Company/Website: CSA Travel Protection

Category: insurance company/administrator

Overall Rating: Very Good

About: CSA Travel Protection offers their own line of travel insurance products, available directly from CSA or through agenct sales.

Special Features: Identity theft protection, rental car damage protection

Full Review:

“Just give us the best plan”

Going against the industry trend of having different policies for different needs, CSA Travel protection has consolidated their offerings into 1 plan, called Freestyle.

“Customers have told us, ‘just give us the best plan'”, says CSA spokesperson David Craychee.

The premium, which varies by age, time of year and other factors, is in the standard range for package polices: about 5.5 percent to 7 percent of the trip cost.

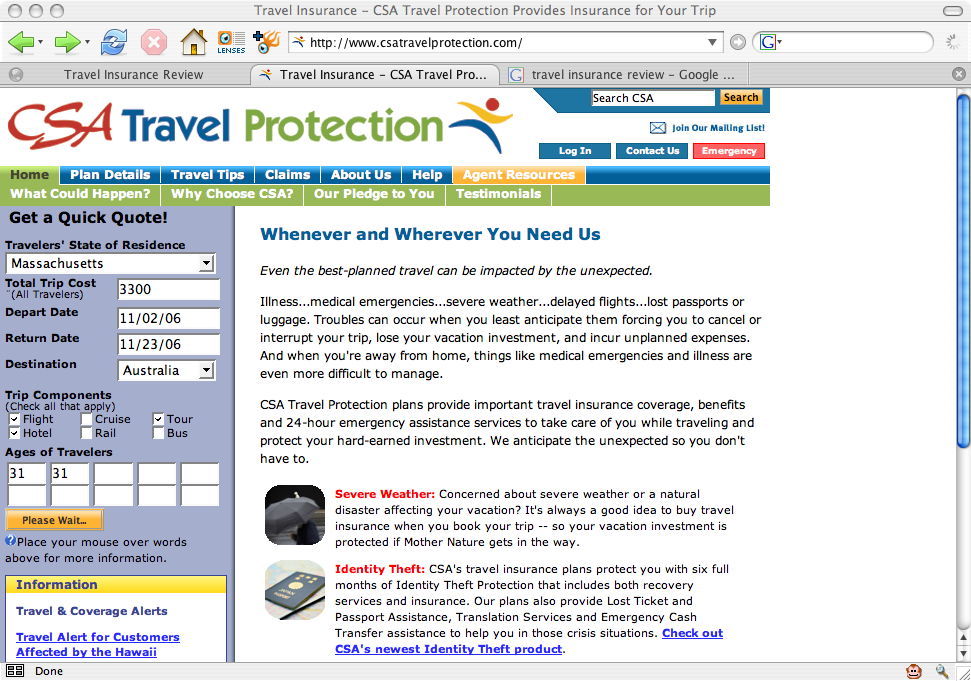

Arriving at CSA’s homepage, you clearly see their quote engine in the “sweet spot” of web design, the top left corner. They ask for very basic information: State of residence, trip cost, trip dates, trip type, and ages of travelers. This takes less than a minute to fill out:

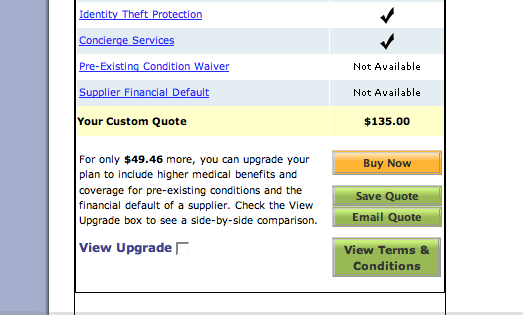

On the quote screen, you will see one column with some of the plan details. Notice how the benefits are stated in actual dollars, based on the trip cost you enter to get the quote. For example: with a total trip cost of $3300, the 150% trip interruption benefit shows $4950 (150% of $3300).

All the standard coverage is here: trip cancellation/interruption/delay, baggage lost/delayed, medical/dental emergencies, medical transport, and air flight accident.

CSA also lists some of their specialized coverage towards the bottom. You will notice some benefits such as pre-existing condition waiver are not available. They do offer an upgrade, to Freestyle Luxe, which will add these additional features as well as higher medical limits. Check the “View Upgrade” box to see the additional benefits and cost of the Freestyle Luxe upgrade:

You can compare the standard Freestyle plan with the upgrade option, Freestyle Luxe. The upgrade includes a pre-existing condition waiver, coverage for supplier financial default, and higher limits on baggage, medical and dental, medical transportation, rental car damage, and the addition of travel accident (AD&D)

Summary: CSA is a very simple, consumer focused company. By making their policy selection easier and removing confusing choices, CSA makes travel insurance a lot less painful.

They also have policy features that are very attractive to everyday travelers, such as higher baggage coverage, and identity theft protection. These are both great selling points.