A visitor to Longboat Key, near Sarasota, Florida, was recently bitten by a raccoon twice on the leg while showering beach sand off herself and her infant. The Ohio woman kicked the raccoon away, but it came back and bit her a second time before running into the surrounding sea grapes. A trip to the Sarasota emergency room revealed two puncture wounds to her right leg.

A visitor to Longboat Key, near Sarasota, Florida, was recently bitten by a raccoon twice on the leg while showering beach sand off herself and her infant. The Ohio woman kicked the raccoon away, but it came back and bit her a second time before running into the surrounding sea grapes. A trip to the Sarasota emergency room revealed two puncture wounds to her right leg.

You are probably already aware that your U.S.-based health insurance coverage will not likely cover you outside the U.S., but out-of-network medical care is also a problem for travelers who find themselves with a medical emergency.

Every year vacationers find themselves in an emergency medical facility each year for dog bites, stingray stings, and more. The odds that you will visit an emergency room on your trip go up if you are also an adventure traveler. Many travelers have good health insurance coverage back home, but when traveling outside their health coverage network, the medical bill can be higher than they expect.

It’s for this reason that we recommend travelers – even those staying within their home country – get at least $10,000 in medical coverage with emergency medical evacuation benefits that can help you get you back inside your health insurance network for continued treatment. For a relatively minor incident that can be easily treated with an emergency room visit, you’ll have the secondary travel medical coverage you need to cover your out-of-pocket expenses after your primary health insurance covers their out-of-network portion.

Hint: If you need help understanding primary versus secondary medical insurance, please see this page.

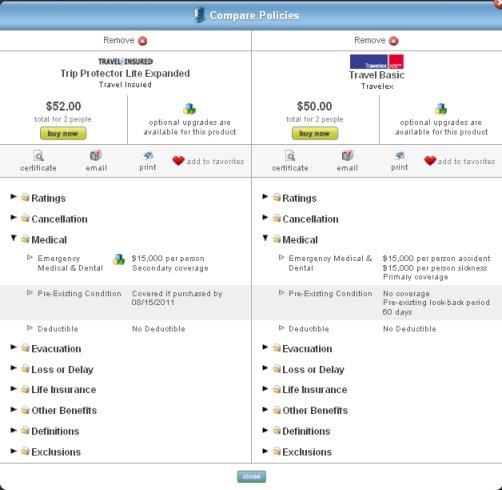

As a quick comparison, we ran a travel insurance quote comparison for two travelers ages 38 and 42 traveling in the U.S. and we quickly selected two plans:

* Please note, we did not included trip cancellation in our plan selection.

As you can see, for just a little extra, you can have the secondary coverage you may need even if you already have health insurance. Adventure travelers enjoying activities such as whitewater rafting, or downhill skiing, or rock climbing can usually upgrade their coverage to include those activities. Either way, you’ll avoid a huge medical bill on your vacation.