Overview of Travel Insurance coverage for the Coronavirus outbreak

Travel insurance covers Coronavirus for medical emergencies, medical evacuations, interruptions, and cancellations if you are currently insured and meet the right conditions.

If you are currently insured and want to cancel because you are concerned about getting sick, that is not a typical covered reason for cancellation and you would not be covered. The only way you would be covered is if you have Cancel For Any Reason (CFAR) coverage.

If you are not currently insured and want to buy travel insurance to cover cancelling for Coronavirus, a regular plan would not cover it. It is no longer an unexpected and unforeseen event, and concern of getting sick is not a covered reason for cancellation.

If you are not currently insured, want to buy insurance, and want it to cover Coronavirus cancellation, the only option is a Cancel For Any Reason policy (see How to buy travel insurance for coronavirus below).

How is Coronavirus covered?

Travel insurance coverage for Coronavirus can touch on several areas, which I will outline below.

If you currently have travel insurance

If you already have travel insurance, you might have coverage for the following situations:

Trip Cancellation– Travel insurance covers cancellations if you, a traveling companion, or a family member becomes ill and cannot travel. A physician needs to verify that you are unable to travel, but this is a common reason for cancellation.

Trip Interruption– Travel insurance also covers interrupted trips if it needs to be cut short. You can be reimbursed for lost expenses if you, a traveling companion, or a family member becomes ill and you need to cancel the trip partway through.

Medical Emergencies– Travel insurance covers emergency medical expenses for the insured if you get sick while on your trip.

Emergency Evacuation– If you become seriously ill on your trip and need to be transported home, it is covered by travel insurance.

If you do not currently have travel insurance

If you are planning a trip and want to buy trip insurance, you would have the following coverage regarding Coronavirus:

Trip Cancellation– You would have coverage in the general covered reasons for cancellation, if some got sick from Coronavirus. But, cancelling out of fear of getting Coronavirus would not be covered.

Trip Interruption– You would have coverage in general for interrupted trips if it needs to be cut short. You can be reimbursed for lost expenses if you, a traveling companion, or a family member becomes ill and you need to cancel the trip partway through.

Medical Emergencies– Travel insurance would covers emergency medical expenses for the insured if you get Coronavirus on your trip.

Emergency Evacuation– If you become seriously ill from Coronavirus on your trip and need to be transported home, it is covered by travel insurance. This is generally very rare.

Summary of coverage for Coronavirus

There are many combinations of how this is all covered, so I’ll summarize below:

- Travel insurance covers Coronavirus like any other illness. Any coverage related to an illness such as cancellation, interruption, medical , and evacuation would have the same coverage for Coronavirus.

- Travel insurance does not cover cancelling a trip because you are concerned about getting sick. This is not a covered reason for trip cancellation.

- The only option for cancel out of concern for getting sick is with Cancel For Any Reason coverage.

Cancel For Any Reason travel insurance

The best travel insurance option is you want “peace of mind” for whatever happens is Cancel For Any Reason coverage.

Cancel For Any Reason is a policy upgrade that lets you cancel your trip at your choosing, for any reason. This extends the standard covered reasons for trip cancellation.

Requirements for this coverage:

- You need to insure 100% of your trip costs

- You need to buy it soon after your first trip payment, usually 10-30 days

- You need to cancel your trip at least 48 hours before departure

*Also note, CFAR does not reimburse 100% of your trip cost, but usually up to 75% of the insured trip cost.

How does Cancel For Any Reason coverage work?

Cancel For Any Reason is an upgrade to a typical plan. It costs more because it covers a lot more, and the insurance company has higher risk of paying a claim.

You can get CFAR coverage 2 ways:

- Many plans allow you to “upgrade” to CFAR coverage for a fee

- Some plans automatically include CFAR and are priced accordingly

How to buy travel insurance for Coronavirus

As stated above, when it comes to buying travel insurance for Coronavirus-related issues, there are two options:

Option 1- Get standard travel insurance and you are covered with Coronavirus like with any other illness. This costs less but you cannot cancel because you are afraid of traveling.

