Many of us are looking at our list of resolutions for the new year, and if travel is on your to-do list for the coming year, it just might be time to look into your travel insurance coverage ahead of time.

Many of us are looking at our list of resolutions for the new year, and if travel is on your to-do list for the coming year, it just might be time to look into your travel insurance coverage ahead of time.

Travel insurance is designed to save a traveler from expensive financial losses when unexpected things happen while you’re traveling:

- Your passport is stolen from your backpack in Madrid, and you’ve got reservations in Paris in a few days.

- Wandering along a beach in Costa Rica, you step on something sharp and cut your foot badly.

- You get a phone call in the night – your mother is very ill and you have to get home quickly.

Here are 3 reasons to consider buying an annual travel insurance plan versus purchasing your travel insurance on a trip-by-trip basis.

1. Coverage for Planned Trips and Last-Minute Travel

Annual travel insurance plans cover all the trips you take during the year – those that are planned well in advance and those that happen when you snag a great last-minute travel deal.

The best part? You don’t have to remember to buy your travel insurance with each and every trip! With an annual travel insurance plan, you’ve already handled that detail and you can forget about it (until next year, of course).

2. Same Coverage, Same Hotline All Year Long

Once you’re familiar with the coverage, you have that same coverage all year long. The travel insurance policy is the same – as is the toll-free hotline you’ll need to call, so there’s a lot less keeping track of policy details and phone numbers. Make a copy of the policy and keep it on your mobile device or in your email, program the toll-free number into your phone and away you go.

3. Cost Savings for Frequent Travelers

And last, but certainly not the least important reason – travelers who purchase annual travel insurance often save substantially because annual policies are more cost effective than purchasing separate policies for each trip if you’re a frequent traveler, such as a business owner, an academic, journalist, or retiree. Families on round-the-world trips should certainly look into annual coverage as well.

Let’s look at an example

Let’s take a look at an example: our sample traveler is 43 and she lives in New York. At the start of the year, she knows she’ll be taking the following trips:

- A two-week vacation in Costa Rica in September

- A three-day yoga retreat in California in July

- A five-day girlfriend getaway to Mexico in June

- A conference trip to New York in March

- An unknown number of business trips to meet with clients

She’d like to have some coverage for trip interruption (in case something happens and she needs to get home quickly), as well as emergency medical and evacuation coverage for those trips outside the country (where her medical insurance won’t apply).

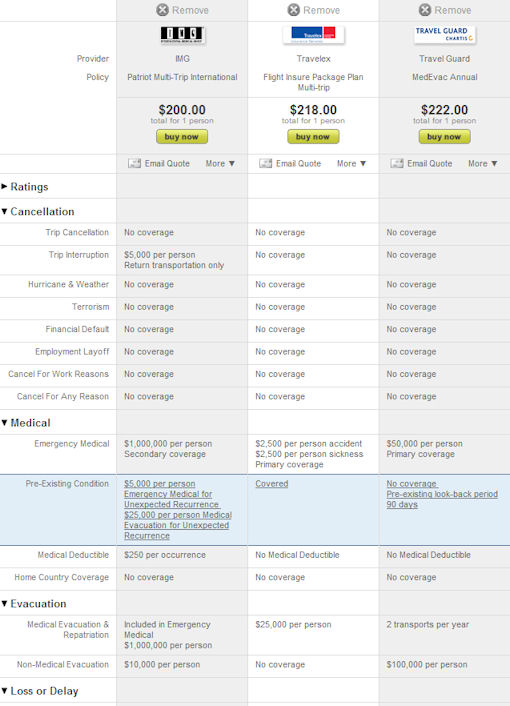

We ran those details through our travel insurance comparison tool and came up with 3 plans that meet her criteria:

While that price tag may look scary, take a look at what her known individual trips would cost – all were quoted without trip cancellation coverage to make a fair comparison:

- The Costa Rica vacation: $25-$42

- The yoga retreat in California: $20-$38

- The girlfriend getaway to Mexico: $18-$30

- The conference in New York: $25-$41

Of course, if this traveler added trip cancellation, those individual plan prices would be higher and she might prefer to have the trip cancellation protection.

In short, she’ll be spending as much as half the cost of an annual plan by covering her known trips and she still has all those business trips to cover. Is an annual plan right for this traveler? It depends on her concerns and needs.

Is annual travel insurance the same coverage?

No, it’s not. There are important differences between annual travel insurance and single-trip coverage plans, including the following:

- Trip cancellation is limited, but some plans include good trip interruption coverage.

- Medical coverage is usually secondary and doesn’t apply to trips inside your home country.

- Upgrades like coverage for pre-existing conditions are not always available (although some plans do offer it).

- The number of medical evacuations may be limited to a certain number per year (usually 2).

- Plus other differences.

So it’s important that you carefully review the description of coverage to be 100% confident in your travel insurance purchase.