It is not uncommon for travelers to fall ill when they are traveling, because they may have trouble getting used to the food and climate in other countries. Accidents can also happen during travels, especially for those who participate in high-risk activities. Getting medical care for illnesses and injuries can be expensive in some countries, and some foreign hospitals may require advance payment before treatment is administered. One solution to the problem is to get travel medical insurance. With a travel medical insurance, travelers will receive compensation for the medical expenses incurred when they become injured or sick during their trips.

It is not uncommon for travelers to fall ill when they are traveling, because they may have trouble getting used to the food and climate in other countries. Accidents can also happen during travels, especially for those who participate in high-risk activities. Getting medical care for illnesses and injuries can be expensive in some countries, and some foreign hospitals may require advance payment before treatment is administered. One solution to the problem is to get travel medical insurance. With a travel medical insurance, travelers will receive compensation for the medical expenses incurred when they become injured or sick during their trips.

Travel medical insurance is usually offered as part of a basic travel insurance policy, and it provides coverage for hospital or doctor bills. Some insurance policies will also compensate for the costs of medications and dental treatment, or provide special features such as: preventive services, chiropractic, acupuncture, and maternity benefits. The maximum compensation offered by a travel medical insurance can range from thousands to tens of millions of dollars. While a low compensation may not be sufficient to cover medical bills, a policy with a high compensation can be costly. The best thing to do is to opt for a policy offering maximum compensation of one or two million dollars. Travel medical insurance policies provide coverage for a limited duration of time, which can range from one day to six months, but options are available to extend the coverage duration to beyond six months.

Other than compensation for medical expenses, a travel medical insurance policy may also offer coverage for medical evacuation. In the event of a medical emergency, this coverage will provide protection for the costs of transporting a person to a medical facility. It is particularly useful for those who are traveling to rural places where there are no hospitals nearby. In some cases, transportation cost for a trip from a rural area to a hospital may amount to thousands of dollars.

Another option available for travel medical insurance is trip cancellation or interruption coverage. This type of coverage will provide compensation for the amount of money lost when the policy holder cancels or interrupts their trip due to medical reasons. Those who are spending a lot of money for their travels should get trip cancellation or interruption coverage because it will ensure full reimbursement of their travel investment if the travel company refuses to give a full refund.

Senior travelers and those suffering from pre-existing medical conditions require special travel medical insurance policies. Such policies offer great benefits that will make their trips more convenient and worry free. Travelers who are taking part in hazardous activities can also apply for special policies to provide coverage for such activities.

Travelers should provide honest information about their health when they are completing the travel insurance application forms. This will enable insurance providers to plan the right policies.

Photo credit: https://www.flickr.com/photos/pdenker/

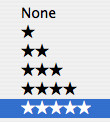

These days, there are numerous insurance companies that offer a wide variety of travel insurance policies, and many travelers have trouble finding out which company offers the best policies. One of the best ways to find a good travel insurance policy is to take a look at ratings of travel insurance companies. Usually, a reputable insurance company will provide policies with good coverage and efficient compensation.

These days, there are numerous insurance companies that offer a wide variety of travel insurance policies, and many travelers have trouble finding out which company offers the best policies. One of the best ways to find a good travel insurance policy is to take a look at ratings of travel insurance companies. Usually, a reputable insurance company will provide policies with good coverage and efficient compensation. Traveling on your own is already tough, but traveling with children presents a whole new challenge. Here are some tips to ensure a smooth trip:

Traveling on your own is already tough, but traveling with children presents a whole new challenge. Here are some tips to ensure a smooth trip: Traveling anywhere is tricky enough without having to worry about age restrictions, but there are some circumstances when age actually matters, especially in the matters of travel insurance and limitations.

Traveling anywhere is tricky enough without having to worry about age restrictions, but there are some circumstances when age actually matters, especially in the matters of travel insurance and limitations. Many people are traveling by air these days, and there is plenty of baggage for the airport crew to manage. Sometimes, those who are handling the baggage may make a mistake or two, and this can result in

Many people are traveling by air these days, and there is plenty of baggage for the airport crew to manage. Sometimes, those who are handling the baggage may make a mistake or two, and this can result in  Sometimes, you cannot prepare for the inevitable. No matter how perfectly planned your vacation is, some things are beyond your control. Bad weather conditions like hurricanes and severe thunderstorms can force you to cancel your vacation. What can you do?

Sometimes, you cannot prepare for the inevitable. No matter how perfectly planned your vacation is, some things are beyond your control. Bad weather conditions like hurricanes and severe thunderstorms can force you to cancel your vacation. What can you do?