As a site that allows individuals to post reviews of their travel insurance experiences and invites travel insurance providers to respond, we’ve seen our share of angry comments from insured travelers whose claims were denied. We also see angry tweets that label travel insurance companies as fraudulent, crooks, and worse.

As a site that allows individuals to post reviews of their travel insurance experiences and invites travel insurance providers to respond, we’ve seen our share of angry comments from insured travelers whose claims were denied. We also see angry tweets that label travel insurance companies as fraudulent, crooks, and worse.

While we do not have access to the specific details of any insured traveler’s policy – we only see the comments –  it’s clear that many travelers unfairly label travel insurance a fraud simply because the policy didn’t pay out when the insured thought it should.

Here are just a few of the most recent reasons travelers unfairly labeled travel insurance as ‘fraudulent’ and a ‘scam’ that we’ve seen in our comments and on tweets.

1. My flight was canceled and my claim was denied?

Many insured travelers are shocked to find that travel insurance doesn’t pay for cancelled flights. When you purchase your ticket with the airline and the airline cancels your flight, it’s their responsibility to compensate you, not your travel insurance provider. This is also true of trains, tour operators, and other travel suppliers as well.

If your travel supplier cancels for lack of attendance, lousy weather, or any other reason, they usually offer the traveler the option to reschedule. While this may not be convenient to the traveler, it’s the deal you made with the travel supplier when you purchased your ticket.

Avoiding this problem: know your rights with the airline, train, or other travel supplier. Read their cancellation policies and work with them to get satisfaction.

2. My elderly mother got sick but my claim was denied due to a pre-existing condition?

Many travel insurance claims are denied due to pre-existing conditions, and it’s not just your own health that’s reviewed – it’s the health of the person whose illness or death caused you to cancel or interrupt your trip too.

A pre-existing condition is any condition that a person experienced the symptoms of or had diagnosed prior to their trip. If your mother’s illness was due to a pre-existing condition, and her illness is the reason your trip was cancelled, then the travel insurance company has no responsibility to reimburse your lost trip expenses.

Avoiding this problem: if you, a traveling companion, or anyone you care about enough to cancel your trip has been to the doctor recently, consider purchasing the pre-existing condition coverage with your policy. See our full review of pre-existing condition coverage for an understanding of how it works.

3. Our baggage was delayed, but not long enough?

We all know it’s uncomfortable and problematic when we arrive but our bags do not. The airlines have guidelines that allow some monetary funds to be distributed when an emergency occurs, but it’s not required compensation and it’s defined differently from carrier to carrier. In many cases, the airline will ‘compensate’ a passenger with future travel vouchers which isn’t very useful when you need your shoes instead.

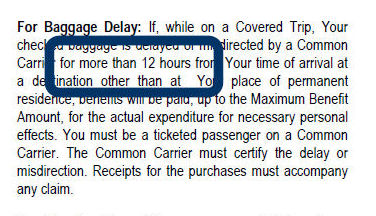

Travel insurance also places rules around their baggage coverage and requires that a bag be delayed a certain amount of time before it will reimburse the traveler according to the policy details. It may not sound fair, but it’s explained right in the policy documentation, as shown in this certificate example:

4. My best friend was hospitalized and my cancellation claim was denied?

Every travel insurance plan lists the family members that are covered by the terms of the policy, but non-relatives are not covered and, in some cases, some family members are not covered (sister- and brothers-in-law are often not covered). Neither are beloved pets, favorite neighbors, bosses, baby-sitters, or anyone else.

If the person you’re canceling your trip for isn’t listed as one of the covered members in the policy, then your claim will be denied.

Avoiding this problem: if you believe there’s any chance you would have to cancel as a result of a person that is not listed in the policy, then you want to be able to cancel for any reason. Get a travel insurance policy with ‘cancel for any reason’ coverage and be sure to cancel your trip within the plan’s guidelines (typically 48 hours is required for this coverage).

5. We were parasailing and got hurt, then my medical claim was denied?

Travel insurance companies, just like every other type of insurance company, has to limit their liability. After all, you wouldn’t expect your home insurance coverage to reimburse you after you deliberately set your home on fire – that’s a claim you would expect to see denied.

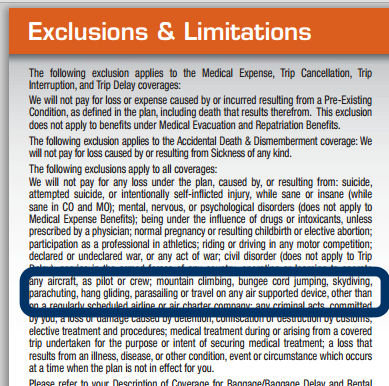

Every travel insurance plan has a list of exclusions that apply to the traveler’s trip and understanding those exclusions is critical to understanding how your plan works. Here’s an example of the parasailing exclusion that’s listed in many travel insurance plans:

All kinds of things are typically excluded in travel insurance plans: riding motorcycles, bungee jumping, medical tourism, mental illness, and more – just like setting fire to your own home is excluded under your home insurance policy.

Avoiding this problem: read your travel insurance policy carefully and be honest with yourself about what you plan to do on your trip. If you’re headed to a resort where parasailing is an activity and you think you may want to try it, then get a plan what covers it. Many travel insurance plans allow you to add coverage for ‘adventure’ activities as an option and some don’t even charge you extra if you buy your plan early.

Steps to Help Ensure Your Travel Insurance Claim is Paid

The following are the recommended steps to ensure your travel insurance claim gets paid:

- Read your policy – especially noting the exclusions – as soon after you buy it as possible (during the review period), so you know what’s covered and (perhaps more important) what is not covered. You can avoid a lot of heartbreak with this one step.

- When a claim-worthy event occurs, keep all your receipts and get any causes of delay in writing. Lots of claims are denied simply because the traveler couldn’t prove the cause or even that they had a ticket for that flight.

- Call your travel insurance company before you file a claim and ask what’s needed to make the claim successful.

- Be reasonable about the delay – claims typically take between two and four weeks to process, but many take longer because they require research before the insurance adjuster can make a decision. A large natural disaster will trigger a flood of claims, and if yours is in the pile it may take awhile.

See Making a Successful Travel Insurance Claim for more details.

The Bottom Line

Many travelers seem to think that if they pay a little and buy some travel insurance plan, they’re covered for anything that happens – anything at all – and that’s really unreasonable. Travel insurance doesn’t cover ‘everything’ that can go wrong on a trip.

Your travel insurance policy is an agreement – a legal contract between you and the travel insurance provider, just like any other type of insurance. When insured travelers are frustrated because a claim is denied, they assume they’ve been cheated but in most cases their claim is denied fairly according to the policy.

We agree that it’s no fun when you buy a travel insurance plan and believe you’re covered only to find out you were never covered at all. This scenario is 100% avoidable if travelers will read their plans and understand the exclusions.

For more information and help understanding the ‘loopholes’ that confuse travelers see our article: 5 “Loopholes†and How to Avoid Them and please, read the fine print of your travel insurance document within the policy’s review period (typically 10-14 days after purchase) so you know you have a plan that will deliver the coverage you expect.