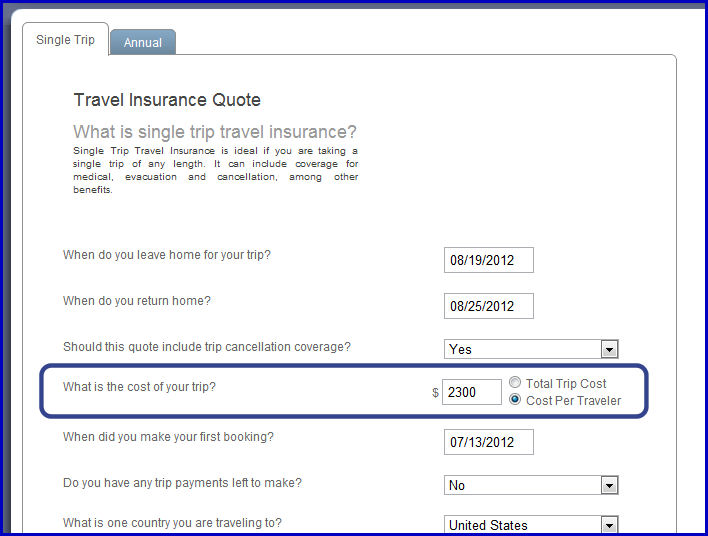

When you’re filling our travel insurance quote form, you’ll see the selection here:

When getting a travel insurance quote, you’ll need to calculate your total trip cost, which is the cash value equivalent of all arrangements that were booked and paid for.

What factors determine total trip cost?

Your trip costs are determined by adding up the total of the pre-paid, non-refundable expenses that would be lost if you had to cancel your trip. These include:

- All non-refundable payments, including deposits, toward your trip: hotel, airfare, cruise, etc.

- Pre-arranged, pre-paid transportation costs like taking a pre-paid shuttle to and from the airport

- Non-refundable fees you pay for before you leave, including those fees related to tours, conventions, classes, or retreats

- Any cancellation penalties that you’ll be assessed if you suddenly cancel, such as in the deposit for a condo on the beach (check your rental agreement for the cancellation penalty schedule)

- Non-refundable tickets such as those to the theater, special events, Disneyworld passes, etc.

What costs are not included in my total trip cost?

These costs are not pre-paid and so they should not be included in your total trip cost:

- Meal and lodging costs you pay after you arrive

- Day trips or excursions arranged for and paid for after departure

- Souvenir, gift, or other costs for items you purchase during your trip

- Emergency passport replacement costs (although many travel insurance plans have an allowance for those costs if your passport is lost or stolen while you’re on your trip)

- Any other costs that were not pre-paid

If you include these in your total trip cost amount, it amounts to over-insuring your trip because these costs will not be reimbursed to you.

Do not include these costs in your total trip cost!

Do not include the costs associated with any pre-paid expenses that can be changed. This is where a lot of travelers make a mistake. It’s important to remember that travel insurance only reimburses you for losses.

If the bed and breakfast you reserved in Paris doesn’t allow for cancellations, but they will happily reschedule your stay, then it’s not a loss and you won’t be reimbursed for those costs by your trip cancellation coverage even if you can’t take your scheduled trip for a covered reason.

To protect your trip investment, think carefully about where you book your lodgings, tours, retreats, etc. If their ‘cancellation’ policy doesn’t allow for true cancellations, then reconsider and don’t include those costs in your total trip costs because they won’t be covered anyway.

What about airline ticket purchased with points?

If you purchase your airfare with points or frequent flyer miles, check the rules of your plan. In many cases, if you have to cancel your trip, the airline will re-deposit those points minus a fee.

In brief, you’ll include these costs in your total trip cost amount:

- The fee to re-deposit your frequent flier points or miles

- The taxes paid on the airline tickets

Essentially, the fee to reimburse your account with your points is non-refundable, but the ticket cost itself is not.

What if I don’t know all my trip costs – should I estimate?

If your total trip cost is unknown, and you want to purchase your policy in time to take advantage of certain benefits that require early purchase (typically between 10 and 14 days of your initial trip deposit) to be in effect, including but not limited to:

- Pre-existing condition waivers

- ‘Cancel for any reason’ benefits

- ‘Cancel for work reasons’ coverage

It’s wise to round up in order to avoid being precluded from access to these coverage options.

If you later discover that you’ve over-insured your trip, the policy can be updated to reflect the accurate trip cost and the difference in the premium will be refunded to you as long as the changes were made prior to your departure.