We recently noticed this question on a message board: Can I renew an expired passport if I can’t find it – it seems to be lost!

We recently noticed this question on a message board: Can I renew an expired passport if I can’t find it – it seems to be lost!

Unfortunately, no. The passport renewal process is relatively simple and inexpensive as long as you have the passport that’s about to or has already expired. The key is having your expired passport in hand.

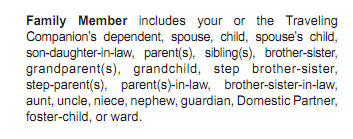

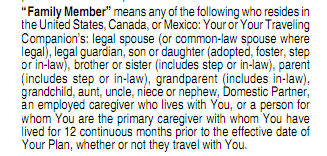

You can renew your passport by mail if all of these conditions are true:

- The passport is intact and can be submitted with your renewal application.

- The passport was issued when you were at least 16 years old.

- The passport was issued in the last 15 years.

- The passport was issued in your current name or you can legally document your name change.

See the instructions from the U.S. State Department to renew your passport by mail. If any of the above list is not true, then you must apply in person for a new passport starting from scratch.

One note of caution: the State Department would likely appreciate receiving a form called DS-64 Statement Regarding a Lost or Stolen Passport. The primary reason for this is to be sure that your passport isn’t being fraudulently used by someone else.