Option 2- Get Cancel For Any Reason (CFAR) coverage, and you have both the standard covered reasons for cancellation (which pay 100% of your expenses), but can also cancel for any reason and get most of your expenses reimbursed (up to 75%).

For a complete tutorial, read our How to Compare Travel Insurance tutorial.

Here is a short version for comparing plans for Coronavirus coverage.

Time needed:Â 15 minutes.

How to quote, compare, and purchase travel insurance:

- Use a comparison engine to get quotes from all companies

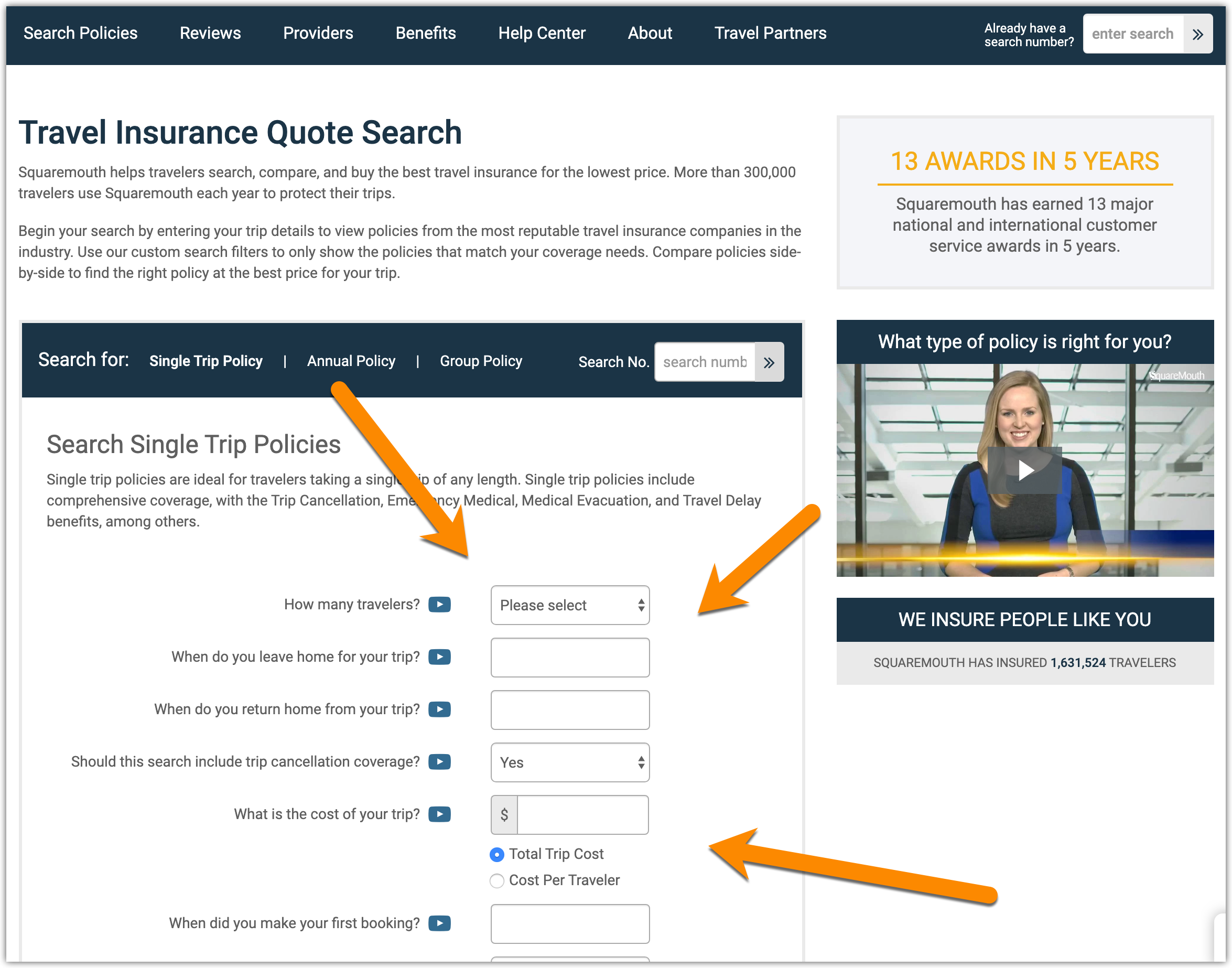

You can get quotes from all major companies through our partner website Squaremouth.com.

- Enter your trip details

Here you will enter information about your trip like traveler ages, travel dates, cost, deposit date, destination, and residency.

- Click “Search Now” when finished

After entering your trip information, click the Search Now button.

