It’s getting close to ski season in many parts of the U.S. and Canada. About this time every year, travelers start asking what they should remember when they buy travel insurance for a ski trip.

It’s getting close to ski season in many parts of the U.S. and Canada. About this time every year, travelers start asking what they should remember when they buy travel insurance for a ski trip.

So, what do you need to think about when it comes to insuring this season’s skiing, snowboarding, and even dog-sledding trips?

Cover your head and your bum with travel medical

If you’re traveling abroad, or your health insurance network range doesn’t extend to where you’re traveling, you’ll want to have travel medical coverage in case of an accident.

Most health insurance plans in the U.S. do not extend their coverage outside the U.S. borders – that means a ski accident just over the border in Canada could cost you a fortune.

If you can’t afford a big medical bill because a skiing accident sent someone to a hospital outside his or her health insurance network, a travel medical plan will act as secondary coverage inside the U.S. and as primary coverage outside the U.S. For example, if you’re traveling from Oklahoma to Colorado and your son has a skiing accident that sends him to the emergency room, your health insurance plan would pick up the expenses at the out-of-network rates and your travel medical plan would pick up the rest (up to the policy limit).

See our full review on travel medical insurance for more information.

Get evacuation and repatriation if you’re traveling abroad

If you’re traveling abroad for your ski trip, you’ll want to have a travel insurance plan with emergency evacuation and repatriation coverage. This benefit pays for medically necessary evacuations to a medical facility where you can receive treatment if no medical facility nearby can appropriately accommodate your injuries. It also pays for the recovery of an insured traveler’s body should that person die while on a trip.

Neither of these is a pleasant thought, but when you consider that serious injuries such as paralysis, head injuries, etc., occur at the rate of about 43 per year (according to the National Ski Areas Association) and deaths occur at the rate of about 40 per year, it’s coverage worth having unless you want your family to have to fork over as much as $80,000 or more to get your injured body to a qualified medical center.

It’s important to note that evacuation and repatriation coverage is not useful unless you’re traveling outside your home country because these coverages do not apply within your home country.

See our full review of evacuation and repatriation coverage for more information.

Cover your pre-paid travel costs with trip cancellation

When you’re planning a ski vacation, you may reserve a lodge, plus ski passes, ski equipment, and more. All of those pre-paid non-refundable trip expenses are costs that you may want to insure if something happens to cause you to have to cancel your trip.

Most vacation rentals these days have cancellation policies that look something like this:

If you have to cancel your reservation, we will gladly refund your payment minus a small administration fee with at least 60 days’ notice. If you must make a last-minute cancellation, and we cannot fill your reservation with another guest, you will forfeit your entire payment.

Cancellation policies are standard procedure for inns, bed and breakfasts, vacation homes, condos, and even many hotels.

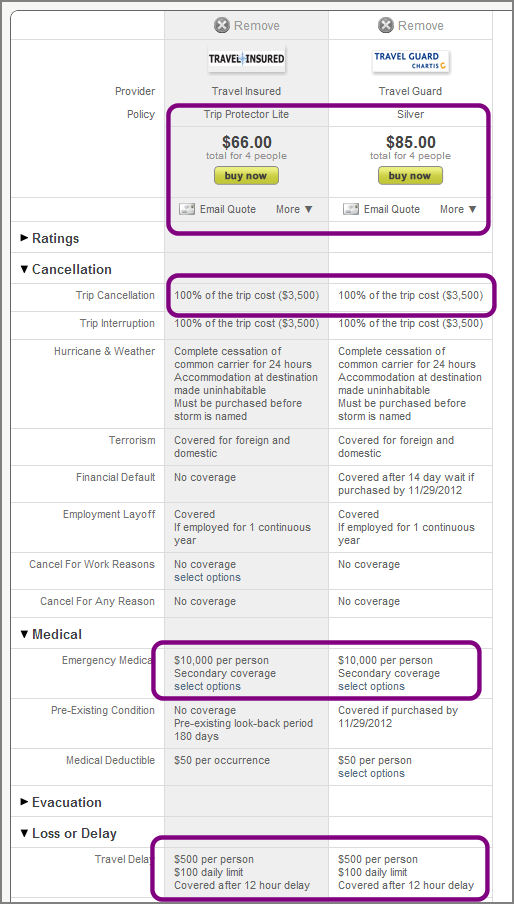

The pre-paid expenses for a ski trip for a Miami family of four heading to Colorado for a week of skiing could run as high as $3,500. You can usually cancel your car rental and wait to buy your ski passes when you arrive, but the reality remains: that’s a lot of money to lose if someone gets sick, for example. Running the basic trip details through our travel insurance comparison tool, you can see at least two plans are available to cover this trip for less than $100.

Cover your travel delays and trip interruptions

Two other coverages are useful for ski trips: travel delay coverage and trip interruption coverage, and we’ll explain why you might want with your travel insurance plan now:

- Travel delay come in many forms (especially in winter months): weather delays, road closings, flight operation delays, and more. This benefit reimburses the traveler for unexpected expenses if your trip is delayed for a covered reason. See the full review of travel delay coverage for more detail.

- Trip interruptions are those unexpected events that cause a traveler to abandon their trip and return home to handle an emergency. The benefit reimburses a traveler for their unused trip costs and often provides additional money for unexpected return airfare – in some cases, it will also bring you back so you can enjoy what’s left of your trip. See the full review of trip interruption coverage for more detail.

These two coverages are great when unexpected things happen after you’ve left home.

Cover your ski equipment and gear

This coverage can be a little confusing for some travelers. Skiing equipment nearly always has to be checked in with the airline – it’s simply too big to fit anywhere else but the hold of the aircraft. Many travelers are aware that the airline coverage for lost, damaged, or destroyed bags is limited and they have strong limits on their liability even if the gear inside the bag is expensive.

This is why professional photographers check their clothes and carry their cameras!

Travel insurance also places a per-item maximum on lost items, so if you’re taking your skis and ski equipment along with you, and you want coverage if it’s lost, stolen, or destroyed, you’ll need to look into a sports equipment rider, which will increase your travel insurance premium a bit.

A few travel insurance companies provide up to $2,500 in sports equipment coverage, but most give an insured traveler $300-$500. See our review of sports equipment coverage, including a list of companies that provide it and how much they’re willing to pay for your ski equipment.

Wear a helmet or don’t wear a helmet?

Recently, a British travel insurance firm – Essential Travel – started requiring skiers to wear a helmet on the slopes or face having their policy invalidated. So far, U.S. travel insurance companies have not pushed the same requirement, but it’s important to note that the following are always excluded from travel insurance plans without special coverage:

- heli-skiing

- extreme skiing

- skiing outside marked trails

- skiing while under the influence of drugs or alcohol*

* This last one is just plain excluded from all plans.