The terror attacks of September 11, 2001 were like nothing the traveling public had ever seen before. When a terrorist attack occurs, travelers understandably get nervous and wonder whether they should cancel their travel plans.

The terror attacks of September 11, 2001 were like nothing the traveling public had ever seen before. When a terrorist attack occurs, travelers understandably get nervous and wonder whether they should cancel their travel plans.

Some travel insurance plans exclusively prohibit any claims due to terrorist attacks and others list incidents of terrorism as a covered reason for travelers to make a claim on their various travel insurance benefits. The key is that a terrorist incident must be listed in the policy as a covered reason for canceling your trip, going home early, accessing medical care, etc.

There are, of course, limits to the coverage for terrorist incidents with a travel insurance plan. It’s important to note that most travel insurance plans state that the terrorist incident must have occurred recently (usually within 30 days of your departure) and it must be in or within a certain number of miles from a city listed on your itinerary.

The following are 8 ways travel insurance protects travelers from terrorists.

1. Cancel your trip and get your money back

Many travel insurance plans allow the insured traveler to cancel their trip prior to leaving when a terrorist attack occurs. This is a great way to protect your trip investment from the actions of terrorists.

If your destination is a long way from where the terrorist act occurred, but you want to cancel your trip for fear of follow-on attacks, you’ll need to have ‘cancel for any reason’ coverage to make a claim.

2. Go home when terrorists strike

If a terrorist incident occurs where you are traveling and you want to leave the area and go home, trip interruption coverage will reimburse the insured traveler for additional transportation expenses (up to the plan limit) less any money you receive from the exchange of your airline ticket (if any).

Depending on how much of your trip remains, you may also be reimbursed for the non-refundable trip costs you paid for but didn’t use prior to heading home.

3. Get medical treatment when injured in a terrorist attack

While travel insurance providers place limits on some coverage for terrorist attacks, there is no such limitation on medical treatment when the traveler is injured in a terrorist attack. If you are in a foreign country and caught in a terrorist attack, your emergency medical treatment will be covered up to the limits of the travel insurance plan.

Acts of terrorism and terrorist incidents must not be listed under the general exclusions for this benefit to be available to a traveler caught in a terrorist incident.

4. Send your kids to college even if you’re dead

Most travel insurance plans include some Accidental Death and Dismemberment (AD&D) or flight accident coverage. If you are killed during a terrorist incident while on an insured trip, your beneficiaries will receive the amount of money listed in the policy details. This benefit if secondary to any other life insurance or AD&D you have through your employer or other sources.

5. Catch a ride out the mess

When a terrorist does their worst, the insured travelers are in a much better position to catch a ride out of the area where the terrorist action has occurred. Many travel insurance providers offer security or political evacuation coverage and they will retrieve their covered travelers and take them to a safer place.

6. Manage delays caused by terrorism

Many travel insurance plans list travel delays as one of the covered events. If you are delayed from reaching your destination due to a terrorist act, you’ll have the money you need to cover unexpected lodging and transportation among other things. You’ll also have the support of the travel assistance services to book hotel rooms, re-arrange flights, and much more.

7. Recover your body

If you are killed in a terrorist incident while traveling, a travel insurance plan with coverage for the return of mortal remains, or repatriation, will work to recover your body and return it home for burial. The travel assistance team will negotiate with government officials, handle the paperwork, arrange and pay for the shipping costs to ensure that your body is safely returned home.

8. Help if you’re hospitalized

If you are traveling with your children and you are hospitalized as a result of a terrorist attack, many travel insurance plans include coverage to return minor children to their home or to a suitable caregiver while you recover. Another little-known benefit of travel insurance is one called bedside visit or emergency medical reunion. This benefit brings a family member or friend to your bedside if you will be hospitalized in a foreign country for a minimum number of days (usually 7).

Your Definition of Terrorism May Not Match Theirs

When a travel alert or warning is issued by the U.S. Department of State and warns travelers about the potential for terrorist acts in the near future, many travelers scramble to find their travel insurance plans and review their coverage. As they say, “the devil is in the details.†What you might identify as a terrorist incident may not be identified as such by others – specifically by your travel insurance provider.

The terminology of the travel insurance plan plays an important part. If the event does not turn out to be caused by a terrorist as defined by the terms of the policy, your claim will be denied.

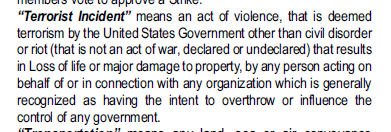

Let’s look at how some plans define terrorist incidents. The following one is from Travel Guard’s Platinum travel plan:

Another travel insurance company – Travel Insured International – defines terrorist incidents as follows:

In the second case, the terrorist act must be identified as such from the U.S. government. If a train blows up in the city where you are visiting and you think it’s a terrorist action and make a claim for trip interruption when you return home, your claim will only be paid when (and if) the U.S. government identifies it as an act of terrorism. Otherwise, your claim will be held in limbo until the matter is decided by the government.

While insured travelers have some protection against terrorist acts (depending on the plan they chose), there is no coverage for terrorist threats – even when the warning is issued by the U.S. government. Your only guarantee that you will be able to cancel your trip and recover some or all of your trip investment is to have ‘cancel for any reason’ coverage with your travel insurance plan.