Is Travel Insurance Worth the Cost?

1 August 2013

Determining whether travel insurance is worth the cost or not comes down to how much you stand to lose on a trip – either from a cancellation, a travel delay, a trip interruption or a medical emergency while on your trip.

These days, even the hotels and resorts are getting in on the game of keeping a traveler’s investment if they cancel. Long gone are the days when you could cancel your hotel the day you intended to arrive and pay nothing. Airlines have been inventing new fees and raising the expected one for many years now and the fee to change a flight can now cost as much as the original flight in some cases!

It’s not just about when you are forced to cancel your trip either, if you get injured or ill on a trip, the associated expenses could leave you bankrupt.

Factors that Determine Whether Travel Insurance is Worth the Cost

We’ll be the first to admit that not every trip needs travel insurance, but here are the most important factors that make the investment worth the cost:

- If you have a significant amount invested in your trip. While no one thinks they’ll have to cancel, there is a wide range of totally unexpected events that can force you to cancel your trip – someone gets sick, you’re in a car accident, your passport is stolen, a natural disaster destroys your home or vacation spot, and much more.

- If you are traveling outside your health insurance network. The cost of medical care may be highest in the U.S. and Canada, but it’s not cheap anywhere and if you’re injured or get ill and need medical care (a factor you cannot predict), then having travel insurance is worth every penny.

- If you are concerned about the quality of medical care where you’re traveling. When you’re traveling in a region with limited or poor quality medical care, having a travel insurance plan with emergency medical evacuation can certainly be worth the cost.

Determine your Personal Travel Risks

Since not every trip needs travel insurance, the best way to determine if it will be worth it to you or not, make a list of your concerns before you travel. For example:

- A single parent taking a trip with friends may want to be sure that they can cancel and get their money back if their kid suddenly gets a severe ear infection.

- A baby boomer may want to have coverage in case their elderly parent is unexpectedly hospitalized back home and they want to return home.

- A family traveling to help build houses in a remote village may want to have good medical coverage in case someone gets hurt and/or needs to be evacuated to receive medical care.

- Another traveler concerned about making their cruise departure if a storm or mechanical problem causes an ill-timed delay may be most concerned about missed connection coverage.

Every trip and every traveler is different. Putting together a list of your concerns – those that affect your personal life and your wallet – is the best way to determine whether travel insurance will be worth the cost or not.

2 Travel Insurance Cost Examples

To put number to these ideas, let’s look at two trips. We’ve plugged the trip details into our travel insurance comparison tool to get some prices.

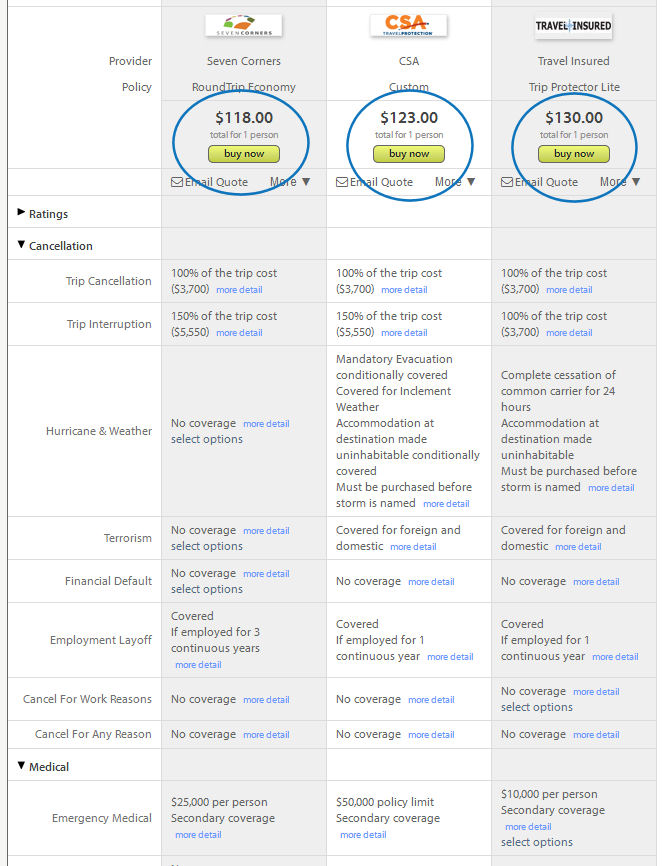

A two-week yoga trip for a 38-year-old New Yorker to Costa Rica at a cost of $3,700 yields many travel plans to choose from – here are the lowest three:

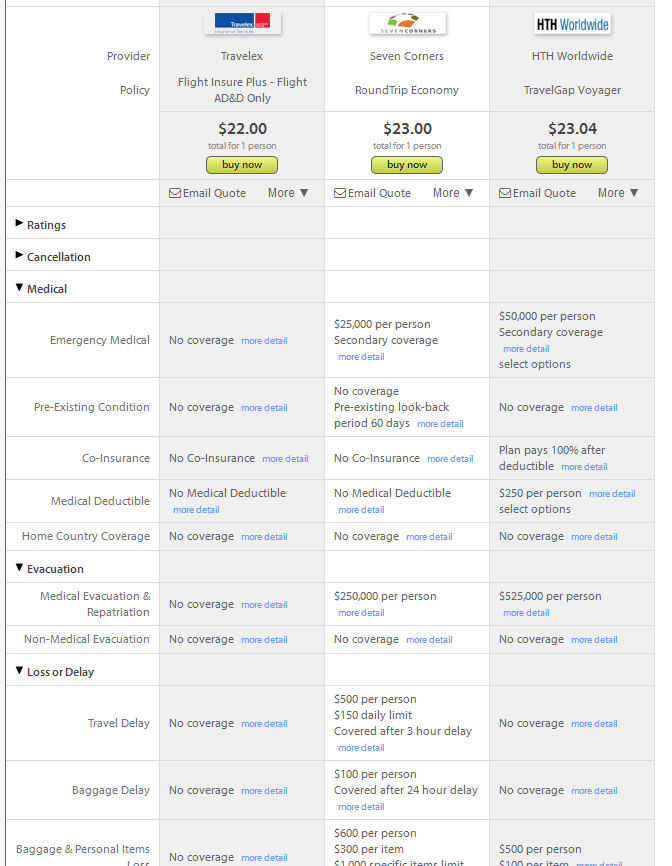

If this same traveler is not concerned about trip cancellation, this is how much it will take to cover her trip:

Is spending a little over $100 to cover $3,700 worth of pre-paid trip costs worth it? It depends on your comfort for risk. Either way, if you’re traveling outside your health insurance network, you could be considered foolish for not spending the extra 25 bucks to cover yourself for medical emergencies.

Understanding How Travel Insurance Costs Break Down

It’s important to understand that the largest portion of a travel insurance premium is tied up in the cancellation coverage. If you don’t need cancellation coverage, then you can get away with a simple travel medical plan, which is very affordable.

If you believe you need trip cancellation coverage, you can still control your travel insurance cost by not insuring expenses you would be refunded (hotels without strict cancellation policies, for example) and keeping your medical and evacuation limits at a reasonable amount (you don’t need multi-millions in evacuation costs, for example). Use our travel insurance comparison tool to get a list of plans and compare policies.

See our Rules for Saving Money on Your Travel Insurance for tips to keep the travel insurance premium down.

Damian Tysdal is the founder of CoverTrip, and is a licensed agent for travel insurance (MA 1883287). He believes travel insurance should be easier to understand, and started the first travel insurance blog in 2006.