A few years ago, the cruise ship health news was all about the norovirus, nicknamed the ‘cruise ship virus’. Norovirus is an infection that causes over 20 million cases of gastroenteritis annually in the U.S. alone and for which there is no treatment. In 2011, an experimental norovirus vaccine was developed and studied.

A few years ago, the cruise ship health news was all about the norovirus, nicknamed the ‘cruise ship virus’. Norovirus is an infection that causes over 20 million cases of gastroenteritis annually in the U.S. alone and for which there is no treatment. In 2011, an experimental norovirus vaccine was developed and studied.

Cruise Ship Sanitation Reports

In the meantime, however, cruise ship travelers have definitive resource to find out how safe their cruise ship may or may not be: the CDC maintains a Vessel Sanitation Program (VSP) to assist the cruise industry on the prevention of the spread of gastrointestinal diseases on their ships. They post the most recent sanitation scores and reports for specific cruise ships on their website.

It operates under the Public Health Service Act and works by:

- inspecting cruise ships periodically and by unannounced inspections

- monitoring gastrointestinal illness outbreaks

- training cruise ship employees on public health practices

Plus, they provide health information regarding the cruise ship industry to the traveling public. For more information, read about the CDC’s Vessel Sanitation Program (VSP).

Research your intended cruise ship’s sanitation scores: enter the cruise ship, the cruise line, and choose the dates for which you want their scores. In general, the higher the score, the higher the level of sanitation, but this score does not reflect the risk of getting some diseases. A score of 86 (out of 100) or higher is considered good.

Alternative Cruise Ship Information and Cruise Travel Insurance

Alternatively, you can select the cruise ships with scores of 100 and review their reports.

In addition, the CDC provides updated outbreak information for international cruise ships and public health information for cruise ship travelers.

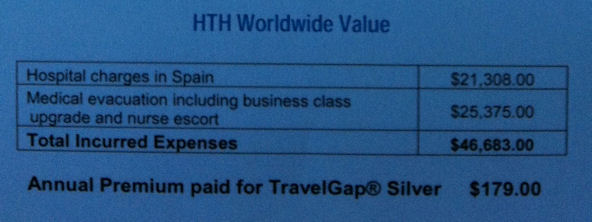

If you’re planning a cruise trip for 2012, be sure to review your health insurance policy and the coverage area to understand whether you will have health care protection on your trip. Also, remember that Medicare does not provide coverage outside the U.S. borders and if you have to be medically evacuated off the ship to receive medical care, having a travel insurance plan with medical evacuation coverage is a sure way to avoid a very expensive and unexpected bill.