Sara Baker, a young woman from the UK, recently broke her back snowboarding in Canada.

Sara Baker, a young woman from the UK, recently broke her back snowboarding in Canada.

Baker lost control in Whistler resort and needed immediate surgery to repair crushed vertebrae and a nearly severed spine. Rescuers had to land on a glacier to rescue her. According to current media reports, she has a good chance of walking again but she’s facing months of rehabilitation.

Baker thought she had annual travel insurance, but unfortunately her policy had recently expired. It’s an easy mistake to make.

Now, her family and friends are trying to raise the funds necessary to get her home in a specially adapted air ambulance – at a reported cost of £50,000 (close to $80,000).

Here at Travel Insurance Review, we hate hearing stories like this because the tragedy of a travel accident is horrifying enough without adding a financial burden that can take years – even decades – to recover from as this American couple traveling in Costa Rica recently discovered.

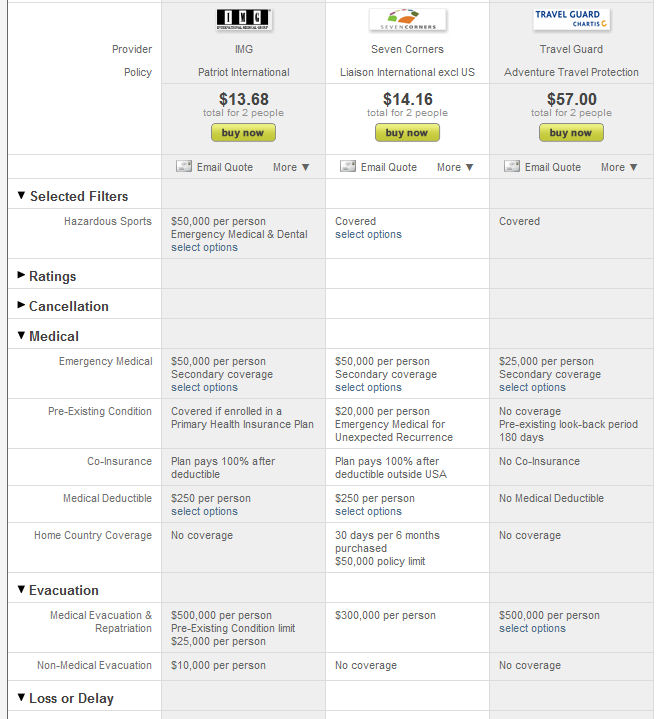

It’s vital for citizens of all countries to have travel insurance and be sure it’s valid before traveling. Â Emergency medical evacuation coverage provides for medically necessary evacuations to a medical facility, medically equipped flights home, and even the repatriation of mortal remains. With many travel insurance plans, this coverage will also pay to have a friend or family member brought to your bedside if you are hospitalized a certain number of days (usually 7).

Read all about emergency evacuation and repatriation coverage, including a list of plans and policy limits.