Editor Review of HTH Worldwide

The Good: HTH Worldwide offers a few package plans for single and multiple trips throughout a year. They’re known, however, for their high-quality travel medical plans for both U.S. and non U.S. citizens.

The Drawbacks: Only one of the student plans covers U.S. students. Repatriation reimbursement across all HTH Worldwide plans is relatively low when compared to other companies. Coverage for pre-existing medical conditions in some plans is not available until after one full year of coverage. Benefits for claims resulting from downhill skiing and SCUBA diving are limited and there are no options for adventure sports coverage in any of the HTH Worldwide plans.

The Bottom Line: A leading provider of international health insurance since 1997, HTH Worldwide has a good number of travel medical plans, including single-trip plans, annual plans, major medical plans, and plans for students. They also offer a few full-featured package plans. Many of their plans are available for senior travelers and non U.S. citizens.

About HTH Worldwide Travel Insurance

HTH Worldwide is a leader in providing international health coverage for travelers. Founded in 1997 as Highway to Health, Inc., HTH Worldwide has become one of the most trusted providers of international health insurance programs. HTH Worldwide provides a wide range of individual health insurance programs, all of which include their unique Global Health and Safety Service – a set of online tools for contacting local medical health professionals, receiving health and security news alerts, and more.

HTH Worldwide travel medical plans often cover travelers up to age 74 and 84. Their plans cover individuals and families, students traveling into and away from the U.S., global citizens and expatriates.

HTH Worldwide’s travel insurance package plans are typically full-featured plans, including trip cancellation, interruption, and travel delay protections as well as medical coverage, evacuation and repatriation coverage, baggage loss and delay coverage, and more. The only common feature they do not include in any plans is missed connection coverage.

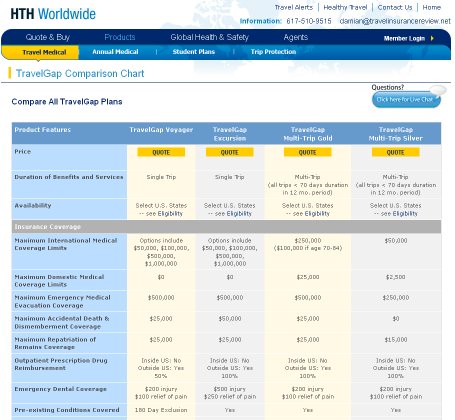

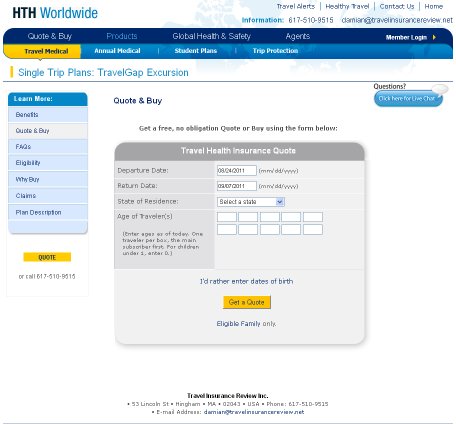

Their website is easy to use and you can quickly find the plan you need using the top navigation. Information about each plan, including the ability to compare plans, is quick to find.

Optional Coverage Available in HTH Worldwide Plans

- If package plans are purchased before or within 24 hours of a traveler’s final trip payment, pre-existing medical conditions are automatically waived at no additional cost.

- Some plans offer optional prescription drug coverage.

Highlights of HTH Worldwide Travel Insurance

- Deductibles are waived or reduced by half for treatment by an HTH Worldwide provider or a Student Health Services Center.

- All plans – travel medical and package plans – include some emergency dental care coverage and prescription care coverage.

- Some package plans include an additional $25 reimbursement to expedite the return of lost luggage when it’s found.

HTH Worldwide Travel Insurance plans

Package Plans

TripProtect e-Saver

Affordable protection focused solely on cancellation and air flight accident benefits

This highly focused plan does not require travelers to have a health plan, and it provides trip cancellation, air flight accident, and some lost baggage benefits. It does not include many benefits typically found in a package plan, so it’s not for every traveler – only those concerned primarily about their vacation investment and having AD&D for flight accidents.

