Unfortunately, like many other natural disasters, a flu pandemic is impossible to accurately predict although there are some warning signs we can all pay attention to – including the fact that the WHO and others are closely watching the H5N1 flu virus strain for its potential to mutate into a human-to-human transmissible disease.

Unfortunately, like many other natural disasters, a flu pandemic is impossible to accurately predict although there are some warning signs we can all pay attention to – including the fact that the WHO and others are closely watching the H5N1 flu virus strain for its potential to mutate into a human-to-human transmissible disease.

Travelers who could be caught in a pandemic include:

- Private U.S. citizens residing abroad

- U.S. citizens working overseas

- Students studying abroad

- Even short-term visitors and tourists

Understanding what happens in a pandemic and knowing your options is critical to surviving. First, we’ll start with some facts.

The type of flu matters

Seasonal flu (the common flu) season occurs every year. Seasonal flu causes headaches, fever, sore throat, coughing and exhaustion for most patients, and it’s easily spread from person-to-person through contact with respiratory droplets. Infected people sneeze and cough, releasing droplets in the air, and others get sick by breathing those droplets in or by touching their eyes, noses, or mouths after touching surfaces contaminated with the droplets. This flu is easily prevented by getting an annual vaccine.

On the other hand, pandemic influenza or pandemic flu is a worldwide outbreak of the flu caused by a new flu virus to which humans have little or no immunity. Because the flu virus is highly adaptive, experts believe that a flu pandemic is very likely to occur in the future. A pandemic flu virus would be spread just as easily and could cause a large number of people to get ill and die. The relatively recent avian flu outbreaks in Southeast Asia remain largely contained geographically and limited in scope, but if the virus were to mutate into a fully transmissible human pandemic virus, it would spread worldwide and affect all populations.

Flu pandemics are recurring events

On average, a pandemic has occurred every 30-40 years over the last 400. During the 20th century, there were three flu pandemics:

- 1918 causing approximately 40 million deaths

- 1957 causing over two million deaths

- 1968 causing approximately one million deaths

Public health experts estimate that should a flu pandemic occur, 90 million people in the U.S. alone will become ill and over 200,000 may die as a result of a moderate pandemic flu scenario. If you’ve seen the movie Contagion by Warner Brothers, you have a pretty good idea of how quickly the abrupt surge in illness and death can overwhelm health services and cause significant social disruption and economic loss.

The national flu pandemic response strategy

The national response strategy to a flu pandemic has been fully documented by the Department of Homeland Security. Strategic actions to be implemented upon confirmation of the first human outbreak include such actions as:

- Implementing screening mechanisms to limit the spread of a pandemic flu

- Restricting travel to and from travel from the affected areas

- Diverting inbound international flights with suspected pandemic flu cases

- Closing the borders between countries entirely

In addition, the federal government’s ability to respond to lend aid to U.S. citizens who are living and traveling abroad in the event of a pandemic may be limited because travel into and out of an affected country may not be possible, safe or medically advisable.

What occurs during a pandemic

During a pandemic, the following is likely occur:

- Social disruption could be widespread – this includes services provided by hospitals, banks, stores restaurants, hotels, and more. In addition, those services that remain open may raise their prices sharply.

- Being able to work could be difficult – businesses may close to halt the spread of the disease, and those affected may have to work from home, use paid leave, or plan for the potential loss of income.

- Schools may be closed for an extended period of time – if the schools are closed, those affected will have to arrange alternative childcare or stay home with their children.

- Public transportation services may be disrupted – not only because there is a shortage of workers, but also to quarantine affected areas and stop the spread of the disease.

If you’re traveling outside the U.S. this means that you may not be able to get back home; ditto for those who are traveling inside the U.S. and reside abroad. If you are traveling, you may have to be prepared to stay longer than you originally planned even though services where you are could be severely limited and prices could be difficult to afford.

6 Steps to prepare for flu season travel

Travelers heading out during flu season should use the following steps to prepare for their trip:

- Check the health risks for your destination before you plan your travel.

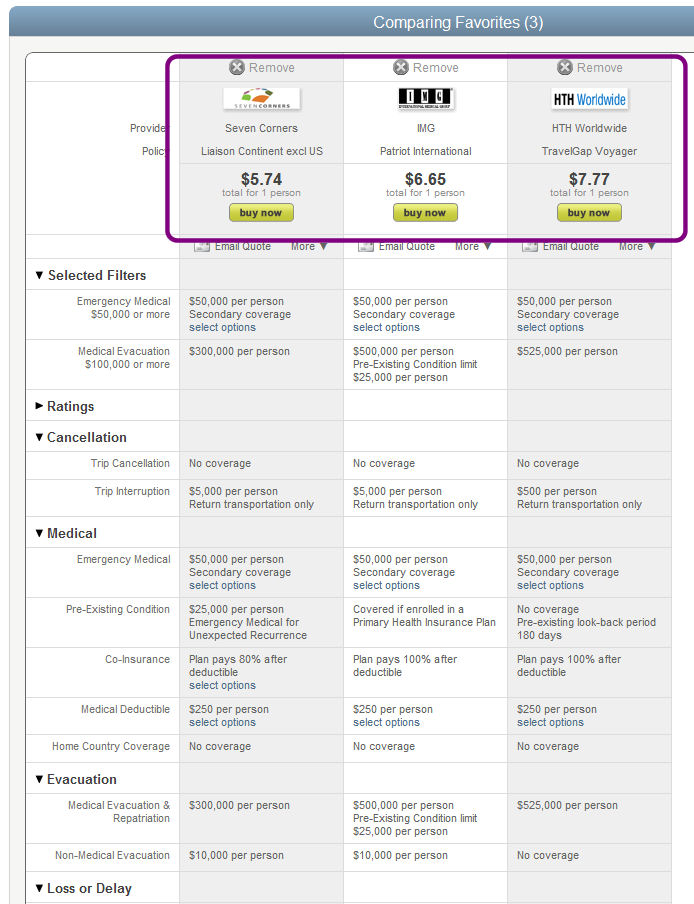

- Purchase your travel insurance early to have the longest possible cancellation window.

- Read your plan carefully to understand what it covers (and what it doesn’t).

- Pack antivirals in your emergency travel medical kit.

- Stay connected on your trip – keep up with the news and stay in touch with family (they’ll likely know more about what’s going on than you do).

- Know how to find local medicare on your trip.

See our facts about travel insurance and the flu.

Additional sources of information: