Did you know there are hostels to fit every type of travel? We were surprised too, but we found that some hostel sites define different types of hostels – luxury, romantic, family, etc.  –  and tag them by activity  – ski, party, beach. You can even find designations for the structure in which the hostel is lodged: prisons, haunted houses, ryokans, and more.

Did you know there are hostels to fit every type of travel? We were surprised too, but we found that some hostel sites define different types of hostels – luxury, romantic, family, etc.  –  and tag them by activity  – ski, party, beach. You can even find designations for the structure in which the hostel is lodged: prisons, haunted houses, ryokans, and more.

Many people believe that hostel travel is only done by the young, single backpacker on a budget, but these days there are hostels to fit nearly every type of traveler. Most hostel travelers are watching their budgets, but they also enjoy the experience of staying in a hostel for a range of reasons. Some hostels give you a lively social scene, for example, and the opportunity to make friends. Not all hostels are like big, open dorm rooms either – many have separate rooms for 1, 2, 3, or more travelers who want a little more privacy.

Of course any trip comes with risks and limiting your exposure to travel risks is what travel insurance is all about. We looked into what hostel travelers should know about insuring their hostel trips and came up with the following tips.

1. No traveler expects to have to cancel

It’s important to understand the range of reasons that could cause you to cancel your trip and some may surprise you:

-

You’re in a traffic accident just days before your trip and not recovered enough to travel

-

A family member is diagnosed with cancer, and you want to help with their care (you can travel once the cancer is gone)

-

You’re unexpectedly offered the job-of-a-lifetime, but you have to start tomorrow

-

Your best friend commits suicide and you just can’t stand the thought of leaving right now

Most of the time the reason a traveler has to cancel any trip is completely unexpected. It’s a surprise entirely out of the blue; something you’d never predict happening. Of course, that’s the intent behind insurance. After all, no homeowner expects to see their house burn down in a wildfire, but these things happen.

If you are taking a trip and you’ve spent money on that trip that you cannot afford – or would prefer not – to lose, then insuring that trip against cancellation is a wise idea. When you insure a trip for cancellation, you are insuring the pre-paid costs that are non-refundable. Anything you pay for before you leave – hostel reservations, airline tickets, train tickets, etc. – is a pre-paid trip expense. Some of those expenses are refundable in certain circumstances, but many are not. After all, they want their money too and cancellation policies are written to protect the one who has your cash.

2. Getting home fast can be difficult and expensive

Just like covering your trip for cancellations, it’s important to have a plan for how to get home should you be called home in a hurry. No one expects that their little sister will be in a tragic accident on her way to school, after all, but if you’re traveling wouldn’t you cancel your trip and head home to be with her and your family if they needed you?

Last-minute flights are expensive, especially if you already paid for your return trip ticket. The airlines are a lot less forgiving than they used to be about flight changes – even for emergencies. In some cases, the cost of changing a flight can be worth the price of a new ticket.

Travel insurance plans include trip interruption coverage, which is designed to get a traveler home in a hurry, and 24/7 traveler support for emergencies.

Trip interruption coverage reimburses the traveler for unexpected, and often expensive, travel costs like last-minute airfare, lodging, taxis and more. It can even reimburse a traveler for the portion of their trip they didn’t get to use because of the interruption – so you can travel again once the emergency is handled.

Travel assistance services can help a traveler arrange last-minute travel home.

3. Emergency medical care is always expensive

The cost of medical care is expensive no matter where you travel and when you travel outside your home country, your health insurance plan (if you have one) doesn’t usually cover your medical costs overseas.

Young people – especially active young people – have medical emergencies and if you’re traveling in a foreign country you may be required to pay for your medical care up-front. Unless you’re willing to put your credit card on the line to pay for x-rays, surgery, bandages, medicines, a doctor’s time, and more, you should have travel medical coverage.

Luckily, travel medical coverage is very affordable and even more so for young travelers. It’s almost a no-brainer when it comes to traveling outside the country where a foreign government is simply not responsible for taking care of your medical needs.

4. Baggage gets pilfered

No one is completely safe from thieves no matter where you go, but travelers can minimize their exposure to risk by leaving the valuables at home, carrying limited amounts of cash, using a money belt, and more.

Many hostels also provide lockers that travelers can use to protect their belongings and hostel travelers know to bring their own locks. A little research in advance will let you know if you will have lockers available.

Coverage for lost, stolen, or delayed bags with a travel insurance plan can help the hostel traveler in several ways:

-

If your bag is temporarily delayed, you can get a fresh change of clothes and some basic personal items to get you through until your bag arrives.

-

If your bag is irretrievably lost or stolen, you can be reimbursed for the clothing, personal items, etc. you have to buy to get through your trip (including a bag to take it all home).

