5. A travel delay strands you in a city and you need a hotel room for the night

If a travel delay strands you unexpectedly, you might need to get some accommodations for the night. Avoid getting stuck with the hotel bill by insuring your trip.

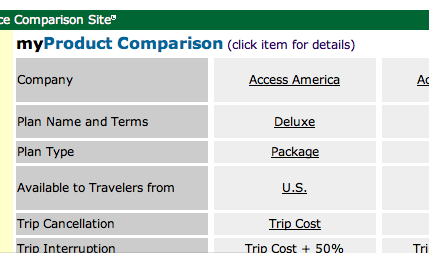

Most package plans includes coverage for travel delay. This covers additional expenses incurred after being delayed for a certain amount of time. Different travel insurance companies have varying delay times, usually between 3-12 hours but sometimes up to 24 hours.

What happens if I miss my connecting flight? Will I be covered?

What happens if I miss my connecting flight? Will I be covered?