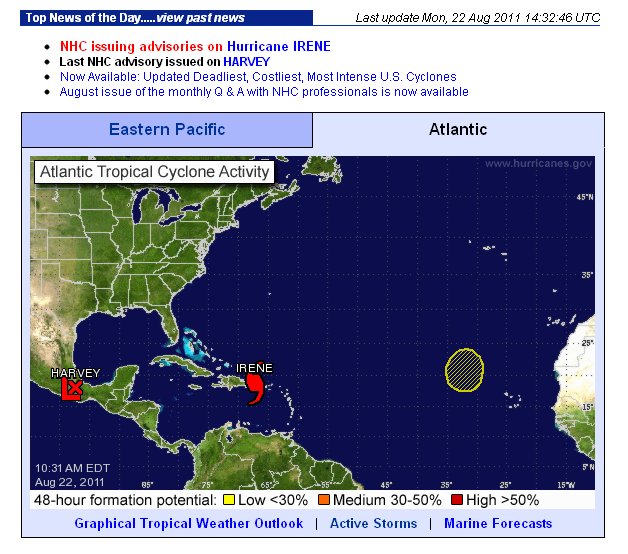

JetBlue recently announced a change fee waiver for multiple flights that are predicted to be affected by Hurricane Irene, and they listed the origination/destination cities in a flight operations update on their website.

The currently affected cities and airports include:

- Nassa, Bahamas (NAS)

- Turks & Caicos (PLS)

- Dominican Republic (PUJ, POP, SDQ, STI)

- Puerto Rico (SJU, BQN, PSE)

Customers are requested to make their flight changes by the dates listed in the JetBlue flight operations update.

Rebooking terms and conditions include:

“Customers may rebook their flights for travel through the dates indicated above or opt for a refund to the original form of payment by calling 1-800-JETBLUE (538-2583) prior to the departure time of their originally scheduled flight.”

Is JetBlue the first or the only airline that will help travelers out this way? Time will tell.