There are a number of limits to baggage coverage, including a minimum number of hours before the delay coverage kicks in, and more. Click the links above for a better understanding of baggage coverage with your travel insurance plan.

What’s the Cost to Insure this Hostel Trip?

Let’s take a look at a hostel trip and what you might need to insure on this trip.

Let’s say a group of four college friends will be traveling for two weeks in Amsterdam. They are coming from all over the country and haven’t seen each other since graduation.

-

Tom – Los Angeles is spending $1,149 for airfare

-

Steve – Seattle is spending $1,166 for airfare

-

Owen – Newport is spending $992 for airfare

-

Matt – Dallas is spending $936 in airfare

They settled on staying at a downtown hostel because it’s in a great walkable location with lots of nightlife, museums, and cafes nearby – ideal for younger travelers who don’t want to rent a car.

To save money, they chose to reserve their rooms as non-refundable. They reserved a 4 bed suite to share at just $245 or $61.25 each. Each traveler will want to insure their pre-paid trip costs – their airfare + their portion of the hostel cost.

Each traveler also has individual concerns for this trip:

-

Avid cyclists, Tom and Matt are taking along their road bikes and plan to ride each day.

-

Steve and Own are self-employed and each is taking a laptop to keep tabs on work.

Tom and Matt will want a plan that includes baggage coverage for their bicycles in case they are stolen or lost along the trip. Baggage coverage with most travel insurance plans includes coverage for bicycles, but the total coverage for any one stolen item is not high. So they may want to choose a plan with a higher limit for baggage coverage. Riding your bike on streets is not considered a hazardous sport by the travel insurance companies, and so they don’t need adventure coverage.

Owen and Matt should understand that there is limited coverage for electronics with any travel insurance plan. They can talk with their homeowner’s policy and cover the electronics that way, but otherwise they should plan to carry them onto the plane and keep them locked in the hostel safe or in private lockers when not in use.

See our techniques for keeping valuable safe while traveling for more ideas.

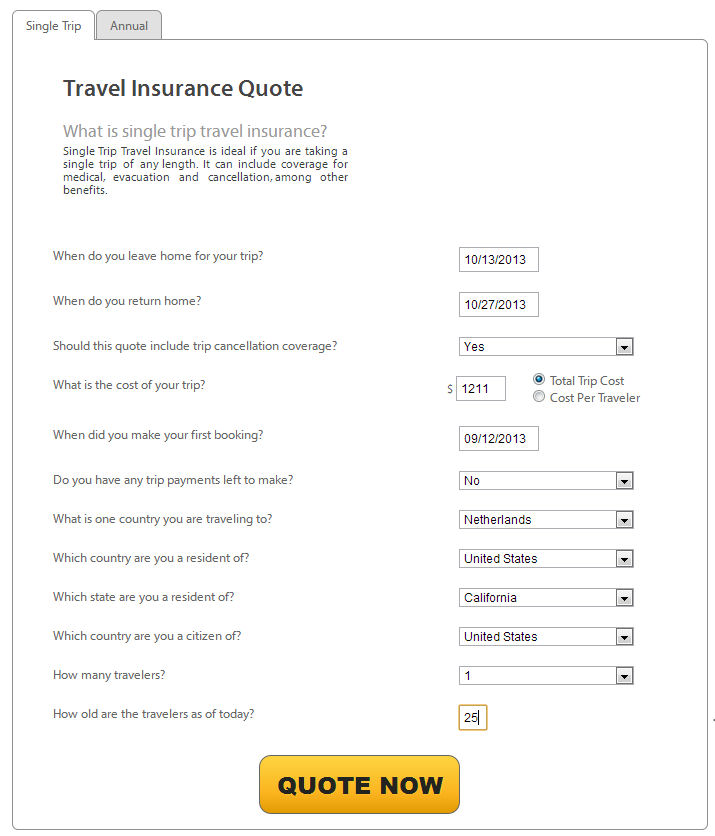

Here are Tom’s trip details plugged into our travel insurance comparison tool:

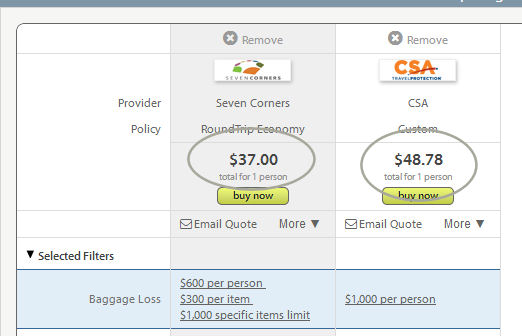

Tom chooses plans with a little higher per-item limit (at least $1,000) on the baggage coverage for his bike:

This image shows just a couple of plans to give you an idea of the cost, which you can see is very affordable for benefits like 100% trip cancellation, 150% trip interruption, $25,000 – $50,000 in emergency medical (in case he falls on a ride), and more.