Editor Review of FrontierMEDEX

The Good: FrontierMEDEX has specialized in travel medical insurance plans and medical evacuation plans for over 30 years. They offer full-featured, worldwide travel medical protections for U.S. and non U.S. citizens. The TravMed Abroad plan offers full benefits for travelers up to age 85, which is rare in the industry. Several plans can be enhanced with trip cancellation, interruption, and luggage benefits to create a more full-featured travel insurance plan.

The Drawbacks: Extremely limited coverage for pre-existing medical conditions across the FrontierMEDEX plans.

The Bottom Line: FrontierMEDEX delivers comprehensive short-term and annual accident and illness insurance, emergency evacuation, repatriation, and worldwide 24-hour medical assistance for travelers. Some travel medical policies can be enhanced with package benefits such as trip cancellation, interruption, and lost luggage. They also deliver two useful medevac plans for students and other travelers.

Company Information

Company Name | |

|---|---|

| US Travel Insurance Association Member | Yes |

| Refund Policy | 14-day Free Look Period |

| Travel Insurance Plans | Travel Medical plans TravMed Abroad TravMed Choice TravMed Global Travmed International Medical Evacuation plans Plus Scholastic Safe Trip |

| Company Contact Information | FrontierMEDEX 8501 LaSalle Road Suite 200 Baltimore, MD 21286 1-800-732-5309 1-410-308-7905 Fax mktginfo@frontiermedex.com |

| Policyholder Questions | 1-800-732-5309 |

| Travel Assistance/Emergencies | Inside US/Canada: 1-800-732-5309 (toll free) Outside US/Canada: call operator & connect to 410-453-6330 (no charge) |

About FrontierMEDEX

FrontierMEDEX travel insurance plans are medical- and evacuation-focused. They offer a range of travel medical plans for U.S. and non U.S. citizens – even those up to age 85! Some plans are short-term medical protection and some are major medical and some are simply medevac plans.

All evacuation coverage comes with emergency medical reunion and the return of minor children.

The MEDEX website offers some great case studies that underline the reason travelers purchase travel medical plans. Their travel assistance services are happy to provide pre-trip information, transfer of cash, facilitate hospital payments, and multi-lingual translation services to stranded or concerned travelers the world over.

Optional coverages available with some plans includes enhanced AD&D limits, hazardous sports coverage, and the unexpected trip cancellation, interruption, and lost luggage benefits, which round out the coverage.

Optional Coverage Available in FrontierMEDEX Plans

- Optional hazardous sports coverage available in some plans.

- Some plans can be upgraded with enhanced AD&D limits.

- Optional trip cancellation and lost baggage benefits available with some plans.

Highlights of FrontierMEDEX Travel Insurance

- FrontierMEDEX plans have very easy to understand pricing and the description of coverage is available one click from the plan’s summary page.

- Advance payments can be arranged to a hospital or medical facility, if necessary.

- Most plans include coverage for emergency medical reunion and return of minor children (age 18 and younger).

- Incidental trips back home and home country extensions are available to ensure consistent coverage.

- Travel assistance services include pre-trip information, transfer of funds, facilitation of hospital payments, translation services, and more.

FrontierMEDEX Travel Insurance Plans

Travel Medical Plans

TravMed Abroad

Travel medical and evacuation coverage with full benefits for U.S. citizens up to age 85

Comprehensive, short-term travel medical and evacuation coverage for illnesses and injuries incured while traveling outside the U.S. Includes worldwide travel assistance services. Plan is available as annual coverage.

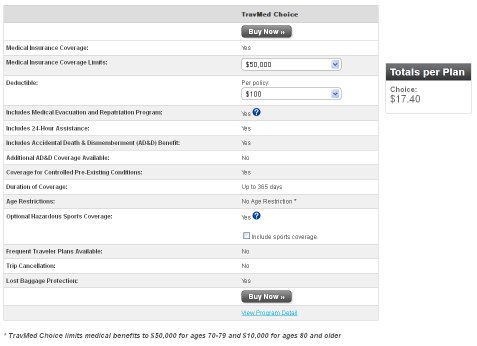

TravMed Choice

Short-term medical protection for U.S. and non U.S. citizens traveling outside their home country

Accident and illness insurance for global travelers, this plan includes the flexibility of selecting your medical benefit limit and deductible. Optional hazardous sports rider available, along with some package-like benefits such as trip cancellation, interruption, lost luggage, and more.

TravMed Global

Highly focused, comprehensive medical insurance with medevac, emergency dental, and AD&D

This is a comprehensive plan that includes travel medical coverage, evacuation and repatriation, as well as optional benefits for trip cancellation and interruption, enhanced AD&D and more. The base plan is highly focused and does not offer a lot of extras.

TravMed International

Complete major medical for medical and dental care for those working or living away from home

Ideal for travelers, workers, or expats who are away from home for extended periods of time. Base coverage is only in effect when the travelers is outside their home country. Plan can be described as high-limit worldwide major medical coverage for healthy travelers.

Medical Evacuation Plans

Plus Scholastic

Emergency medical evacuation and repatriation for students and faculty

A complete medical evacuation and repatriation plan for students, faculty and scholars and their dependents traveling over 100 miles from home. Includes worldwide travel assistance services.

Safe Trip

Ideal for long-term travelers and expatriates, this plan provides emergency evacuation coverage

With 100% of covered expenses covered for travelers who are 100 miles from their home (distance not applicable to expatriates), this plan is ideal emergency medical and political evacuation coverage. Includes unique home country coverage for U.S. residents traveling long distances within their own country. Excellent plan for seniors up to age 80.

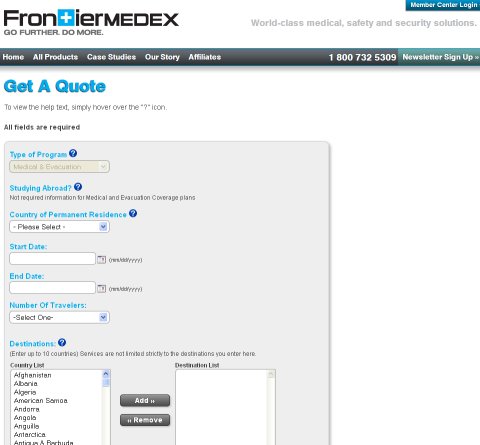

Screenshots of FrontierMEDEX Website