TripProtector – most popular plan

Excellent all-around traveler protection with high medical and evacuation limits

Coverage for U.S. residents with a primary health insurance plan who are under age 85 and traveling more than 100 miles from home. This plan covers 100% of medical, surgical, and prescription costs and includes high evacuation limits. Ideal coverage for U.S. travelers – even senior travelers – who care about their travel investment and want to protect themselves from unexpected financial losses due to emergency medical care.

TripProtector Preferred

A plan for those up to age 85 with high medical limits and excellent identity theft protection

Excellent, high-limit coverage for U.S. residents with a primary health insurance plan, under age 85, and traveling more than 100 miles from home. Includes $20,000 in detection and recovery reimbursement for identity theft. Ideal for travelers who want the maximum protections against unexpected financial losses due to emergency medical care, medical evacuations, and identity theft.

Travel Medical Plans

TravelGap Excursion – most popular single-trip plan

Single-trip health and accident insurance with your choice of medical limits and deductibles

Covering 100% of medical expenses after the deductible and up to your choice of plan limit, this single-trip travel medical plan does require a traveler to have a primary health plan. Comprehensive travel medical coverage for single trips by U.S. citizens traveling abroad with some package benefits, including minimal trip interruption, lost travel documents, and lost luggage protection.

TravelGap Voyager

Single-trip travel medical for trips up to six months for travelers age 74 and younger

Covering 100% of medical costs after your deductible and up to your choice of plan limit, this travel medical plan does not require a primary health plan. Comprehensive medical coverage for single trips up to six months for U.S. travelers leaving their home country.

TravelGap Multi-trip

A multi-trip travel medical plan offered at two plan levels for U.S. travelers up to age 84

Offered at two plan levels, this plan covers 100% of a traveler’s medical costs – emergency and non emergency – outside the traveler’s home country for all trips of 70 days or less throughout a 12-month period. This plan includes coverage for pre-existing medical conditions. It’s designed for travelers who have primary health insurance.

Global Citizen – most popular annual plan

Annual international major medical health coverage for world travelers

Comprehensive annual major medical insurance for emergency medical and preventative medical care. Optional dental coverage and prescription drug coverage. Qualifies as a group employer-sponsored plan for employees of U.S. companies. Available to residents of the U.S. age 74 and younger. Includes global travel benefits such as evacuation, repatriation, and AD&D.

Global Citizen EXP

International major medical health coverage for U.S. travelers with a health insurance plan

Annual worldwide health insurance for emergency medical and preventative medical care for individuals and families. Optional prescription drug benefits and global travel benefits such as evacuation, repatriation, and AD&D. Maternity care after a 12-month waiting period. Qualifies as a group employer-sponsored plan for employees of U.S. companies. Exclude coverage in the U.S. for greater premium savings.

Global Navigator

Short-term medical insurance plan for those leaving their home country for at least three months

Global health insurance for preventative and emergency medical care for individuals, their spouses, and dependents. Low deductibles, few pre-certification requirements, and access to one of the largest PPO provider networks in the world.

Global Student USA – most popular student plan

Basic major medical for non U.S. students in the U.S. for educational or research purposes

This major medical plan covers international students ages 14-65 who are in the U.S. for educational reasons. It offers good medical maximums and reasonable deductibles. Coverage for hospital room and board, physician office visits, intensive care, ground transportation and more are included. Global travel benefits include emergency medical evacuation, repatriation, and bedside visits if the insured is hospitalized.

Global Student USA Preferred

Good major medical for non U.S. students in the U.S. for education or research purposes

This plan provides major medical coverage for international students ages 14-65 who are in the U.S. for educational or research purposes. If offers good medical maximums and reasonable deductibles, including coverage for inpatient and outpatient treatment, intensive care, hospital room and board, ground transportation and more. Global travel medical benefits such as emergency medical evacuation is included at a high limit. Repatriation and bedside visits are also included.

U.S. Student Abroad

Essential major medical coverage for U.S. students outside their home country

This is HTH Worldwide’s coverage for U.S. students on international educational trips. Provides essential major medical coverage up to $100,000 and includes coverage for medical and surgical care, hospital room and board, ground transportation, intensive care, and more. Global travel medical benefits include emergency medical evacuation, repatriation, and bedside visits. Includes AD&D for additional protection.

Screenshots of HTH Travel Insurance Website