A ‘covered reason’ is very specifically an event (a reason) that is covered by the benefits in your travel insurance plan. Nearly all complaints about travel insurance arise out of confusion over a plan’s coverage. Sure, we’re all familiar with how our health insurance or life insurance coverage works back home, but travel insurance is a relatively new breed of insurance. It’s highly useful stuff, but only when it’s understood by the traveler.

A ‘covered reason’ is very specifically an event (a reason) that is covered by the benefits in your travel insurance plan. Nearly all complaints about travel insurance arise out of confusion over a plan’s coverage. Sure, we’re all familiar with how our health insurance or life insurance coverage works back home, but travel insurance is a relatively new breed of insurance. It’s highly useful stuff, but only when it’s understood by the traveler.

Every travel insurance plan is unique, but they typically follow a basic pattern of specific reasons you can make a claim for benefits. The details about any plan, including the covered reasons, will be found in the plan’s description of coverage. This is the document that we, the travel insurance companies, and everyone else strongly encourage you to read. In nearly all cases, a plan’s description of coverage is available with the plan information right on the website.

Let’s look at some examples that should help you understand how to determine whether the travel insurance plan you’ve chosen will be right for you.

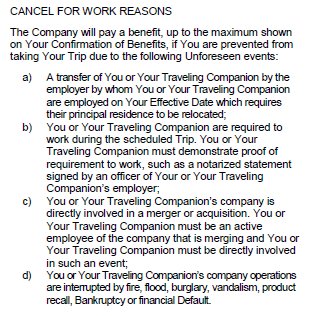

Covered reasons for work cancellations

Let’s take a look at one plan’s covered reasons for making a trip cancellation claim due to work reasons. The following is copied from the Travel Insured International Worldwide Trip Protector Gold plan and with this plan, the ‘cancel for work reasons’ coverage is an optional add-on:

Now, if you take a minute and read that text, it’s pretty clear right? If you have any questions, however, you can call the travel insurance company and ask. If your conclusion is that this plan won’t work for your needs, you can cancel the coverage as long as it’s within the travel insurance plan’s free review period.

Let’s take a look at another set of covered reasons.

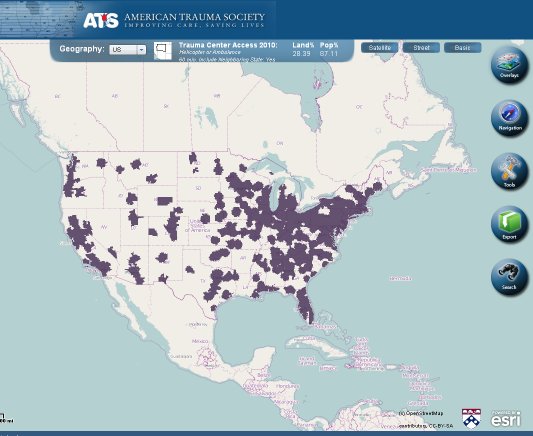

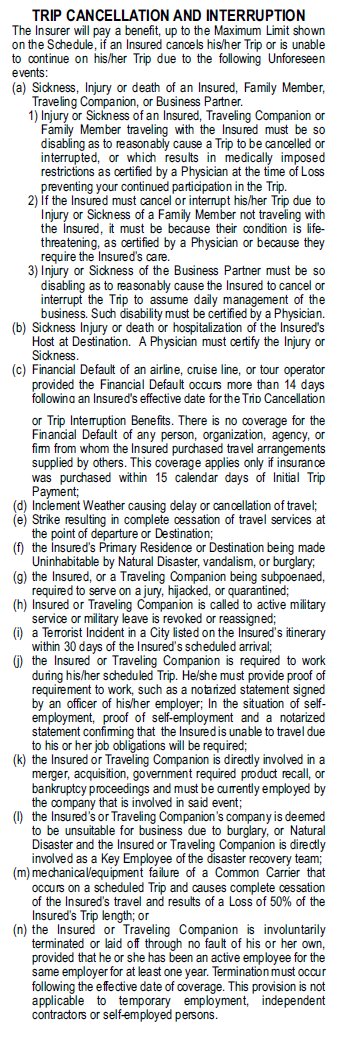

Covered reasons for general trip cancellations and interruptions

In general, the covered reasons for trip cancellations and interruptions (and sometimes trip delays and missed connections) are lumped together in the plan’s description of coverage. The following is copied from the Travel Guard Gold plan:

Now, we realize that’s a long list, but if you read through it, can you understand it? Notice, that to make a trip cancellation claim for terrorist concerns (see (i)), the terrorist incident must be listed on your itinerary, i.e., it can’t be in a nearby country, and it must occur within 30 days of your scheduled arrival. That’s pretty reasonable when you think about it.

Will the covered reasons meet your needs?

This is where you have to make some decisions and only you can make this determination. If you read through the covered reasons and think through the stuff that could go wrong (in fact, reading the description of coverage will often be a surprise in that it will cover things you never even thought about) and if each of those events is covered, then you’re probably good to go.

If you read through the covered reasons for a particular benefit and think you are facing a unique situation that may not be covered, give the travel insurance company a call and explain the situation. They’ll help you determine if you have the right plan.

A new

A new