As you might expect – the answer is: It depends. Every travel insurance company and plan is different, as is every traveler. That being said, there are some commonalities between travel insurance plans on which we can draw to answer this question.

As you might expect – the answer is: It depends. Every travel insurance company and plan is different, as is every traveler. That being said, there are some commonalities between travel insurance plans on which we can draw to answer this question.

In this scenario, you can cancel and be reimbursed your trip costs

If your travel insurance plan has trip cancellation coverage that lists family member’s death as a covered reason for cancelling your trip, then yes you will have coverage.

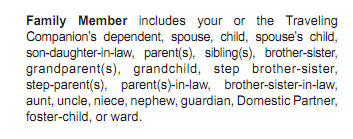

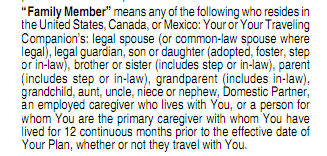

Caution! You’ll need to know what constitutes a family member according to your plan. Some plans cover only spouse and children, some extend coverage to in-laws, grandparents, aunts, uncles, cousins, and more.

Here’s the definition of ‘family member’ from the Travelex Travel Select plan certificate:

And here’s one from the MH Ross Bridge plan certificate:

The key is to read the coverage.

In this scenario, you cannot cancel and be reimbursed your trip costs

If the family member who died had a pre-existing medical condition and you did not purchase a travel insurance plan with pre-existing medical condition coverage, then no you won’t have coverage for cancelling your trip. This is where travelers often get caught – they only take their own pre-existing conditions into account, not those of family members. If your uncle dies from an existing heart condition, you won’t have coverage to cancel your trip unless you purchased a pre-existing medical condition waiver with your plan.

As we’ve mentioned before, no insurance plan can cover everything – that’s not the nature of insurance. Every travel insurance company carefully spells out the covered reasons for cancellation in their description of coverage or the plan certificate. The key is to read the coverage.

FYI, some travel insurance plans include the death of a host as a covered reason for cancellation too.