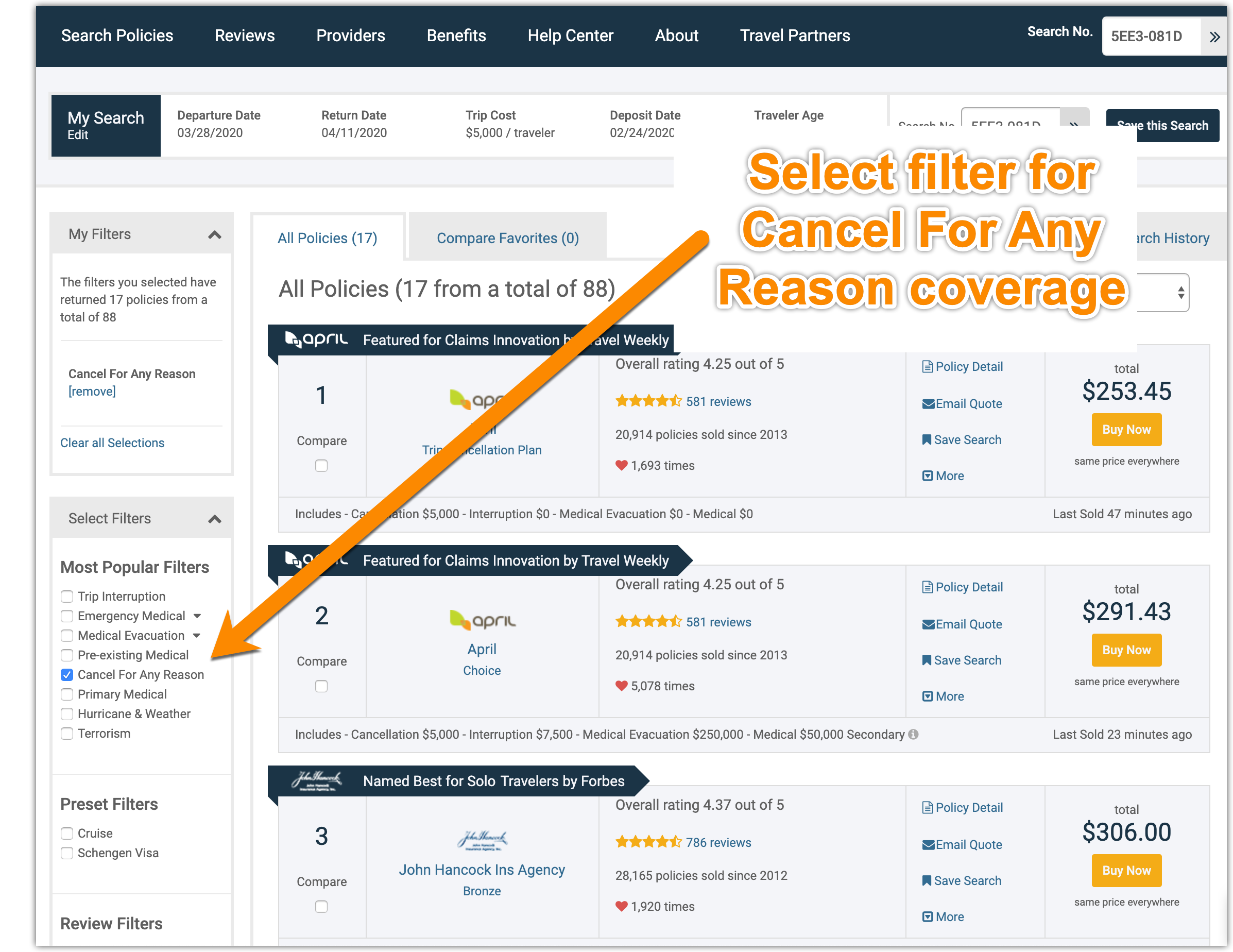

- View results screen

Next you will be shown quotes from all major companies and policies.

- Check filter for “Cancel For Any Reason” coverage to see plans with that option

To see plans with the CFAR coverage, check the filter box on the left side of the results screen. This will show only plans with this coverage, and let you see the price difference between plans with and without CFAR coverage.

- Choose a plan and click “Buy Now” to purchase

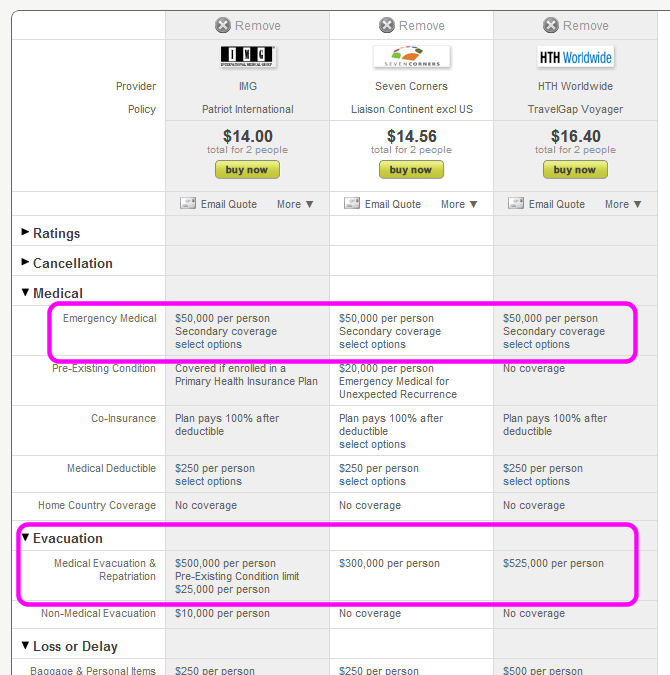

To help you find the best plan, you can apply other filters for different coverage amounts. You can also select several plans and compare them side-by-side, which helps see how the coverage compares easily.

- You will receive an immediate email confirmation of coverage

When you are done, you will receive an immediate email with a confirmation of coverage and printable documents to take with you on your trip.

Frequently Asked Questions

No, trip cancellation for concern or fear of travel associated with sickness, epidemic, or pandemic is not covered under travel insurance covered reasons.

If an airline cancels a flight, they should reimburse you for the cost of the flight. This would not be covered by travel insurance.

Emergency medical coverage (part of travel insurance) would cover any medical expenses from coronavirus if you get sick during your coverage period.

If you are quarantined you can have coverage under the Trip Interruption benefit of your policy.

It is very uncommon for travel insurance companies to arrange for evacuation off of a cruise ship. Typically, you have to be hospitalized first and the assistance company will work with the attending physician to arrange transportation to another hospital, or back home if required. This would mean heading to a port-of-call.

Links for Coronavirus Resources

Outside the topic of travel insurance for Coronavirus, here are some great resources.